The government's star witness in its suit to stop AT&T's proposed purchase of Time Warner took the stand in a marathon court session Wednesday.

Economist Carl Shapiro said his analysis shows that U.S. consumers could together pay an additional $571 million in the year 2021 if the merger is approved.

The government sued last year to stop AT&T's merger with Time Warner, CNN's parent company, arguing that it violates antitrust law in part because the combined company will raise prices for consumers. AT&T has argued that prices would not necessarily go up, and that it would have no reason to take measures that would keep its content from competitors because it would then make less in ad revenue.

"The merger will in fact harm consumers and the harm is significant in terms of the dollar amount," Shapiro testified.

Shapiro, who is also a professor at UC Berkeley, outlined three main reasons why he has concluded AT&T's proposed acquisition of Time Warner would be anti-competitive. Shapiro said his research and analysis show the merger would increase the cost to other distributors of the networks owned by Time Warner subsidiary Turner; the merged company could coordinate with Comcast-NBCUniversal to block their programming from emerging online distributors; and AT&T would be incentivized to restrict other distributors' use of HBO as a promotional tool to attract or retain customers for rival distributors

Much of Shapiro's analysis had already been introduced in the pre-trial brief presented by the government and was cited frequently by government attorneys as they questioned the previous 18 witnesses. Shapiro was the government's final witness.

Shapiro testified that AT&T would have increased bargaining leverage as a result of owning Turner, whose content, he said, is vital to competitors. He argued that if the new company reached a stalemate in negotiating with other distributors that carry Time Warner networks, and the networks are blacked out on those distributors, AT&T could benefit from consumers seeking the channels switching to its DirecTV service.

"The inevitable consequence of the merger is that DirecTV subscribership will grow over time," Shapiro said.

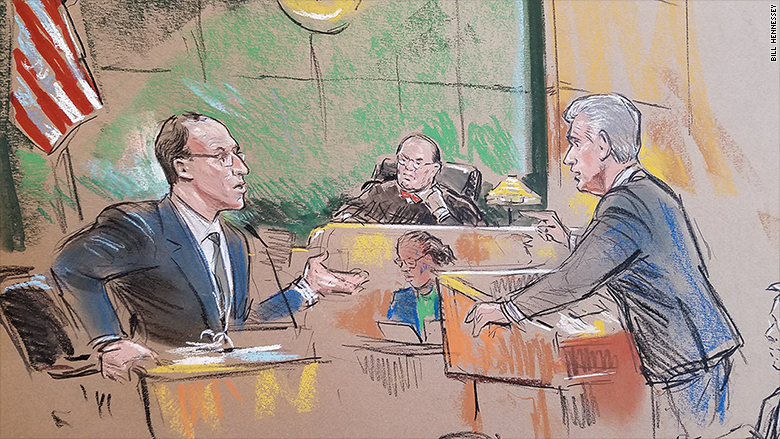

Judge Richard Leon questioned some aspects of Shapiro's conclusions, asking whether AT&T would actually have an active role in subscriber fee negotiations for Time Warner content post-merger, and whether it could influence the fees charged per subscriber. AT&T provides internet, phone and television services, while Time Warner provides content through Turner, HBO, and Warner Bros.

Leon referenced testimony from NBC's chair of content distribution, Madison "Matt" Bond, who told the court that NBC negotiates on its own with no interference from parent company Comcast. Comcast, a cable distribution company, purchased NBCUniversal in 2011. That merger is a constant subject in this trial because, like the proposed combination of AT&T and Time Warner, it was a vertical media merger -- and it was allowed to move forward after certain conditions were imposed.

"They do their own negotiations," Leon said of NBC. "I believe the previous testimony is that they don't take orders from Comcast."

Shapiro acknowledged the judge's point and that there is a "tension" between the basic economic theory that a company will always work to maximize profits in the "joint interest of the overall company" and the testimony from real world practitioners.

"I'm not in a position to say how AT&T will structure negotiations," he said. "What I'm saying is it will be in AT&T's interest to use this leverage."

Leon replied, "That's an assumption. You don't have an independent basis."

Leon also asked Shapiro about the general loss of subscribers the cable industry has experienced recently, and noted that many traditional pay-TV subscribers are older.

"If (those subscribers) are 60 years or older, they're dying off ... that might account for this decline nationwide," he said.

Shapiro is a world-renowned economist who regularly consults for and testifies in merger cases. He was also the chief economist in the Justice Department's antitrust division from 1995 to1996, and again in 2009 to 2011. He was a member of the White House's Council of Economic Advisers from 2011 to 2012.

AT&T and Time Warner's lead attorney, Daniel Petrocelli, focused during cross examination on what he saw as the missing pieces of Shapiro's analysis and report. Petrocelli pointed out that Shapiro did not consider real world negotiations or current, longer term contracts currently in place that prevent certain price increases for years to come. One of those large contracts that runs for the next few years would negate a vast majority of the net increase, Petrocelli argued.

Petrocelli also said Shapiro was using outdated profit margin data from AT&T as part of his harm analysis, and that more recent profit margin data available to him would have shown a 40 percent drop in the harm calculations though Shapiro said he didn't find the most recent profit margin data representative enough. Petrocelli also noted Shapiro did not consider the effects of Turner's arbitration offer presented to 1,000 cable distributors after the government's lawsuit was filed. The offer guarantees distributors baseball-style arbitration for seven years in the event a distributor believes Turner is charging too much for its content.

But Shapiro defended the decision, saying he was focusing on the longer-term impact of the market structure in the event of a merger.

"I'm generally wary of regulatory fixes and regulated prices. Most of my career has been about promoting competition instead of regulation," he added.

At the end of Shapiro's more than six hours of testimony, Leon noted that he was still somewhat confused by Shapiro's analysis and that he'd need to re-read the day's testimony.

"I'm not sure any of it is intuitive," he noted.

AT&T will begin its case Thursday. It is set to call University of Chicago economist Dennis Carlton to the stand as its first witness.