|

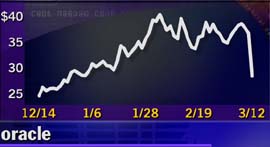

Techs feel Oracle's pain

|

|

March 12, 1999: 5:23 p.m. ET

Nasdaq slides along with software firm, after sales don't hold up to analyst targets

|

NEW YORK (CNNfn) - Oracle Corp., a leading technology company, paid a price for failing to meet Wall Street analysts' targets on Friday -- casting a pall on the sector overall.

Reading the tea leaves of the database-software maker's quarterly earnings report, investors panned Oracle (ORCL), which fell 8-5/16 to 28-9/16 after reporting Thursday third-quarter profits of 20 cents per share, a penny better than analysts' targets. However, revenue growth of 19 percent was less than the 26 percent expected. The company blamed the disappointment on unexpectedly light sales of database and applications software.

More than 100 million Oracle shares traded. A spokesman for the Nasdaq said the Oracle spill was responsible for a loss of roughly 10 points off the index Friday.

The Nasdaq Composite index closed down 30.72 points at 2,381.53.

The stock price tumble Friday was more than one analyst had expected.

Rick Sherlund, an analyst at Goldman Sachs, said he had expected Oracle shares to close at about $30 Friday, adding that the company's revenue problems may not be resolved in the near term.

"They said the pipeline looks strong, but they've had difficulty turning that in to revenue," Sherlund said.

At least a half-dozen investment banks downgraded Oracle's stock, among them: Merrill Lynch; Warburg Dillon Read; Piper Jaffray; Donaldson, Lufkin & Jenrette; Dain Rauscher; and NB Montgomery Securities.

Year 2000-related issues continue to plague Oracle, along with such competitors as PeopleSoft Inc. and Germany's SAP AG. After the company reported earnings late Thursday, Jeff Henley, Oracle chief financial officer, expressed uncertainty regarding when the industry will recoup Y2K-related losses. Sherlund noted that Oracle's revenue may continue to suffer for the next few quarters.

"Companies are reluctant to buy stuff that's disruptive to their infrastructure" as the new year approaches," Sherlund said. "That suggests it could be a difficult year ahead."

Meanwhile, signs that Oracle is making up ground in the customer-management software segment walloped Siebel Systems (SEBL), a maker of sales automation and customer- service software maker which fell 3-7/8 to 49-1/8.

Among other software players, PeopleSoft (PSFT) drifted 3/16 to 17-15/16, Microsoft (MSFT) slipped 1-1/4 to 160-3/16 and BMC Software (BMCS) fell 1-5/8 to 36-5/16.

Analysts said the tech sector may be slipping.

"It seems like money is coming out of technology, and going into more defensive plays," said Brian Finnerty, head of Nasdaq stock trading with C.E. Unterberg. "I'd rather see a broadening out, even within technology."

AOL-Netscape deal OK'd

America Online (AOL) shares edged up 5/16 to 96-1/8. The U.S Justice Department said Friday it won't oppose the online company's proposed buyout of the Internet browser and portal provider Netscape Communications (NSCP). Netscape added 1/4 to 84-7/8.

AOL also plans an alliance with software and hardware maker Sun Microsystems (SUNW). Its shares lost 5-3/16 to 103-11/16.

In a statement, Justice said its antitrust division carried out a thorough probe and found "neither the merger nor the alliance violate antitrust laws."

Aside from Oracle's woes, elsewhere on the earnings tableau, CMG Information Services (CMGI) fell 18-1/8 to 164, after the Internet venture investor reported earnings before one-time items of 44 cents a share, short of analyst targets.

Andrew Hadjecky, CMGI's chief financial officer, said the company, as an investment firm, has a model "not built on an [earnings per share] valuation."

And in the computer-chip sector, National Semiconductor (NSM) slipped 9/16 to 10-1/8 after reporting after the bell Thursday a third quarter loss of 16 cents per share, while analysts expected a loss of 20 cents.

Needham & Co. raised National Semi to "strong buy" from "buy" following the report.

Again drawing the fascination of investors, Bottomline Technologies (EPAY) rose 20-7/32 to 57-27/32, up 53 percent on continued momentum after some top brokerages opened coverage on the stock with a favorable rating earlier this week

Bottomline makes software used to manage corporate payments.

|

|

|

|

|

|

|