|

U.S. confidence rises

|

|

September 26, 2000: 11:55 a.m. ET

Report shows fuel costs haven't dented consumer attitudes about economy

|

NEW YORK (CNNfn) - U.S. consumer confidence climbed in September, as rising fuel costs failed to shake Americans' faith in the strength of the economy, according to a survey released Tuesday.

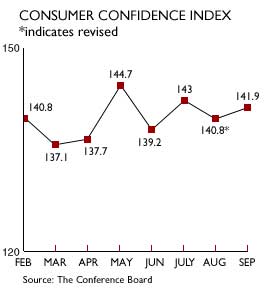

The Conference Board, a private business group, said its monthly gauge of consumer attitudes climbed to 141.9 in September from a downwardly revised 140.8 in August.

The index came in at a higher-than-expected level. Analysts polled by Briefing.com anticipated the index would rise to 141.4. The gauge hit an all-time high of 144 earlier this year.

"Despite higher gasoline prices this summer and the prospect of higher heating oil costs this winter, consumers remain in an upbeat mood," said Lynn Franco, director of the Conference Board's consumer research center. "Nothing in this latest survey suggests the economy will run out of steam soon."

The index, based on a survey of 5,000 U.S. households, is closely monitored by investors and policy makers because consumer spending fuels about two-thirds of the U.S. economy. The index, based on a survey of 5,000 U.S. households, is closely monitored by investors and policy makers because consumer spending fuels about two-thirds of the U.S. economy.

Other indicators tracked by the survey also showed consumer attitudes are strong. The percentage of consumers who rated current business conditions as "good" rose to 48.9 percent, from 46.2 percent in August, while the percentage expecting business conditions to improve over the next six months climbed to 18.4 percent from 17.2 percent in the previous month.

Consumers also were more upbeat about the job market. Consumers expecting more jobs to be available in the next few months rose to 17.9 percent in September, from 17.1 percent in the prior month.

As long as record U.S. unemployment continues and new jobs are created at a fast pace, consumer confidence should remain at its current strong levels even though fuel costs are cutting into American's pocketbooks, said Douglas Lee, president of Economics from Washington, a consulting firm.

"The bottom line is everybody has a job, everybody feels confident that they can get a job if they lose the job they have," he said. "That makes people feel confident about things."

|

|

|

|

|

|

The Conference Board

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|