|

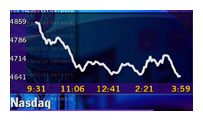

Nasdaq slump resumes

|

|

March 29, 2000: 5:37 p.m. ET

Tech selling continues as money chases value stocks, lifting Dow

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index fell for the third straight session Wednesday, posting its third-biggest point loss on record, as investors swapped high-flying technology leaders for beaten-up oil producers, retailers and consumer-products makers.

Cisco Systems, Sun Microsystems and JDS Uniphase fell, but stocks like Wal-Mart, Coca-Cola and Exxon-Mobil gained, lifting the Dow Jones industrial average -- which is still down year-to-date.

Peter Coolidge, senior trader at Brean Murray & Co., pinned the day's action on a periodic but usually fleeting phenomenon: money fleeing the most expensive stocks for out-of-favor bargains.

"Out with the new, in with the old," Coolidge said.

The 29-year old Nasdaq fell 189.22 points, or 3.9 percent, to 4,644.67, adding to a 131-point drop over the previous two sessions. The day's loss topped the previous No. 3 plunge of 188.13 points set March 20.

The Dow, born in the 19th Century, gained 82.61 to 11,018.72. The index of 30 blue chips first closed above 10,000 one year-ago Wednesday. In that time, the Dow is up 10.1 percent while the Nasdaq has nearly doubled as investors chase the technology stocks expected to lead the economy's growth.

But for a day anyway, money fled high-growth companies

"Money which has driven up technology stocks over the last three to six months is getting awfully jittery," Terrence Gabriel, stock market strategist at IDEAglobal.com told CNNfn's market coverage. "Investors that have pushed these stocks higher perhaps have discounted all these good earnings that have come in April."

Illustrating recent volatility, eight of Nasdaq's top ten losses came this year while nine of its 10 largest gains occurred in the same period.

The broader S&P 500, meanwhile, rose 1.19 to 1,508.65.

Market breadth was mixed. Advancing issues led declining ones on the New York Stock Exchange 1,556 to 1,413 on volume of 1 billion shares. But Nasdaq losers beat winners 3,006 to 1,301, as more than 1.7 billion shares changed hands.

In other markets, the dollar fell against the yen but rose versus the euro. Treasury securities were little changed.

Nasdaq falters

Analysts cited no one catalyst behind the day's action, which comes amid a news void following last week's Federal Reserve interest rate hike and next month's earnings reporting season.

Some linked some of the technology slide to influential Goldman Sachs strategist Abby Joseph Cohen, who Tuesday reduced the weight of technology stocks in her model portfolio.

Others pinned the drop on technology stocks' loss of support from end-of-quarter buying that lifted them for much of March.

"Keep in mind most people are now working into the next quarter," said Richard Cripps, chief market strategist at Legg Mason, referring to the period which begins Monday. "The window dressing that has been powering the market may be gone."

Cripps also said expectations for strong technology earnings, another catalyst that has driven Nasdaq higher, may already be priced into tech stocks, removing buying catalyst.

Finally, words from well-regarded emerging markets money manager Mark Mobius added to the selling.

Mobius, of Templeton Funds, said a recent bout of volatility in Internet stock prices could herald the onset of a global crash in the high-flying sector.

He later reiterated his remarks on CNN's Moneyline, saying that the prospect of a crash exists especially in stocks of companies with no earnings. (248K WAV or 248K AIFF)

"The mere fact that me, an emerging markets person, says something about Internet and the market reacts the way it has is and indication that people are very jittery," Mobius said.

Mobius said a continued increase in the supply of Web businesses could prompt a crash. (394K WAV or 394K AIFF)

Whatever the reason, money continued to flee some of Nasdaq's best performers.

Cisco (CSCO: Research, Estimates) shed 1-13/16 to 76-1/16, Sun Microsystems (SUNW: Research, Estimates) lost 3-1/2 to 97-1/8, JDS Uniphase (JDSU: Research, Estimates) dropped 9-11/16 to 119-3/8.

Still, Scott Bleier, investment strategist at Prime Charter Ltd., told CNNfn's Talking Stocks called the sell-off healthy. (368K WAV) (368K AIFF)

Money, meanwhile, moved into non-technology names, lifting the Dow.

Wal-Mart (WMT: Research, Estimates) jumped 4-11/16 to 59-3/16, Coca-Cola (KO: Research, Estimates) gained 2 to 46-7/8, and Exxon-Mobil (XOM: Research, Estimates) rose 1-9/16 to 80-9/16.

Exxon's gains come after OPEC late Tuesday agreed to increase crude output, sending oil prices lower and bringing a sigh of relief that the rising cost of the commodity would not eat away at corporate profits.

"These increases will bring lower prices that should sustain economic growth here in America," President Clinton said in a press conference Wednesday.

Still with oil prices nearly tripling in a year, the 1.45 million barrel jump by OEPC is less than what some hoped for.

General Electric was the Dow's biggest gainer, lifted after Prudential Securities raised its 2000 earnings estimates on the conglomerate to $3.73 a share from $3.70. General Electric (GE: Research, Estimates) rose 7-1/2 to 163-1/2.

Microsoft (MSFT: Research, Estimates), also a Dow member, had another good day, rising 2-7/8 to 107-3/16, as speculation mounted the software maker would settle its antitrust case with the government.

Among other stocks in the news, AT&T Corp. (T: Research, Estimates) rose 9/16 to 60-7/16 after the long-distance provider announced plans to launch a tracking stock for its wireless operations. At $13 billion, the stock would be the largest initial public offering on record. In other news, AT&T boosted its stake in Excite@Home (ATHM: Research, Estimates), which soared 3-3/8 to 37-11/16.

Palm (PALM: Research, Estimates), the maker of the popular Palm Pilot personal computing device, fell 5-1/8 to 49-11/16. Palm late Tuesday reported fiscal third-quarter operating earnings that topped analysts' expectations, but executives at the company said they expect growth to slow ahead.

|

|

|

|

|

|

|