|

Upward surge on Wall St.

|

|

January 31, 2000: 6:09 p.m. ET

U.S. stocks stage a recovery; financial issues boost Dow prior to Fed meeting

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Wall Street staged an impressive rally Monday, but the last-minute heroics were not enough to wipe out what can only be described as a dismal month for investors, with all three major indexes suffering their worst January performance since 1990.

After ending the year on a high note, technology stocks came back to earth in January, taking the broader market with them. And even though both blue chips and technology shares rebounded Monday -- ahead of a key two-day Federal Reserve meeting -- experts say January's rough start could spell trouble for the rest of the year.

"I think we've had a tremendous run. I mean Nasdaq had a terrific year. A lot of the Internet names that we hold in the fund had terrific years and quite frankly I think going forward it's going to be more challenging," Ryan Jacob, portfolio manager at Jacob Internet Fund, told CNNfn.

On Monday, the Dow Jones industrial average rallied to end up 201.66 points, or 1.9 percent, at 10,940.53. However, for the month the blue-chip index fell 4.85 percent, its worst January performance since 1990 when the Dow lost 5.9 percent.

The Nasdaq composite index, which languished in negative territory for most of the session, posted a late comeback, gaining 53.28 points, or 1.4 percent, to 3,940.35.

Earlier, the technology-laden index had tumbled more than 130 points, putting it in the neighborhood of a correction. A correction occurs when an index falls more than 10 percent from its high. While the late-session rally ended any talk of a correction for now, investors remained anxious. For the month, the Nasdaq composite index has lost 3.16 percent, its worst January performance since 1990.

The S&P 500 index rose 34.30, or 2.5 percent, to 1,394.46. The broad-based index declined 5 percent this month, its worst January performance since 1990, when it declined 6.9 percent. The S&P 500 index rose 34.30, or 2.5 percent, to 1,394.46. The broad-based index declined 5 percent this month, its worst January performance since 1990, when it declined 6.9 percent.

On the New York Stock Exchange, declines led advances 1,621 to 1,452 as trading volume reached 968 million shares. On the Nasdaq, declines outnumbered advances 2,596 to 1,589, on volume of 1.5 billion shares.

Treasury prices fell, with the bellwether 30-year Treasury bond losing 12/32 of a point in price, raising its yield to 6.48 percent from 6.45 percent late Friday. The dollar rose against both the yen and the euro.

Awaiting the Fed

Despite the day's advance, analysts noted the gains occurred in a market that is oversold with negative breadth. "Putting it in context, it wasn't a great display of bullishness one would assume," said Richard Cripps, chief market strategist at Legg Mason Wood Walker.

Cripps said profit taking is likely to occur until a clear catalyst emerges to provide direction. In addition, investors continued to express caution about rising interest rates as the U.S. economy continues to strengthen. Peter Cardillo, director of research at Westfalia Investments, said the market is becoming more conscious of interest rates on a daily basis than it has been in the past.

On Tuesday, the Fed will begin a two-day meeting to determine interest rates, its first monetary policy meeting for the year. A decision is expected Wednesday afternoon.

Analysts widely expect the Fed to increase short-term interest rates by a quarter of a percentage point at the conclusion of its meeting Wednesday afternoon. However, some analysts expect a larger rate hike.

"Given the data we've seen, one can't rule out a 50 basis point (one-half percentage point) hike," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "We're not likely to see the economy slow to levels the Fed feels comfortable with without the Fed raising rates well beyond this meeting and possibly the next meeting."

The January barometer

With all three major indexes posting declines in January, market participants spoke of the "January barometer," in which the market has a tendency to perform poorly all year if the S&P 500 index posts a decline in January, according to the Stock Trader's Almanac. The S&P 500's worst performance was in 1970, when it posted a 7.6 percent loss.

But the negative forecaster runs counter to a positive one - the tendency for markets to perform well in a year when the National Football Conference team wins the Super Bowl. On Sunday night, the St. Louis Rams of the NFC beat the American Football Conference champion Tennessee Titans 23-16 in Super Bowl XXXIV.

Financial shares regain momentum

Boosting the Dow industrials was a rebound among financial shares. The sector is highly sensitive to interest rates and concern about what the Fed will do has sent the sector tumbling in recent sessions.

Among Dow components, American Express (AXP: Research, Estimates) rose 6-1/2 to 164-3/4, Citigroup (C: Research, Estimates) advanced 7/8 to 57 and J.P. Morgan (JPM: Research, Estimates) added 4-7/8 to 122-15/16.

Within the technology sector, Qualcomm (QCOM: Research, Estimates) contributed to gains for the Nasdaq. The stock jumped 16-7/16, or nearly 15 percent, to 127, amid reports the wireless technology firm was close to completing a wireless deal in China.

3Com Corp. (COMS: Research, Estimates) also supported the composite index, advancing 4-3/16 to 50-3/4. A leading maker of computer networking products, 3Com announced details Friday of its initial public offering of its Palm subsidiary, Palm Inc. 3Com shares also benefited from an upgrade by SG Cowen to "buy" from "neutral."

Elsewhere in the sector, Motorola Inc. (MOT: Research, Estimates), a leading mobile phone maker, gained 8-1/4 to 136-1/2 after signing a multi-million dollar deal with Deutsche Telekom AG to provide high-speed data service.

However, Internet issues were a mixed bag. Both Amazon.com (AMZN: Research, Estimates) and Yahoo! (YHOO: Research, Estimates) reversed earlier losses - Amazon rose 2-7/8 to 64-9/16 and Yahoo! gained 8-9/16 to 322-1/16.

But Priceline.com (PCLN: Research, Estimates) eased 1-5/8 to 58, and America Online (AOL: Research, Estimates) declined 1-15/16 to 56-15/16.

Ash Rajan, stock market strategist at Prudential Securities, referred to the technology sell-off that occurred through most of the session. He told CNNfn market participants often "overreact. " (374K WAV) (374K AIFF)

More earnings

On the earnings front, former Dow component Union Carbide Corp. (UK: Research, Estimates) ended up 1-5/16 at 55-5/8 in wobbly trade. The chemical producer posted stronger-than-expected fourth-quarter earnings of 68 cents per diluted share against analysts' expectations of 46 cents.

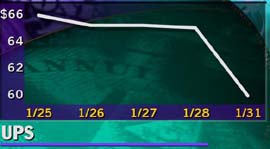

But United Parcel Service Inc. (UPS: Research, Estimates) tumbled 4-13/16 to 60-1/8, after reporting earnings just above expectations. The report is the first since the world's No. 1 package-delivery company's record $5.4 billion initial public offering in November.

Click here for a look at today's CNNfn hot stocks.

Click here for a look at today's CNNfn technology stocks.

|

|

|

|

|

|

|