February 1, 2006

Ben Bernanke is named Federal Reserve chief

Princeton economist Ben Bernanke succeeds the legendary Alan Greenspan, who was Fed Chairman for nearly 20 years.

December 2007

U.S. is in recession

The U.S. housing bubble has burst and homeowners have begun to default on their mortgage payments in large numbers. It's enough to sink the country into recession.

March 16, 2008

Bear Stearns is acquired by JPMorgan Chase

JP Morgan agrees to pay $2 a share or less than 7% of what Bear's stock is trading at. JPMorgan later raised the acquisition price to $10 a share. The acquisition is partly funded by loans totaling $29 billion from the Federal Reserve. It will be the first of many such deals engineered by the Fed.

September 15, 2008

Lehman Brothers files for bankruptcy

It's the largest bankruptcy in U.S. history. The financial crisis is underway. Dow drops 504 points or 4.4%. It was the biggest one-day percentage drop since the first day of trading after the terrorist attacks on the World Trade Center, September 11, 2001

September 16, 2008

AIG gets $85 billion government bailout

The Federal Reserve steps in again with an $85 billion rescue package for AIG. It is the largest government bailout of a private company in U.S. history. "This is the financial equivalent of war, and we're going to need wartime powers," Treasury Secretary Hank Paulson told a group of Fed bankers, according to the New Yorker.

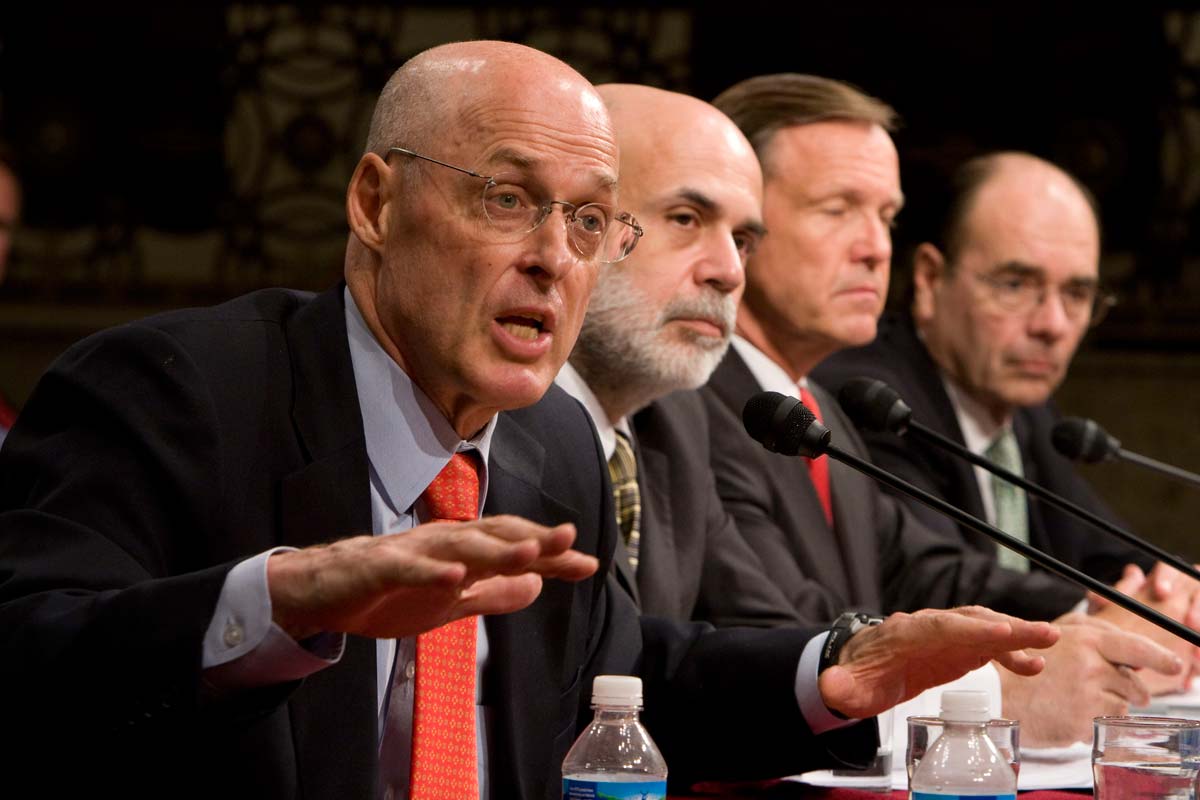

September 29, 2008

Congress votes down $700 billion bailout package

Hank Paulson begs Congress to save the financial system and granting him $700 billion. But his proposal consisted of just three pages and was short on details. Members of Congress wouldn't buy, and voted it down. Global markets went into convulsion, the Dow dropped 778 points and credit markets froze.

October 3, 2008

Financial bailout package passes

Paulson came back this time with a better prepared, 400-page description of the bailout package and what it would entail. Among the key proposals was that the Federal Reserve will buy billions of mortgage-backed securities.

October 13, 2008

Top 9 U.S. banks forced to take billions from government

The government uses part of the bailout money to buy stakes in the largest banks, by purchasing preferred stock in each of them. The banks are forced to take a total of $125 billion. The banks — Goldman Sachs, Morgan Stanley, JPMorgan Chase, Citigroup, Wells Fargo, State Street, Bank of New York Mellon and Bank of America and Merrill Lynch – aren't given a choice.

November 4, 2008

Barack Obama is elected president of the United States

December 16, 2008

The benchmark interest rate is cut to zero

This is the last of several Fed moves to cut interest rates in two years. Bernanke also announces that the Fed will soon launch an economic stimulus program to buy hundreds of billions worth of Treasurys and mortgage-backed securities starting in 2009 to help reboot the U.S. housing market.

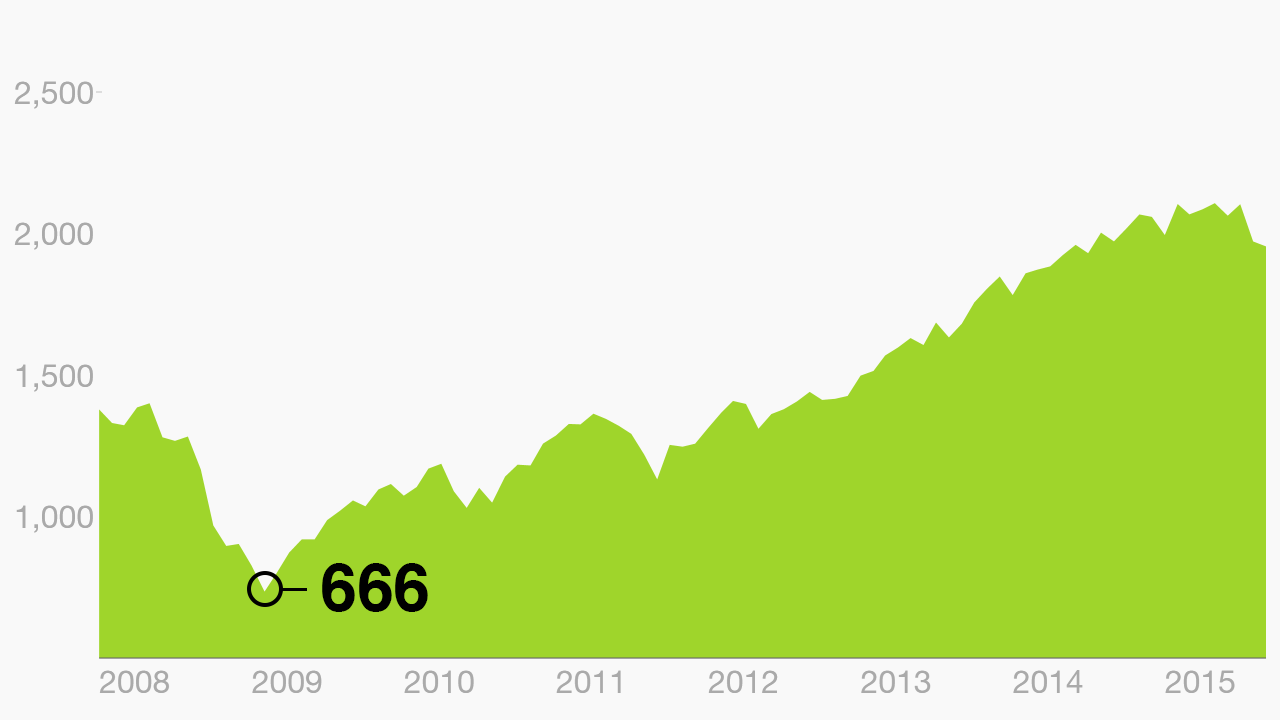

March 9, 2009

S&P bottoms out at 666

This marks the S&P 500 index's lowest point since 1996 and also the beginning of a 6-year bull market run.

June 2009

U.S. recession ends

The U.S. recession has officially ended, though regular Americans hardly feel that way as jobs get cut left and right.

November 6, 2009

Unemployment rate hits 10.29%

The Labor Department announces that the unemployment rate in October hit 10.29% in October (it would later be revised to 10%). It's the first time in 26 years that the unemployment rate hits double digits, and it's a new low for the U.S. economy.

August 5, 2011

U.S. is downgraded and loses AAA rating

The S&P downgrade was the first time the government was given a rating below AAA. The downgrade occurred after intense bickering in Congress over the U.S. debt ceiling.

November 6, 2012

President Obama wins re-election

The economy continues to recover, but growth is sluggish.

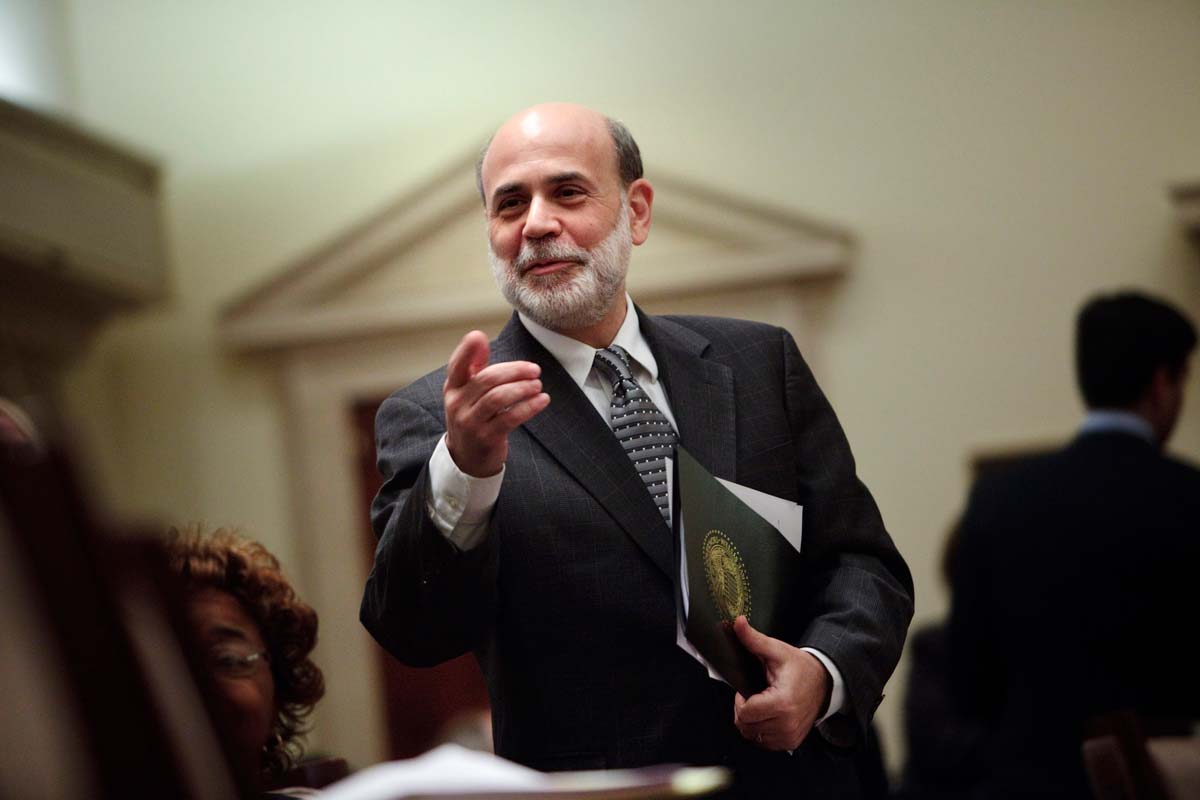

May 22, 2013

Bernanke starts a taper tantrum

Testifying before Congress, Bernanke signals that the Fed will gradually end or "taper" its bond-buying program to stimulate the economy. This unexpected comment triggers a dramatic selloff in global stocks, especially in emerging markets. The fallout from Bernanke's comments becomes known as the Taper Tantrum.

October 9, 2013

Janet Yellen is named Fed chair

President Obama nominates Janet Yellen to succeed Bernanke as Chair of the Fed. Formerly the Vice Chair, Yellen becomes the first woman to take the top job at the most powerful central bank in the world.

March 19, 2014

Janet Yellen holds first press conference, spooks markets

Minutes after Yellen spoke, the Dow fell as many as 180 points before recovering. What she said: the Fed's stimulus program would most likely be finished by fall and a rate hike could come as early 2015.

December 17, 2014

Fed says it will be patient before raising rates

The U.S. economy has its best year of job gains since 1999 and economic growth is strong. The unemployment rate steadily falls, but wages are still barely inching up.

March 18, 2015

The Fed says it will no longer be "patient"

Yellen emphasizes the Fed won't be "impatient" either. Speculation begins that the Fed will raise rates in June.

June 2015

No rate hike

After some good but not great economic data, the Fed chooses not to raise rates at its June meeting. Economists across the spectrum agree that the road is clear for a September rate hike.

August 24, 2015

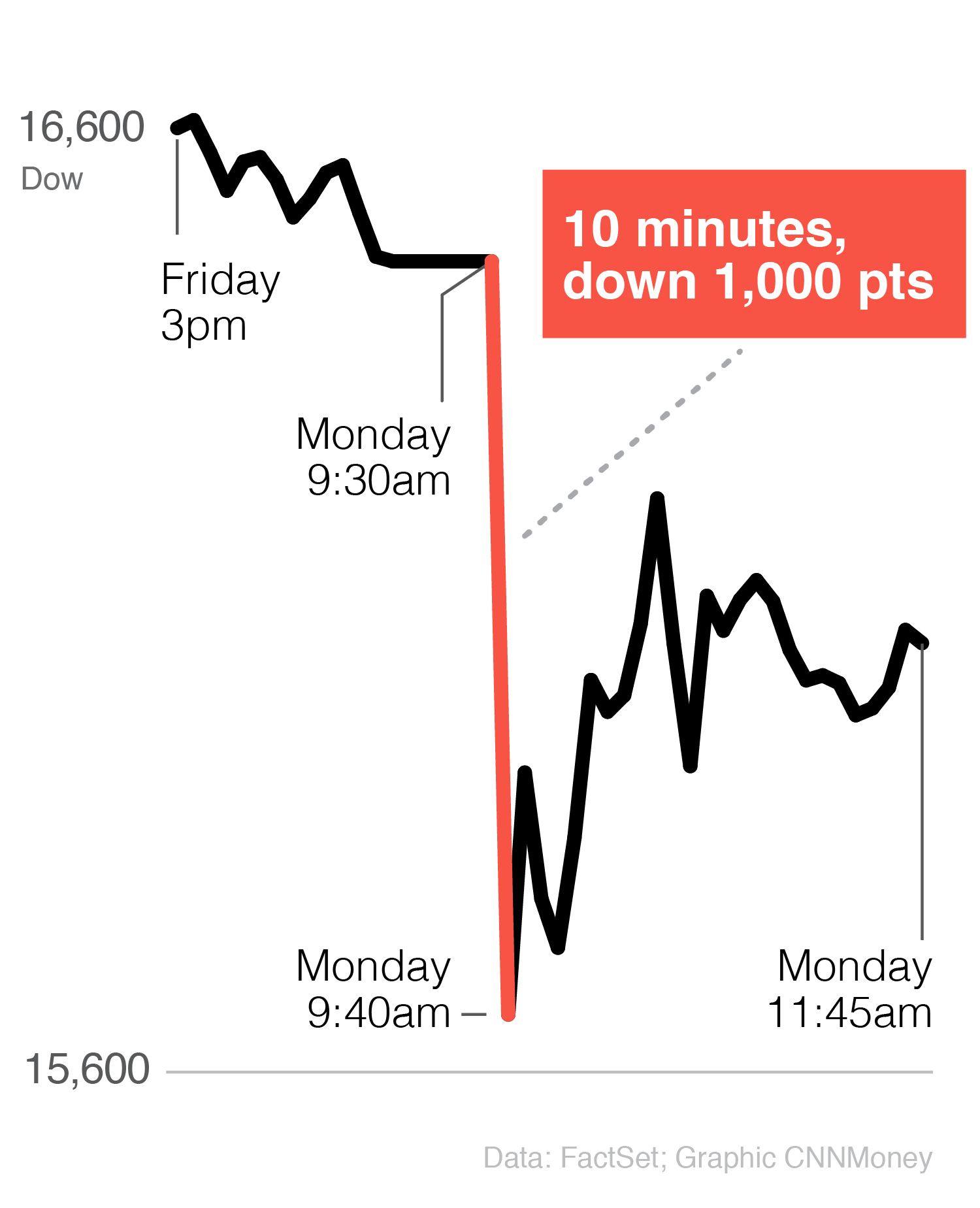

Dow tanks over 1,000 points on China worries

The Dow's 1,000-point nosedive at the open on August 24 is its largest intraday point decline on record. Global fears about China's economic slowdown and its ripple effects shook stock markets around the world for a second week in a row. It all started with China devaluing its currency, the yuan, on August 11.

September 4, 2015

U.S. unemployment rate falls to 5.1%

The rate is at its lowest mark since April 2008. Still the number of jobs created fell short of expectations and wage growth isn't stellar.

September 17, 2015

September FOMC meeting

Fed doesn't raise rates — signals global slowdown may "restrain" U.S. economic growth.

October 28, 2015

October FOMC meeting

Fed tones down language about global fears but keeps rates at zero.

November 6, 2015

October jobs report

U.S. economy adds 271,000 jobs, unemployment falls to 5% and wages growth 2.5%. The report builds the case for a December rate hike and the economy picks up more momentum in November with another solid jobs report.

December 16, 2015

December FOMC meeting

Finally! Fed raises interest rates for the first time since June 2006. It moved its key rate from a range of 0% to 0.25% to a range of 0.25% to 0.5%.