|

Reconsider CDs & MMAs

|

|

October 18, 2000: 10:23 a.m. ET

A disappointing stock market is all the more reason to spread the eggs

By Laura A. Bruce

|

NEW YORK (Bankrate) - How many stomach-churning drops in the stock market can you handle?

With the Nasdaq spending a lot of time in bear territory and the Dow struggling to keep its head above water, what kind of a beating are your savings and investments taking?

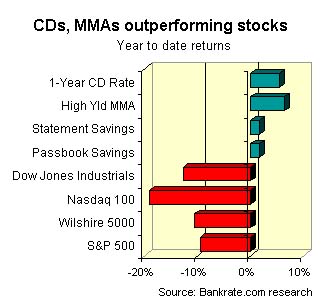

But while major stock indexes -- S&P 500, Wilshire 5000, Nasdaq 100 and the Dow -- have posted year-to-date losses of 9.5 percent to 19 percent, one-year CD rates are at 5.5 percent and high yield money markets are returning 6.36 percent -- guaranteed!

CD and money market account rates have just peaked and begun to back off a little -- but they are still offering their best earning in years.

Talk about timing.

Bankrate financial analyst Greg McBride says the imbalance between a sagging stock market and the continuing strength of CDs and MMAs highlights the folly of an all-the-eggs-in-one-basket strategy.

"People have been chasing the heady returns of the stock market. Now we're seeing the flip side and it's justification for a diverse portfolio."

Timing, timing, timing

There's no saying when the market will overcome its recent volatility, but one thing is for sure -- if you want to safeguard some of your money with a solid, guaranteed return, act now.

The average national yield on the five-year CD is 6.01 percent. McBride estimates it could be as low as 5 percent six months from now. (He advises using Bankrate's listings of the best deals, latching onto a high-rate CD and locking it in for as long as possible.)

"That's quite the opposite of what it was six or 12 months ago when we were in a rising interest rate environment," says McBride. "At that time everyone was going with the shorter term so they could reinvest at a higher yield going forward."

There are two main reasons CD yields had such a nice run: the Federal Reserve was hiking interest rates and banks needed money to meet heavy loan demand so they boosted CD rates to raise money.

But now the Fed appears to be done with rate hikes and as the economy backs off from its breakneck pace, there's less demand for loans.

Strategy

The best strategy now -- find the highest rate and lock in for the longest time, says McBride. But that can be tough because bank CD "specials" are offering higher rates on shorter-term certificates. The best strategy now -- find the highest rate and lock in for the longest time, says McBride. But that can be tough because bank CD "specials" are offering higher rates on shorter-term certificates.

"You need to ask yourself, 'When this CD matures in six months what rate will I be reinvesting at?'" says Barry Vosler, a certified financial planner in DeWitt, Iowa. "Am I better off taking a two-year CD at 6.5 percent or a six-month CD at 7 percent? If six months from now the 7-percent CD has matured and interest rates have lowered to 5 percent are you better off having gotten that extra 0.5 percent for six months? No."

Vosler suggests laddering CDs -- buy them with durations of two to five years or longer. Spread them out over a time frame so you're not gambling on interest rate movements.

Don't run scared

While it's definitely time to rethink your strategy, don't let this scenario scare you into making bad moves. Don't raise money by cashing in on CDs that are a few months from maturity. McBride says people need to plan but they shouldn't be overly concerned that they'll miss out on opportunities.

"The yields won't drop precipitously -- even a 50-basis-point drop still places the yields at a higher rate than anything between January 1998 and January 2000. It's not worth the early withdrawal penalty - the penalty will outweigh the benefit of the higher yield."

Money markets are also offering attractive rates but unlike a CD you can't lock in the rate and it can change at any time. The point of having funds in money markets is that you have quick access. Bankrate's McBride suggests siphoning some of that money off and putting it into a short-term CD, maybe three-months, but only if you have enough cash remaining in the money market to cover your short-term emergency needs.

Although you can't lock in a money market rate, look for the best yields in Bankrate's 100 highest yield listing and check our quarterly winners list to see how consistent those institutions are with the yields they pay.

- by Bankrate.com for CNNfn.com

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|