|

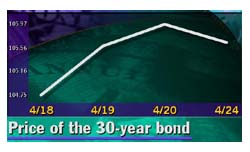

Bonds drift lower

|

|

April 24, 2000: 3:15 p.m. ET

Bonds retreat despite Nasdaq sell-off; dollar slips versus euro, yen

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury bonds ended lower Monday in a notably quiet session, surrendering earlier gains despite a sharp sell-off among U.S. technology shares.

However, other maturities such as 10-year notes drew support from the tech weakness. When stocks decline, investors often flee equities for the relative safety of government securities.

The tech-heavy Nasdaq composite index fell over 6 percent in late trading amid reports that the Justice Department is seeking a breakup of Microsoft Corp. (MSFT: Research, Estimates)

"It's an equity trade - that's all it is," said Tom Estes, head of fixed income at Daiwa Securities, referring to the Treasury market's focus.

Shortly before 3 p.m. ET, the 30-year Treasury bond fell 10/32 of a point in price to 105-21/32. The yield, which moves in the opposite direction to the price, rose to 5.84 percent from 5.83 percent Thursday. The 10-year note gained 3/32 to 103-25/32, its yield at 5.98 percent.

Analysts noted trading activity was limited, with many participants sidelined due to the Easter holiday. European markets were closed Monday in observance of the holiday.

Analysts said one reason Treasury bonds were immune to the weakness  among equities was because investors were reluctant to buy ahead of two key economic reports scheduled for release Thursday - preliminary U.S. gross domestic product (GDP) and the employment cost index (ECI). among equities was because investors were reluctant to buy ahead of two key economic reports scheduled for release Thursday - preliminary U.S. gross domestic product (GDP) and the employment cost index (ECI).

Investors expressed nervousness regarding the data for the first quarter, which may reveal continued strength in the economy. With the U.S. economy in a record period of expansion, investors remain jittery about surging interest rates.

"We're looking at some pretty strong numbers," said Richard Gilhooly, senior bond strategist at Paribas.

Analysts surveyed by Briefing.com expect an increase of 6 percent for the GDP, the broadest measure of goods and services produced, compared with a 7.3 percent in the fourth quarter.

Following these economic reports, Federal Reserve chairman Alan Greenspan is scheduled to speak on the outlook for rural America Thursday in Kansas City, Mo. Market participants will pay close attention to see if the Fed chief sheds light on upcoming monetary policy.

The Fed has increased short-term interest rates five times since last June. But consumer demand remains strong, and analysts predict that the central bank will boost rates at least one more time by a quarter point. Its policy-making arm, the Federal Open Market Committee, meets on May 16.

(Click here for a look at Briefing.com's economic calendar.)

Early in the session, Treasury bonds advanced amid anticipation of another buyback in the wake of the government's $2 billion purchase of longer-dated maturities Thursday.

That repurchase was the third leg in the Treasury's ongoing buyback program that began in March in its effort to reduce the supply of older, longer-term debt. Many analysts expect the government to conduct the fourth buyback this week.

Dollar dips vs. euro, yen

The dollar fell slightly against both the euro and the yen, but was confined to its recent trading ranges Monday. Analysts said trading activity was extremely quiet due to European markets being closed.

"There isn't too much conviction in the market today to trade the dollar in an aggressive fashion," said Alex Beuzelin, senior market analyst at Ruesch International.

Currency traders await the GDP and ECI reports as well as a European Central Bank (ECB) meeting on interest rates Thursday to provide direction.

Beuzelin said there was talk the ECB may hike rates in response to the euro's renewed weakness. Last week, the euro hit a lifetime low against the dollar at 93.55 cents.

Shortly before 3 p.m. ET, the euro traded at 93.94 cents, up from 93.68 cents Thursday, a 0.3 percent loss in the dollar's value. Meanwhile, the dollar changed hands at 105.68 yen, down from 105.85 yen Thursday.

|

|

|

|

|

|

|