|

A plan for procrastinators

|

|

October 6, 2000: 8:32 a.m. ET

Putting a decent financial strategy in place can be like wash 'n wear: easy

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Take your least favorite household chore -- cleaning the bathroom, defrosting the refrigerator, mopping the floor, anything. Now, take this little test: Given the choice, would you rather: A) put on the rubber gloves and get to work; or B) map out and implement a long-term investment strategy for yourself?

Granted, you never claimed to be a Wall Street wonk and the pleasures of projecting how much you'll need to spend on Wednesdays when you're 80 escape you.

But if you'd rather do anything but come up with a serious game plan for your money or are just an old-fashioned procrastinator, you might consider this: It's not that hard, doesn't take that long, and once you do it, a minimum of effort is required to monitor your progress. Oh, and there's an added benefit: It might just bring you financial peace of mind.

No fuss, no muss

The goal is to insure your money works for you while you're busy doing more interesting things, like, say, cracking open a beer and watching postseason baseball.

If you set it up right, maintaining a good plan doesn't have to take more than a couple of afternoons a year, financial planners say. And let's face it: You can't say that about housework. If you set it up right, maintaining a good plan doesn't have to take more than a couple of afternoons a year, financial planners say. And let's face it: You can't say that about housework.

So what if you have no idea where you want to live or what you want to do in retirement? That shouldn't stop you from systematically and smartly investing some money now, said certified financial planner (CFP) Patricia Jennerjohn of Oakland, Calif. After all, she explained, you won't have much choice without a nest egg.

The biggest secret to a successful no-fuss-no-muss plan is to pay yourself first, streamline your investments and maximize your retirement contributions to tax-deferred accounts such as a 401(k), experts say.

Think 'cruise control'

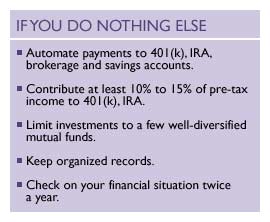

So, if you do nothing else, do these two things. Automate your savings and, where you invest, stick to a few well-diversified mutual funds with solid track records.

That means direct depositing biweekly or monthly contributions into your 401(k) and savings accounts, as well as your IRA and brokerage accounts if you have them. What you never see in your checking account, you won't miss.

Click here to read about some of the best funds for your 401(k).

It also means resisting the urge to be a stock-picker. Successful stock picking requires a lot of work, and more work is the last thing you want. And it's hard for most people to do it right since it's not their full-time job, said CFP Dennis Filangeri, who is based in San Diego. That's why he advises sticking to mutual funds and letting professional managers worry about your investments.

Look at it another way, said CFP Ron Roge of Bohemia, N.Y. "You're taking rifle shots when you hold a stock instead of a shotgun that puts out a very broad pattern. (With funds) you're more likely to hit your target," Roge said.

All you need to worry about is that the funds you pick satisfy your asset allocation needs based on your age and risk tolerance. For instance, the younger you are, the more aggressive your long-term investments can afford to be.

Click here for can't-fail portfolios tailored for the conservative, moderate and aggressive investor.

And generally speaking, you want broad exposure across industries, market caps and investment styles both domestically and internationally.

"Don't go for the sector funds," Roge said, explaining that they can be volatile and require more monitoring on your part.

Only a few pit stops needed

Experts also advise you to keep the number of funds you own to a minimum.

The less-is-more approach works on a couple of levels. First, the fewer the funds you own, the less paperwork you have to organize. Second, fewer funds means you spend less time tracking them.

Speaking of performance, you only need to check it quarterly, Roge said. But don't expect your funds to always be in the top 10 percent of their category. For a long-term, low-maintenance portfolio, you're likely to do fine so long as the funds you own consistently perform better than at least 50 percent of their peers, Roge and Filangeri said. Speaking of performance, you only need to check it quarterly, Roge said. But don't expect your funds to always be in the top 10 percent of their category. For a long-term, low-maintenance portfolio, you're likely to do fine so long as the funds you own consistently perform better than at least 50 percent of their peers, Roge and Filangeri said.

In addition to checking your funds, review your portfolio once a year, Roge suggested. That's the time to assess whether you need to rebalance your holdings or sell a poorly performing fund.

That portfolio review might coincide with a look at your whole financial picture, something Filangeri suggests you do twice a year. Take a few hours to factor in any changes in income or expenses, reassess your near-term and long-term financial goals and calculate how much you'd like to save in the coming months. Be sure, too, to have at least 3 months' worth of expenses set aside in an emergency fund, experts say.

One of the best times to do all this is around tax time, when you already have your financial records out, Filangeri said. Another might be around the time of open enrollment for your benefits at work, Jennerjohn added.

First things first

A well-run financial life presumes you have taken the time to set up the right accounts and organize your records.

That's a chore, but it's a one-time chore and if you feel your inner procrastinator pitching a fit, consider getting help from a certified financial planner.

Click here to read about the top three financial mistakes you should avoid.

Similar to a personal shopper, Jennerjohn said, a planner can help you prioritize your tasks, think about your goals, set up a simple plan and direct your attention to some good investment choices.

Since many planners work on a fee-only basis, you can buy as many or as few planning services as you need, she said.

But if you're fairly organized, have a basic understanding of household finance and are not steeped in debt, there are plenty of inexpensive do-it-yourself options available such as financial planning software programs and online portfolio trackers, Filangeri said.

Motivation 101

Now comes the real test. You've read the article. You even agree with some of the points. But if you now find yourself fantasizing about scrubbing the tub right after the playoffs, it's time to pull out the real ammunition, that old-time favorite: fear of failure.

Consider this when it comes to your finances, Filangeri said. "Failing to plan is planning to fail."

|

|

|

|

|

|

|