|

Housing starts jump

|

|

February 16, 2000: 8:47 a.m. ET

New home construction stronger than expected, despite interest rate hikes

|

NEW YORK (CNNfn) - New home construction stayed stronger than expected in January, shrugging off recent interest rate hikes and storms on the U.S. East Coast.

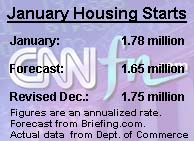

The Commerce Department said housing starts rose 1.5 percent to an annualized rate of 1.78 million in the month.

Analysts polled by Briefing.com had expected housing starts to dip to an annual rate of 1.65 million in January from the upwardly revised 1.75 million rate posted in December. The January number is the strongest rate since January 1999, when the rate was 1.80 million starts.

In a separate report, the Labor Department said U.S. import prices rose a modest 0.1 percent in January while export prices remained unchanged. Excluding gains in petroleum costs, which slowed significantly during January, import prices declined 0.1 percent.

New home construction is an important engine of the current economy's strength, helping to drive retail sales in other sectors. Consumer spending accounts for about two-thirds of the U.S. economy.

Some analysts had been looking for a weakening in the numbers as a sign that the Federal Reserve's efforts to cool the economy were working, thereby reducing the need for additional rate hikes. But the strong numbers Wednesday may be just one more justification for future hikes.

Housing starts took a hit from bad weather in the Eastern United States in the month, but housing permits rose 8.7 percent to an annual rate of 1.76 million in January, with strength across all regions of the country. Briefing.com projected only 1.60 million for the month, down slightly from 1.61 in December.

Interest rates not hurting building yet

The rising rates might actually be spurring some of the housing starts, as buyers are moving to get the homes they want before rates go higher, said James Smith, chief economist of the National Association of Realtors, in an interview on CNNfn's Before Hours program. (337KB WAV) (337KB AIFF)

"It says that an awful lot of people have decided, 'If I am going to get the house of my dreams I better go pick it out and get settled and get busy on it,'" he said. "The increase in mortgage rates is not enough to price many people out of the market today."

The Federal Reserve raised interest rates three times last year and once already this year on Feb. 2. The latest data are likely to be further justification for another hike in March, Smith said.

"This is just the sort of thing that says it's a foregone conclusion, March 21 we go up one more quarter point," he said. "They'll probably keep doing it until we see some impact. Normally you would see it in housing before anywhere else and obviously all we see is the reverse."

The bond market slipped after the news. In morning trading the benchmark 30-year bond fell 10/32 of a point, as the yield climbed to 6.27 percent from 6.24 percent Tuesday. The market is awaiting testimony due Thursday from Federal Reserve Chairman Alan Greenspan to Congress on the state of the economy.

Regionally, housing starts were strongest in the West, up 7.3 percent to a 384,000 unit pace. Starts rose 0.7 percent in the Midwest to a 412,000 pace while the South posted a 0.6 percent rise to an 829,000 rate. The overall gains came despite a 4.5 percent decline in starts in the Northeast to a 150,000 pace, due to the likely effect of bad weather.

No help for builders' stocks

Despite the strength in new home construction, the publicly traded companies in the sector have price/earnings ratios in the low single digits and many of the most profitable builders have seen share price fall steeply in recent months.

"The problem is, things can't get any better, or that's the perception out there in the marketplace," said Stephen Kim, building analyst with Deutsche Banc Alex. Brown, in an interview on CNNfn Wednesday. "In fact we would concur with that opinion. This is a notoriously cyclical sector; that isn't likely to change any time soon. Housing starts are at absolute peak levels. People are concerned where the upside is."

The only builder for which Kim has a strong buy recommendation is D.R. Horton Inc. (DHI: Research, Estimates), a Houston company with a 20-year record of earnings growth. The stock was unchanged Wednesday morning at 12-7/16, with a 5 P/E ratio, and well below Kim's mid-20s target price for the stock.

He said one of the best things that could happen to the stocks is a cooling of housing construction for about six months to give investors the sense there is a chance for further gains.

--Reuters contributed to this report

|

|

|

|

|

|

|