|

Profit-sharing plan ABCs

|

|

October 4, 2000: 6:46 a.m. ET

Know how they differ from 401(k)s and what benefits they offer

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - If someone asks whether you have a profit-sharing plan at work and you have a 401(k), your best answer is: "Technically."

That's because a 401(k), regardless of whether it offers an employer match or not, falls under the umbrella term "profit-sharing."

But there are workplace retirement plans specifically called "profit-sharing plans." They are similar to 401(k)s in that they are both considered defined-contribution plans and are subject to federal laws and protections governing those plans. But they differ from 401(k)s in several ways, particularly with regard to who may contribute, how much may be invested and the tax benefits involved.

Getting your cut of the pie

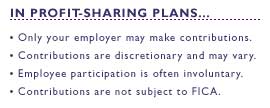

In a pure profit-sharing arrangement, only your employer, not you, may make contributions on your behalf. Those company contributions are discretionary, based on the company's profitability.

"Profit-sharing by its nature is uncertain. Sometimes you have a good year. Sometimes you have a bad year," said David Wray, president of the Profit Sharing/401(k) Council of America. But in the end, the purpose of having such a plan is "to generate goodwill and a feeling of partnership," he said. "Profit-sharing by its nature is uncertain. Sometimes you have a good year. Sometimes you have a bad year," said David Wray, president of the Profit Sharing/401(k) Council of America. But in the end, the purpose of having such a plan is "to generate goodwill and a feeling of partnership," he said.

Very often participation in the plan is involuntary -- every eligible employee (e.g., those who have worked at the company for a certain period of time) will receive a cut of the profit, and that cut may be determined by a formula tied to salary.

In a 401(k), by contrast, participation is voluntary, but if a matching contribution is offered, you must participate in the plan in order to qualify for that match, which is very often based on a formula tied to your contribution. Some companies may also offer a second, discretionary match based on profit, but to take advantage of those 401(k) participation is required.

In terms of tax benefits, profit-sharing plan contributions are exempt from FICA tax - that which you and your employer pay to support Social Security and Medicare, Wray said. By contrast, 401(k) contributions are not, although they may be deducted from your gross income.

Know where (and when) your money is invested

The trend in profit-sharing plans is toward participant-directed investment, as it is in 401(k)s, Wray said. But there are still plans that invest all participants' money in the same pot.

In cases like these, you may not know what investments are in the plan, because plan administrators are not required by law to tell participants, said Department of Labor spokeswoman Sharon Morrissey. However, many plan sponsors do give out this information at least yearly.

If they don't and you are in a plan with 99 or more participants, you may ask the plan administrator for a copy of the latest annual report that the administrator must file with the Labor Department, Morrissey said. That report details, among other things, the investments made for the plan that year.

If you are in a plan with fewer than 99 participants, you may ask the administrator for the information directly since there is nothing precluding him or her from telling you, she added. If you are in a plan with fewer than 99 participants, you may ask the administrator for the information directly since there is nothing precluding him or her from telling you, she added.

You might also consider asking the investment adviser to the plan. Joseph P. Allocca, president and CEO of The Pension Company, which invests for a number of small-business profit-sharing plans, said he would not hesitate to tell a plan participant where he was investing the money.

While matching contributions in a 401(k), at least with larger companies, are often made every pay period or at least quarterly, it may be that the employer contribution in a profit-sharing plan is only made once a year.

"Most often funds come into the accounts in the first quarter of the year," said James Pappas, a registered investment adviser who manages a number of profit-sharing plans.

Withdrawals and rollovers

That doesn't necessarily mean if you leave the company in the second quarter that you can take the money and run.

As in a 401(k), your employer may set out a vesting schedule that dictates how long you must work at the company in order to claim the profit-sharing contributions made in your name.

But if the money is vested, you are permitted to roll it over into an IRA or a new employer's retirement plan when you leave the company.

There are other similarities between a 401(k) and a profit-sharing plan worth noting. While invested in either plan, your money is fully protected from creditors, whether yours or your company's. And participants in both plans are subject to a 10 percent penalty for withdrawals made before age 59-1/2.

Having said that, there are some differences when it comes to withdrawals. No plan provider is required to allow for early withdrawals. But where they do, profit-sharing plans have greater flexibility in deciding the terms under which early withdrawals may be made. For instance, 401(k) participants who make withdrawals may only do so for "hardship" expenses such as medical or educational bills. That same restriction does not have to apply in a profit-sharing plans, although it may. That's the plan administrator's call.

Nevertheless, a recent survey conducted by PSCA found that a majority of profit-sharing plans permit no early withdrawals (or what's known as in-service distributions) whatsoever.

The benefits of a 'combo' deal

Companies that only offer a profit-sharing plan tend to be among the smaller businesses, Wray said. Many larger companies offer what's known as a combination arrangement, where they offer a 401(k) without a match and then also offer a separate profit-sharing plan. Or some offer a 401(k) with both a fixed match and a discretionary profit-sharing match.

The advantage to having both plans is that you get to save steadily for your retirement through your 401(k) regardless of how your company fares from year to year, Wray said.

A combination arrangement, however, does affect how much money can go into each plan on your behalf.

Under federal law, the total yearly contributions made on your behalf by all eligible sources in employer-sponsored retirement plans may not exceed $30,000 or 25 percent of your salary, whichever is less.

That means if you have both plans and you contribute the maximum allowed to your 401(k) -- $10,500 or typically 15 percent of your salary, whichever is less -- then the sum of your employer's contributions into the 401(k) and any other profit-sharing plan available may not exceed $19,500 or some lesser amount that would bring you up to the 25 percent ceiling.

A good plan made better

Whether you have one or both options available to you, don't be surprised if you see improvements made to the plans in the future. Some of them may even be based on employees' suggestions. That's because your long-term happiness has become your employer's business.

In a highly competitive labor market, employers are aiming to tailor their plans to their employees' needs as much as possible since the plans can be effective hiring and retention tools.

Said Wray, many companies are now asking, "How can we tweak our plan to attract the kind of employees we want and need?"

|

|

|

|

|

|

|