NEW YORK (CNNfn) - The Nasdaq composite index fell for the fifth time in five sessions Wednesday, tumbling to its lowest level in nearly four months amid fresh worries about slowing corporate profit growth that have rattled Wall Street all month.

Priceline.com became the latest company to prepare analysts for a revenue shortfall, hitting Yahoo!, another Internet stock and one of Nasdaq's biggest movers.

And Eastman Kodak fell for a second day, pressuring the Dow Jones industrial average, after the company warned about third-quarter earnings.

Ken Tower, director of technical research at UST Securities, told CNN's Street Sweep he isn't sure the worst is over.

"I'd like to see the market turnaround right here, hold Friday's lows and move higher," Tower said. "If we don't hold (the lows) it's a real strong sign that you got to take this market lower to get it fully oversold." "I'd like to see the market turnaround right here, hold Friday's lows and move higher," Tower said. "If we don't hold (the lows) it's a real strong sign that you got to take this market lower to get it fully oversold."

Still, some stocks may have bottomed. Intel gained for the first time in four sessions after falling to a February low. And advances in Hewlett-Packard, down 15 percent this month, kept the Dow's losses from becoming worse.

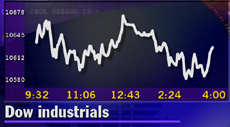

By day's end, the Nasdaq fell 32.80 points to 3,656.30. Wednesday's was the lowest close since June 1, when the Nasdaq finished at 3,582.50. The Dow shed 2.96 to 10,628.36, its third fall in three days. The S&P 500 declined 0.64 to 1,426.54.

John Peluso, head of NYSE trading at Lehman Brothers, described a mostly conviction-less trading session -- something he doesn't see changing in the days ahead. Stocks opened higher, faded by noon, then rebounded, only to close lower.

"The market is treading water," Peluso said. "The market is treading water," Peluso said.

Market breadth was mixed amid heavy trading volume. Advancing issues on the New York Stock Exchange beat declining issues 1,493 to 1,346, on volume of 1.1 billion shares. But Nasdaq losers beat winners 2,459 to 1,533, as more than 1.9 billion shares changed hands.

In other markets, the dollar held steady against the euro but fell versus the yen. Treasury securities declined.

Searching for a bottom

The day's losses come amid a nervous time in the markets. High oil prices and a strong U.S. dollar have prompted a rash of profit warnings this month, sending stocks reeling.

For the quarter, 231 companies have issued earnings or revenue warnings, according to First Call/Thomson Financial. That's above the 155 warnings posted during the second quarter and the 188 reported in the year-earlier period.

Among the latest and most devastating, Priceline.com (PCLN: Research, Estimates) tumbled $7.88, or 42 percent, to $10.75 after warning that its third-quarter revenue would be about $342 million, well below forecasts of about $370 million. Among the latest and most devastating, Priceline.com (PCLN: Research, Estimates) tumbled $7.88, or 42 percent, to $10.75 after warning that its third-quarter revenue would be about $342 million, well below forecasts of about $370 million.

Other Internet stocks also suffered. Yahoo! (YHOO: Research, Estimates) lost $12.06 to $90.38.

Eastman Kodak (EK: Research, Estimates), meanwhile, continued falling, shedding $1.94 to $42.56, one day after the company warned it will miss third-quarter profit targets. The announcement shaved 22 percent off the stock's value Tuesday.

Kodak joined a long list of companies announcing earnings shortfalls. Stocks have fallen steadily on news suggesting shares are still too expensive amid a slowing economy.

Terence Gabriel, stock market strategist at IDEAglobal.com, told CNNfn's Talking Stocks that Wall Street may have entered a bear market phase leaving stocks little changed through the rest of 2000. (367K WAV) (367K AIFF).

More news from CNNfn.com for investors:

· Active funds healthy in 3Q

· Bill gives IRAs a big break

· Selkin likes Ciena

Still, bargain hunters emerged. Intel (INTC: Research, Estimates), which had fallen to its lowest levels since February this week, jumped 56 cents to $43.88. The chip maker's shares tumbled in the prior three sessions following a revenue warning late Thursday.

But UST Securities' Tower said the worst may not be over.

"The chart looks awful on Intel," said Tower, referring to the price patterns that analyst use to determine future stocks behavior. "It may be a great buy but it's too early to see."

Other beaten-up stocks also drew buyers. Among them, Cisco Systems (CSCO: Research, Estimates) rose $2.13 to $57.31 and Hewlett-Packard (HWP: Research, Estimates) gained $4.63 to $102.

"Today (Wednesday), the market is just hanging in there," said Barry Hyman, chief investment strategist at Weatherly Securities. "You're getting some good positive movement amid the lack of any negative news."

Hyman said the market needs to get through the third quarter, which ends Friday, in order to benefit from the release of earnings results for the period, which are expected to be strong.

"It's going to have to be the third-quarter earnings to save the market," Hyman said. "It's going to have to be the third-quarter earnings to save the market," Hyman said.

One company posting results saw gains. 3Com (COMS: Research, Estimates) rose $3.06 to $17 after reporting a smaller-than-expected loss of 12 cents per share for the fiscal first quarter.

And Exxon Mobil (XOM: Research, Estimates), which has gained with the rising price of oil, rose $2.63 to $89.25, advancing with other oil producers.

|