NEW YORK (CNNfn) - Lower-than-expected retail sales helped boost U.S. stock futures early Thursday as they raised hopes that the economy may be cooling enough to reduce the pressure for further aggressive interest-rate increases by the Federal Reserve.

A report early Thursday showed retail sales fell 0.2 percent in April, the government reported Thursday, compared with Wall Street forecasts for a 0.5 percent increase. The decrease was the first decline in nearly two years. Separately, import prices fell 1.6 percent in April.

The news sent futures soaring, reversing earlier indications of a lower open.

The Nasdaq 100 futures rose 86.55 points to 3,339.05 early Thursday. The futures were up more than 72 points from fair value level of 3,266.54, a benchmark set daily by traders to balance demand for the future contracts relative to the underlying demand for the component stocks, indicating a much higher opening for the Nasdaq stock market.

S&P futures, the most widely watched futures contract, gained 16.70 points to 1,404.50 on the Globex trading system, and were almost 14 points above its fair value of 1,390.79, suggesting a higher open for that broad stock measure.

The S&P futures are also watched as an indicator of the Dow Jones industrial average, with one point of difference between the futures index and fair value equal to about eight points on the Dow Jones industrial average. So the S&P futures suggested the Dow would open up about 109 points Thursday.

On Wednesday, U.S. stocks finished lower on light volume. The Nasdaq composite lost 200.28 points, or 5.6 percent, to 3,384.73, while the Dow Jones industrial average fell 168.97 points, or 1.6 percent, to 10,367.78. The S&P 500 index dropped 29.09 points, or 2.1 percent, to 1,383.05. On Wednesday, U.S. stocks finished lower on light volume. The Nasdaq composite lost 200.28 points, or 5.6 percent, to 3,384.73, while the Dow Jones industrial average fell 168.97 points, or 1.6 percent, to 10,367.78. The S&P 500 index dropped 29.09 points, or 2.1 percent, to 1,383.05.

Tech issues fall overseas

Stocks were sharply lower in Asia Thursday, led by technology issues. there. Tokyo's benchmark Nikkei index plunged 819.01 points, or 4.6 percent, to 16,882.46, while Singapore's Straits Times index dropped 53.50 points, or 2.6 percent, to 2,003.72. Hong Kong was closed for a holiday.

Stocks also opened lower in morning trading in Europe Thursday, then moved higher after the U.S. retail report. The Paris CAC 40 edged up 17.43 points to 6,280.77, and Frankfurt's Xetra Dax index gained 38.11 points to 7,158.97. London's benchmark FTSE 100 rose 116.40 points, or 1.9 percent, to 6,217, Zurich's SMI climbed 75.50 points, or 1 percent, to 7,663.

In the Treasury market, the 30-year bond was up 6/32 of a point in price early Thursday. That sent its yield, which moves in the opposite direction, down to 6.14 percent from 6.15 percent late Wednesday.

The 10-year note, which some observers now consider their Treasury benchmark, gained 3/32, lowering its yield to 6.41 percent from 6.43 percent late Wednesday.

In the currency market, the dollar strengthened versus the euro but lost ground on the yen in early trading Thursday. The euro was worth 90.85 cents, compared with 91.87 cents in late trading Wednesday. Meanwhile, the dollar fell to 108.52 yen from 109.39 yen.

Click here for Wednesday's after-hours news.

Click here for Wednesday's after-hours trading.

Click here for Morning Call page.

Click here for after-hours trading quotes

Click here for current world markets

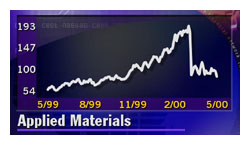

Applied Materials rapped

Earlier this week, a better-than-expected earnings report from technology bellwether Cisco Systems did little to help that stock. Wednesday evening, it was Applied Materials (AMAT: Research, Estimates) that reported earnings in line with the consensus estimates, only to see its stock hammered in after-hours trading.

The manufacturer of equipment used to make semiconductors earned $454 million, or 55 cents a diluted share, before one-time items during the period ended April 30. That is a 224 percent increase from the $140 million, or 18 cents a share, it earned during the same period in 1999. The manufacturer of equipment used to make semiconductors earned $454 million, or 55 cents a diluted share, before one-time items during the period ended April 30. That is a 224 percent increase from the $140 million, or 18 cents a share, it earned during the same period in 1999.

But by merely meeting the consensus, the results apparently disappointed some investors. Shares fell 7 to 77-5/8 in after-hours trading, after a decline of 6 in regular-hours trading.

Earnings were due from Dell Computer (DELL: Research, Estimates) after the market closes Thursday. First Call forecasts that it earned 16 cents a share in the fiscal first quarter, the same as year earlier result. The current forecast is below estimates from earlier this year, before a January warning from the company.

Shares of the second-largest personal computer manufacturer fell 1-7/8 to 44-15/16 in trading Thursday.

Two major retailers were also expected to report disappointing results Thursday. Kmart Corp., the nation's third-largest retailer, and Gap Inc., the largest apparel seller, both warned last week that they would miss earlier forecasts.

Kmart said it would report earnings of about 5 cents a share in the quarter, compared with the previous forecast of 10 cents a share from First Call and year-earlier results of 11 cents a share. Gap said its earnings would miss the forecast of 28 cents a share by one or two cents. The company earned 22 cents a share a year earlier.

Shares of Kmart were unchanged at 7-5/8 in trading Wednesday, while shares of Gap fell 7/8 to 33-1/8.

|