|

Playing the stock shift

|

|

March 8, 2000: 1:34 p.m. ET

'Old economy' investors may be feeling a little blue, but will they stay in the red?

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Out with the old, in with the new.

The firms that have amassed fortunes making everything from consumer products to airplanes to cigarettes to Mickey Mouse are being replaced -- at least in the hearts of investors -- by the companies that are building broadband networks, expanding the use of the Internet, creating faster and better computer chips and developing wireless technology to transport data faster than the snap of your fingers.

But is it really a New Economy we're living in, where traditional valuations of companies and traditional perceptions of how the economy operates no longer exist? Is it an era when companies that produce traditional products such as dishwashing detergent or planes no longer make any money? Or has a bubble of optimism intoxicated Wall Street to the point where anything with dot.com or Internet in its name is worth upwards of $200 a share?

"There is a technology boom going on right before our eyes, and there is justification for the split between the Dow and the Nasdaq," said Larry Wachtel, chief strategist with Prudential Securities. "There are fundamentals behind this. It isn't like the end-user market isn't booming in wireless, in cell phones, the Internet or even in industrials that use technology. But then there's also value in the conventional, cyclical blue-chips."

Explosion of the Net

It's no secret that the explosion of the Internet and all the hardware, infrastructure and software needed to support it has launched the U.S. economy into a period of potential growth not seen since the swinging '60s and in some ways comparable in scope to the industrial revolution. And the rush to buy stock in the companies participating in the revolution is something America hasn't seen since the gold rushes of the 1800s.

At the same time, it's also a given that U.S. and global consumers aren't about to give up their televisions, toothpaste or Tootsie Rolls to surf the Internet anytime soon. Almost any analyst and strategist on Wall Street will tell you that while the Internet is useful for delivering necessities, it hasn't exactly replaced them, suggesting that Old Economy versus New Economy theory is not as cut and dried as it seems.

"It's just the nuttiest argument that I've ever heard -- this whole idea of old economy versus new economy assumes that we're all going to be sitting around in the dark, naked and hungry, surfing on the Internet," Alan Skrainka, chief strategist with Edward Jones, told CNNfn. "The idea that you don't need food companies or companies like Procter & Gamble anymore is just nuts." (369KB WAV) (369KB AIFF) "It's just the nuttiest argument that I've ever heard -- this whole idea of old economy versus new economy assumes that we're all going to be sitting around in the dark, naked and hungry, surfing on the Internet," Alan Skrainka, chief strategist with Edward Jones, told CNNfn. "The idea that you don't need food companies or companies like Procter & Gamble anymore is just nuts." (369KB WAV) (369KB AIFF)

Indeed, it's not just the glory of all things tech that investors appear to be blindly chasing after. Portfolio managers on the hunt for solid returns for their investors increasingly are looking at more-traditional companies and realizing they aren't getting enough bang for their buck.

Demand for workers

"If you're in a traditional balanced fund or a traditional basket of old-line stocks, you're losing money," said Donald Selkin, chief investment strategist with Joseph Gunnar.

The notion of old versus new was born in economic circles on Wall Street almost two years ago, when the U.S. economy hit its strong-growth, low- inflation stride. The Asian economic crisis of 1997 and the Russian debt crisis of 1998 did nothing to derail the voracious appetite of U.S. consumers, producing quarter after quarter of strong growth with little increase in inflation.

One of the main reasons for that was the explosion of jobs in the technology sector, which produced huge demand for skilled workers. That demand pushed the U.S. unemployment rate to a 30-year low and produced a record number of jobs in both 1998 and 1999. One of the main reasons for that was the explosion of jobs in the technology sector, which produced huge demand for skilled workers. That demand pushed the U.S. unemployment rate to a 30-year low and produced a record number of jobs in both 1998 and 1999.

At the same time, massive advances in technology -- faster computers, faster connections to the Internet, wireless technology, new and improved software, new Web-based industries -- helped companies boost their productivity by automating their assembly lines and squeezing more out of their workers without transferring their expenses down the pipe to the retail price tag.

Wall Street caught on fast, forking out money hand over fist to companies like Cisco Systems (CSCO: Research, Estimates), Oracle (ORCL: Research, Estimates), Intel (INTC: Research, Estimates), Amazon.com (AMZN: Research, Estimates), eBay (EBAY: Research, Estimates) and virtually anything else with a dot.com or the word "Internet" attached to it that investors felt would be a winner in the New Economy.

Old-school stocks

But few in the golden triangle at the bottom of Manhattan felt the Old Economy stocks were worth dumping -- companies like Coca Cola (KO: Research, Estimates), General Electric (GE: Research, Estimates), DuPont (DD: Research, Estimates) and J.P. Morgan (JPM: Research, Estimates).

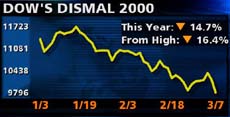

At least until Tuesday, when an earnings warning from Procter & Gamble (PG: Research, Estimates) helped propel the Dow to its fourth-biggest point loss in history. With the Dow Jones average down 17 percent from its all-time high reached last fall, and with the Nasdaq composite index stretching to new records, the divergence of the two bellwether indexes has become extreme.

From exactly a year ago, the Nasdaq has surged more than 102 percent; in the same period the Dow has gained a paltry 0.7 percent. On Wednesday, the two indexes traded places, with the Dow up and the Nasdaq down. From exactly a year ago, the Nasdaq has surged more than 102 percent; in the same period the Dow has gained a paltry 0.7 percent. On Wednesday, the two indexes traded places, with the Dow up and the Nasdaq down.

"I think people are wondering whether the old economy can grow at all these days," said Kevin Bannon, chief investment officer with the Bank of New York. "The new economy is clearly where the great growth is going to be, but they're underestimating what some of the older companies can do."

The Fed factor

At issue now for investors are the Federal Reserve and its inflation-fighting Open Market Committee. The FOMC has raised short-term interest rates four times since last June in a bid to slow the economy down and ensure that inflation remains in check, and it's expected to raise them a fifth time at its March 21 policy meeting.

Higher rates tend to slow the economy down by encouraging consumers and businesses to save more and borrow less. Particularly among companies, higher rates boost the cost of borrowing and erode profits, lowering the potential value of their stock. They also hurt stocks as investors adjust the valuations to account for higher borrowing costs. Higher rates tend to slow the economy down by encouraging consumers and businesses to save more and borrow less. Particularly among companies, higher rates boost the cost of borrowing and erode profits, lowering the potential value of their stock. They also hurt stocks as investors adjust the valuations to account for higher borrowing costs.

With so-called Old Economy stocks, that formula has been tried, tested and true for years. It works. Stocks that are sensitive to rising interest rates are not considered a good investment when the Fed is on the warpath. But with New Economy companies, investors still are trying to work out exactly how to value their growth potential, which seem to defy anything the Fed does.

"The market is trying to find an appropriate valuation for those stocks," said Rob Palombi, senior markets analyst with Standard & Poor's MMS in Toronto. "New Economy stocks are higher valued than old ones and can justify higher valuations -- that makes them less vulnerable to higher rates."

Age before beauty?

So where should investors be parking their cash? Without question, most analysts agree that technology stocks are the way to go.

For Wachtel, companies involved in semiconductors, biotechnology, telecommunications and, of course, the Internet, are the way to go. Ilex Oncology (ILXO: Research, Estimates), Biogen (BGEN: Research, Estimates) and Computer Associates (CA: Research, Estimates) all are good companies with lots of potential left in their shares.

Skrainka likes the more traditional Dow companies, including Procter & Gamble, Johnson & Johnson (JNJ: Research, Estimates), McDonald's (MCD: Research, Estimates), Gillette (G: Research, Estimates). "These are companies that may have suffered minor setbacks here and there but are worth more than what they're trading at now," he said. "These are the companies trading at 65 cents on the dollar that people are going to be scrambling to buy when tech goes into its correction." Skrainka likes the more traditional Dow companies, including Procter & Gamble, Johnson & Johnson (JNJ: Research, Estimates), McDonald's (MCD: Research, Estimates), Gillette (G: Research, Estimates). "These are companies that may have suffered minor setbacks here and there but are worth more than what they're trading at now," he said. "These are the companies trading at 65 cents on the dollar that people are going to be scrambling to buy when tech goes into its correction."

As for old versus new, most analysts agree that the 29-year-old Nasdaq is more vibrant at the moment than the grand, century-old Dow. At the same time, "There's something to be said for age and experience," MMS's Palombi said.

|

|

|

|

|

|

|