|

Cast a vote for the Fed

|

|

August 4, 2000: 10:48 a.m. ET

Will the Fed steer clear of attention ahead of the November election?

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - A presidential election looms just three months away and the Federal Reserve's monetary policy-making body has two meetings left to decide the fate of interest rates before the White House welcomes a new president.

With all the intermingling that goes on in the Washington political arena, it's hard to imagine the Fed would be content being a wallflower during the electoral dance.

|

|

VIDEO

|

|

CNNfn's Christine Romans reports on election economics.

CNNfn's Christine Romans reports on election economics.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

The economy promises to be high on the agenda in what is expected to be a tight presidential race. Vice President Al Gore has been wearing the economic boom like a badge of honor, promising to extend the robust growth if he gets elected as the next president.

Meanwhile, Republican presidential candidate George W. Bush has avoided outlining a specific economic agenda, with the exception of promising huge tax cuts. As economic issues climb the agenda ladder, the Fed cannot be ignored.

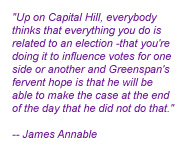

"The Fed will deny that they even know there is an election going on," said James Annable, chief economist at WingspanBank.com. "It is, and clearly has to be, a political organization. It is an enormously powerful public agency, and if you don't have a sense of the political structure you're operating in, you won't survive as a political agency."

The Fed has raised rates six times since June 1999, and investors are desperate for signs that inflation is under control and interest rates will hold steady. But the fact that it is a presidential election year paints an even murkier picture. The Fed has raised rates six times since June 1999, and investors are desperate for signs that inflation is under control and interest rates will hold steady. But the fact that it is a presidential election year paints an even murkier picture.

One former Fed governor dismissed the upcoming election as having any impact on the Fed's monetary policy decisions. "I attended the FOMC (Federal Open Market Committee) meetings as a Fed governor and, before that, as a staff member for 15 years and I never heard the word 'election' mentioned," Lyle Gramley, an economist with Mortgage Bankers Association, said.

However, that certainly doesn't mean the economy and the election are independent of each other. Patrick Lynch, professor of government at Georgetown University, told CNNfn's Market Call that voters place a lot of weight on the economy, cheering or jeering the president for economic prosperity. (352K AIFF) (352K WAV)

"I really think when you talk about pocketbook issues that affect the electorate, people think about the Nasdaq (composite index) and the Dow Jones (industrial average)," said Greg Valliere, managing director with Charles Schwab Washington Research Group. "If we got another rate hike and the market sold off on that, I think people would be displeased. If there's no rate hike on August 22 and the market rallies, you've got to say that helps (Al) Gore." "I really think when you talk about pocketbook issues that affect the electorate, people think about the Nasdaq (composite index) and the Dow Jones (industrial average)," said Greg Valliere, managing director with Charles Schwab Washington Research Group. "If we got another rate hike and the market sold off on that, I think people would be displeased. If there's no rate hike on August 22 and the market rallies, you've got to say that helps (Al) Gore."

A declaration of independence?

So, will he or won't he? The answer to that little question carries a lot of weight for investors and voters, wondering whether or not Federal Reserve Chairman Alan Greenspan will raise rates at the next meeting of the FOMC, the Fed's monetary policy-making body, on August 22.

Some say Greenspan would rather keep the Fed out of the limelight during an election year, unless the economy dictates otherwise.

"Anyone who sits at that table knows that if the Fed puts his head up in the midst of an election campaign when it's not necessary to do so, that would be a rather foolish thing to do," Gramley said. "You don't want people shooting at you unnecessarily - you'd rather live to fight another day."

The Fed will meet two more times before the election - August 22 and October 3 -- but it is rare for the Fed to make a change in interest rates in the month preceding a presidential election.

Former GOP presidential candidate Steve Forbes told CNNfn's In the Money it is unlikely the Fed would move on interest rates in August as the central bank opts to take a back seat to the election campaign (426K AIFF) (426K WAV)

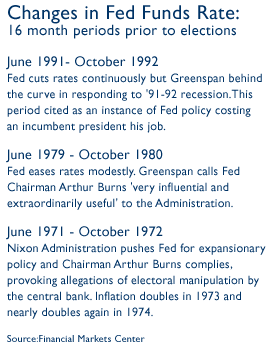

According to a report published by Financial Markets Center, during the past 11 presidential cycles the interest rate has increased only once during the June-May period preceding a presidential election. The increase came during the height of the Vietnam War, during 1967-1968. According to a report published by Financial Markets Center, during the past 11 presidential cycles the interest rate has increased only once during the June-May period preceding a presidential election. The increase came during the height of the Vietnam War, during 1967-1968.

"The 1.74 percentage point increase in the FOMC-controlled federal funds rate between June 1999 and May 2000 is nearly seven times greater than the average change in the funds rate during comparable periods over the past 11 national election cycles," Tom Schlesinger, executive director of the Financial Markets Center, wrote in the report. "During the June-to-May portion of (former Fed Chairman) Paul Volcker's anti-inflation campaign in 1979-1980, the funds rate actually increased substantially less than it has during the current cycle."

Statistically, the odds favor no rate change coming from the next two meetings, but does that mean the Fed is retaining its independence and staying away from politics? Statistically, the odds favor no rate change coming from the next two meetings, but does that mean the Fed is retaining its independence and staying away from politics?

"The mistake some people make about the Fed as a fundamentally, very politically aware organization, is they think that the Fed picks favorites in an election," said WingspanBank's Annable. "I think every one of them (Fed governors) will go vote but the politics of the Fed are to defend the Fed."

With the August meeting just weeks away, the bias is leaning toward no rate change, with the Fed building a case in support of its decision.

"The Fed will be content to sit on the sidelines to await more definitive evidence as to whether inflation is going to be a problem or not," Gramley said. "Setting the election aside entirely, the Fed, looking at the incoming data, would say to itself 'right now we don't want to raise interest rates and we don't need to raise interest rates.'"

But what about the October meeting?

"They won't move on October 3 but, as you know, there's a meeting right after the election," Schwab's Valliere said. "If, during that period between now and November, the economy show signs of re-accelerating, and there's an inflation problem, they could move 25 (basis points) or 50 (basis points) if they had to."

What's up with the economy?

With people snapping up every bit of economic information, early indicators have not been kind - some data have shown a slowdown for the surging economy but other data have not shown much reaction to the rate hike spree.

People are not yet convinced that the Fed's interest rate hikes are taking hold and slowing the economy enough to avoid further rate hikes, leading to jittery moves in the U.S. stock markets.

Since the start of the year, the Nasdaq has had some wild swings and is now down 1.1 percent. The index is nearly 38 percent from its March 10 high of 5,046. Meanwhile, the Dow is down 7.5 percent since the start of the year. Since the start of the year, the Nasdaq has had some wild swings and is now down 1.1 percent. The index is nearly 38 percent from its March 10 high of 5,046. Meanwhile, the Dow is down 7.5 percent since the start of the year.

"If the world gets the idea that this is the end of Fed tightening, the stock market will probably like that and you will have higher stock averages," said Annable. "What it boils down to, in terms of the economy, is the standard of living for wage earners is significantly higher. For (George W.) Bush, he has to neutralize that and for (Al) Gore, he has to figure out how to capitalize on that."

One of the closely watched inflationary gauges, the gross domestic product, grew at a whopping 5.2 percent annual rate in the second quarter, well above the 3.7 percent forecast of analysts surveyed by Briefing.com. The rate was even greater than the revised 4.8 percent growth rate in the first quarter.

But the number itself doesn't tell the whole story. The GDP's price deflator came in as expected at 2.5 percent, and down from the revised 3.3 percent in the first quarter.

"The consumer is not on a spending binge - consumer spending has moderated and I don't think there's a compelling case (to raise rates)," Schwab's Valliere said.

Click here for a comprehensive look at economic data

|

|

|

|

|

|

|