NEW YORK (CNNfn) - Treasury bond prices climbed Friday after a tame July U.S. employment report reinforced expectations that the Federal Reserve will not have to hike rates this month.

In the currency markets, the dollar fell against the euro, but edged higher against the yen.

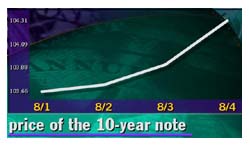

Shortly before 3 p.m. ET, the benchmark 10-year Treasury note rose 11/32 of a point in price to 104-8/32. The yield, which moves in the opposite  direction to price, fell to 5.90 percent from 5.95 percent Thursday. direction to price, fell to 5.90 percent from 5.95 percent Thursday.

The 30-year bond gained 12/32 to 107-19/32, its yield retreating to 5.70 percent from 5.74 percent.

The latest economic news signaled further evidence of a moderation in economic growth. The U.S. economy lost 108,000 jobs in July compared with a revised 30,000 positions created in June, the Labor Department said.

That number was well below consensus estimates of a 70,000 gain. The unemployment rate held steady at 4 percent, in line with expectations.

The September federal funds contract, which gauges market expectations for where rates will go, is now suggesting about a 20 percent chance of a rate boost at the next Fed policy meeting on Aug. 22.

"While the report does not make it a certainty, it increases the probability  that the Fed will leave policy unchanged," said Gary Schlossberg, senior economist at Wells Capital Management. that the Fed will leave policy unchanged," said Gary Schlossberg, senior economist at Wells Capital Management.

In order to cool the economy, the central bank has raised short-term interest rates six times in the past 13 months. Mike Boss, bond futures broker at IBJ Lanston Futures, told CNNfn's Before Hours the market believes the Fed's tightening has worked. (288K WAV) (288K AIFF)

However, analysts said the market's failure to rally on the employment data was partly due to the Treasury's refunding auctions next week. In its quarterly refunding announcement Wednesday, the government said it would sell $10 billion of five-year notes Tuesday, $10 billion of 10-year notes Wednesday, and $5 billion of 30-year bonds Thursday.

Wells Capital's Schlossberg noted there was still lingering disappointment that the Treasury did not announce plans to eliminate the 30-year bond. "That may be holding the market back a bit," he said.

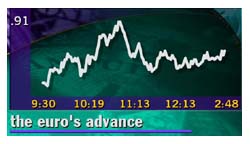

Euro rebounds

The euro regained its momentum against the dollar Friday, rising above the 91-cent level. The euro's gains were fueled by the weaker-than-expected jobs report.

"Today's jobs number would support the idea of a soft landing, or at least  moderation in growth," said Andrew Busch, director of foreign exchange at Bank of Montreal in Chicago. moderation in growth," said Andrew Busch, director of foreign exchange at Bank of Montreal in Chicago.

Meanwhile, traders looked ahead to next Friday's Bank of Japan (BOJ) policy meeting. The BOJ is expected to maintain its zero interest rate policy due to recent bankruptcies and heavy losses among Japanese stocks.

Shortly before 3 p.m. ET, the euro was buying 90.79 cents, up from 90.57 cents Thursday, a 0.2 percent loss in the dollar's value. The dollar traded at 108.54 yen, up from 108.40 yen Thursday.

|