|

Microsoft may face breakup

|

|

April 24, 2000: 4:34 p.m. ET

Reports: DOJ officials want to split company as part of antitrust remedy

|

NEW YORK (CNNfn) - Microsoft Corp. Monday was hit by a double whammy of negative analyst comments in response to its fiscal third quarter earnings and reports that government prosecutors may seek a breakup of the software giant.

The combination of the two caused Microsoft's stock to plunge 12-15/16 to close at 66-5/8, slicing $66 billion from the company's market value within hours. Trading volume in the stock was four times higher than its daily average.

|

| VIDEO |

Government sources tell CNNfn that prosecutors now want to break up Microsoft into two separate units.

Government sources tell CNNfn that prosecutors now want to break up Microsoft into two separate units.

|

| Real |

28K |

80K |

| Windows Media |

28K |

80K |

|

The Justice Department and 19 states are leaning toward asking a court to split Microsoft into separate companies as part of their proposed remedy in the government's landmark antitrust case against the company, a prosecution source told CNNfn Monday.

If the Justice Department and the states make such a recommendation, it would be the first time since the government's antitrust case against AT&T Corp. in the early 1980's that a court has considered a forced break up of a company for monopolizing its markets.

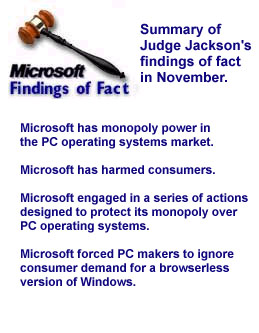

Earlier this month, U.S. District Judge Thomas Penfield Jackson concluded that Microsoft maintained its monopoly power in the market for PC operating systems by anti-competitive means and attempted to monopolize the Web browser market. The judge also found that Microsoft violated the Sherman Act by unlawfully tying its Web browser to its operating system. The federal government and the 19 states involved in the case are expected to submit to the court this week proposed remedies against Microsoft. Earlier this month, U.S. District Judge Thomas Penfield Jackson concluded that Microsoft maintained its monopoly power in the market for PC operating systems by anti-competitive means and attempted to monopolize the Web browser market. The judge also found that Microsoft violated the Sherman Act by unlawfully tying its Web browser to its operating system. The federal government and the 19 states involved in the case are expected to submit to the court this week proposed remedies against Microsoft.

A Solomon approach: Split the company in half

The prosecution source told CNNfn that the proposed remedy being drafted would split Microsoft into one company containing its Windows operating system -- the focal point of the antitrust suit -- and another company containing its software applications. Those applications - which include such titles as Word, Excel and PowerPoint - make up about 40 percent of the company's sales. The Washington Post reported Monday that prosecutors may recommend breaking Microsoft into three companies, one of which would contain the software giant's Internet products, such as its web browser and the Microsoft Network.

Related stories:

Microsoft woes send Nasdaq into a tailspin.

Tech stocks take it on the chin again.

Got an opinion about Microsoft? Check out the message boards.

Previously, securities analysts and antitrust law experts considered a breakup of the software giant to be very unlikely. In fact, the New York Times reported last Friday that neither the federal government nor the states was recommending a breakup. The federal government and the states previously appeared to focus on so-called behavioral remedies, such as forcing Microsoft to change the way it does business with other companies or regulating its pricing policies.

"I thought there would be something a little gentler. This is very harsh," political economist Greg Valliere of Schwab Washington Research Group told CNN's Ahead of the Curve.

"I suppose if you wanted to take a sort of off-the-wall view, maybe they're [the government] trying to negotiate in print. Maybe they're leaking these really harsh remedies in the hope that Microsoft still at this last minute, might come up with a settlement," Valliere said.

The prosecution source said that Assistant Attorney General Joel Klein, the lead prosecutor in the antitrust case, could make his decision and recommendation to Attorney General Janet Reno as soon as Monday. Published reports had indicated that Klein's decision wouldn't come until Tuesday.

Only the fifth inning

Microsoft's chief operating officer, Bob Herbold, responded to the reports by saying that they "don't match the facts and dialog" that have taken place since Microsoft began its settlement discussions with the federal government and the states [204K WAV or 204K AIFF].

"We don't want to overreact to rumors or speculation coming out of the Justice Department or wherever," Herbold said on CNNfn. "We're in the fifth inning of a nine inning game."

In addition, Microsoft spokesman Mark Murray told CNNfn that "if the government proposes radical or extreme steps, then clearly the schedule laid out by the court will have to be revised and lengthened." Judge Jackson's current schedule allows Microsoft just nine days to respond to prosecutors' remedy proposals.

While media attention has focused on the legal threat Microsoft faces, securities analysts are more concerned by the downbeat outlook the company gave for its future revenue growth during a conference call last Thursday. Microsoft's stock didn't trade on Friday because of the Good Friday holiday.

When the software giant reported its third-quarter earnings last Thursday, its revenue for the period was about $300 million lower than analysts had expected, and the company advised analysts to lower their revenue and earnings estimates for the next fiscal year because of sluggish growth in corporate PC demand. The corporate PC market accounts for about 65 percent of Microsoft's revenues.

Goldman Sachs, Lehman Brothers, and SG Cowen on Monday downgraded Microsoft's stock. Goldman Sachs analyst Rick Sherlund removed Microsoft from the firm's "recommended" list of stocks and reduced his estimates of the company's revenue and earnings growth in fiscal 2001.

"There is an increasing risk that Microsoft might atrophy on the PC platform as IBM did on the mainframe platform, while robust growth shifts to hand-held and wireless devices," Sherlund wrote in a research note to clients.

Click here to read the Goldman Sachs report on Microsoft.

SG Cowen senior software analyst Drew Brosseau said today's plunge in Microsoft's stock was triggered more by the analyst downgrades than by news reports about what the proposed remedies may be in the antitrust case.

"The third quarter earnings are clearly negative. The breakup proposal isn't clearly anything," Brosseau said. "It's not clear that a breakup will happen or if it would be negative or positive for the stock even if it did happen."

"The corporate PC market is increasingly mature, and Microsoft has a dominant share of that market, so they are running out of room to grow faster than the market," Brosseau said. The company's best opportunities for future growth are its server software business, which is growing by about 30 percent annually, and its online properties, such as the Microsoft Network, he said.

Waiting on Windows 2000

Investors are counting on Microsoft's new corporate computing operating system, Windows 2000, to re-ignite growth in the company's operating system business. However, that product wasn't released until the middle of Microsoft's third quarter, and companies are expected to take several months to evaluate it before deciding whether to adopt it.

"With Windows 2000 revenues not really kicking in until 2001 and the continued weakness of the business PC sales impacting Microsoft's core business, we expect the fourth quarter to be lackluster, coming in slightly above the third quarter," said CIBC World Markets analyst Melissa Eisenstat.

On April 3, Eisenstat downgraded Microsoft to "hold" from "buy" based on "the lawsuit's potential to negatively impact the operating model." At the time, she said a "50 percent correction in the share price" from a close of 106-5/8 was possible. On April 3, Eisenstat downgraded Microsoft to "hold" from "buy" based on "the lawsuit's potential to negatively impact the operating model." At the time, she said a "50 percent correction in the share price" from a close of 106-5/8 was possible.

|

|

|

|

|

|

|