|

Nasdaq takes big hit

|

|

January 26, 2000: 5:54 p.m. ET

Tech sees big sell-off as money moves to 'out-of-favor' sectors

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index dropped sharply Wednesday, wiping out all of Tuesday's gains, after a financial report from bellwether Qualcomm disappointed investors and helped spark a broad technology sell-off.

But the Dow Jones industrial average ended little changed as gains to a consumer-products maker and financial stocks offset loses to Microsoft, Intel and IBM.

Minnesota Mining & Manufacturing, which posted strong earnings, supported the Dow, as did gains to American Express, J.P. Morgan and CitiGroup.

"You are getting some long-overdue profit taking in the technology sector, and the cyclical stocks are having their day in the sun," said Al Goldman, chief market strategist at A.G. Edwards.

But Qualcomm and Compaq Computer disappointed some investors with quarterly reports that also weighed on the broader technology universe. Five of Nasdaq's biggest movers lost ground.

One "out-of-favor" sector, banks, shot up.

"The financials had a terrific day here and I think you're looking at money coming out of a group that was trading at terrifically high valuations going into a group of stocks that have had fantastic earnings in the fourth quarter and are trading at relatively low price-to-earnings ratios," Joe Finnegan, specialist at Wagner Scott Mercator, told CNNfn's Street Sweep.

Testimony by Federal Reserve Chairman Alan Greenspan before Congress had no apparent market effect. Greenspan said nothing to change expectations the Fed would hike interest rates by a quarter of a percentage point next week.

The Nasdaq composite index fell 97.49 points, or 2.34 percent, to 4,069.92. The index's 10th biggest point drop erased all of Tuesday's gains.

But the Dow Jones industrial average rose 3.10 points to 11,032.99. And the broader S&P 500 lost 5.94 points to 1,404.09.

Still, New York Stock Exchange breadth was positive, with advancing issues topping decliners 1,707 to 1,341. But losers outpaced winners 2,135 to 2,016 on the Nasdaq. Big Board volume reached 1.1 billion while 1.7 billion shares changed hands on the Nasdaq.

In other markets, bonds rose and the dollar fell versus the yen but was little changed against the euro.

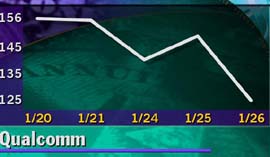

Qualcomm falters

Investor disappointment over closely watched technology companies sparked selling within the sector.

Qualcomm (QCOM) plunged 24-3/8 to 124-5/8 after it reported late Tuesday a fiscal first-quarter operating profit that was slightly ahead of expectations, but warned that product shipments could fall during the current quarter.

A series of stock downgrades followed. (Click here for a look at the day's downgrades).

More than 68 million Qualcomm shares changed hands, making it the most actively traded Nasdaq stock.

Compaq Computer (CPQ), influential on the Nasdaq despite being an NYSE member, fell 1-5/8 to 29-3/8 after posting a 56 percent drop in fourth-quarter profit as it struggled to cope with falling PC prices. The company met Wall Street's reduced forecasts.

"I think the Qualcomm report may be dampening sentiment and Compaq's report is somewhat mixed," said Terrence Gabriel, stock market strategist at Global IDEA.com. "It does seem that disappointment over the Qualcomm report is feeding into the tech stocks."

The Nasdaq composite index's five most heavily weighted stocks lost ground. Microsoft (MSFT) fell 3-7/16 to 99-3/8; Intel (INTC) dropped 5-1/16 to 96-1/2; Dell (DELL) slipped 1-3/4 to 40-3/8; MCIWorldCom (WCOM) dipped 1-1/2 to 41-11/16 and Cisco Systems (CSCO) lost 4-15/16 to 107-3/16.

Dow component IBM (IBM) lost 2-3/8 to 116-3/4.

But not all technology issues suffered. Online auction house eBay (EBAY) soared 16-1/16 to 153-9/16 after reporting better-than-expected fourth-quarter profit Tuesday, reflecting a surge in registered users.

Post-It maker comes through

Minnesota Mining & Manufacturing (MMM) was the Dow's biggest mover, advancing 4-15/16 to 95-9/16 after handily beating analysts' estimates, aided by strong sales in the Asia-Pacific region. The maker of Post-It note pads and Scotch tape said earnings rose 28 percent to $444 million, or $1.10 a diluted share, from $348 million, or 86 cents, a year earlier.

The Dow was also supported by big gains to its three financial services companies. American Express (AXP) leapt 1-3/8 to 159-3/4, CitiGroup (C) jumped 2-1/4 to 58-1/8, and J.P. Morgan (JPM) climbed 7-3/16 to 123-3/8.

"The (financial) group has had blowout earnings across the board," said Art Hogan, chief market strategist at Jefferies & Co. "And let's face it, Glass-Steagall was repealed."

Hogan was referring to last summer's repeal by Congress of a Depression era banking law that made it difficult for banks, brokers and insurers to merge. The repeal sparked optimism about consolidation within the industry.

Earnings pour out

Fourth-quarter earnings continue to show strength. The 43 percent of the companies in the S&P 500 that have reported results have beaten analysts' forecasts by an average of 6.8 percent, according to earnings tracker First Call.

Until Wednesday, no Dow component reported earnings below estimates. But McDonald's and Philip Morris changed that.

McDonald's (MCD) fell 4-5/16 to 35-1/2 after posting higher fourth-quarter earnings that were 1 cent below analysts' consensus.

Philip Morris (MO) lost 13/16 to 21-1/8. The nation's largest tobacco marketer reported fourth-quarter earnings of 77 cents a diluted share, 1 cent below a consensus estimate.

In other earnings reports from Dow components, Merck (MRK) rose 1-15/16 to 72-13/16 after posting fourth-quarter profit that matched Wall Street's expectations. Income at the biggest U.S. drug company rose 12 percent to $1.57 million, or 66 cents a diluted share.

DuPont (DD) fell 9/16 to 60-15/16 after the chemical maker reported lower fourth-quarter earnings of 55 cents a share that were a penny above estimates.

Coca-Cola (KO) fell 2-13/16 to 63-1/16 after saying it will eliminate 6,000 jobs, or 21 percent of its 29,000 employees worldwide -- the biggest job cut in the company's history. The announcement came as the Dow component announced improved results for the fourth quarter, edging past analysts' estimates for the period.

|

|

|

|

|

|

|