|

GE sets $45B Honeywell deal

|

|

October 22, 2000: 9:12 p.m. ET

Last-minute bid by Jack Welch-led conglomerate trumps United Tech offer

|

NEW YORK (CNNfn) - General Electric Co., which entered the bidding process just two days earlier, announced late Sunday it has agreed to acquire Honeywell Inc. in a $45 billion tax-free merger plus the assumption of debt.

As part of the deal, John F. "Jack" Welch Jr. will stay on as chairman of GE through the end of 2001. Welch, who turns 65 on Nov. 19, was scheduled to retire next April. As part of the deal, John F. "Jack" Welch Jr. will stay on as chairman of GE through the end of 2001. Welch, who turns 65 on Nov. 19, was scheduled to retire next April.

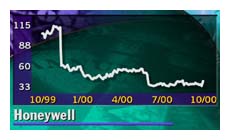

Terms of the deal call for GE to pay 1.055 of its shares for each of Honeywell's 801.5 million shares outstanding. That arrangement values Honeywell (HON: Research, Estimates) at $55.12 per share, a 19.8 percent premium over its closing price Friday of $46 and a 10 percent premium over an earlier offer of about $50 per share from United Technologies.

The companies will formally announce the merger at a 9 a.m. press conference Monday in New York City. The boards of both companies have approved the merger, which is expected to be completed in early 2001.

The deal comes just two days after Honeywell was reportedly finalizing plans to merge with United Technologies for about $40 billion.

"Honeywell's core group of businesses -- Avionics, Automated Controls, Performance Materials and its new microturbine technology -- are a perfect complement to four of GE's major businesses," Welch said in a statement.�

"Not only are the businesses a perfect fit, but so are the people and processes," he added. "GE's operating system and social architecture, coupled with both companies' common culture based on the initiatives of Six Sigma, Services, Globalization and e-Business are also a perfect fit."

Welch is currently in the process of selecting a successor after 20 years at the helm of one of America's most well known companies. A chairman-elect will be named before the end of the year, GE board member Silas Cathcart said in a statement Sunday.

The merger will be accounted for as a pooling of interests and is expected to add to earnings per share in the first full fiscal year, exclusive of any one-time charges, GE said. The merger will be accounted for as a pooling of interests and is expected to add to earnings per share in the first full fiscal year, exclusive of any one-time charges, GE said.

United Technologies announced Friday afternoon that it had broken off negotiations, following a last-minute competing bid for Honeywell Estimates from an unnamed company that turned out to be General Electric �(GE: Research, Estimates).

According to published reports, the talks broke down after a Friday morning phone call from Welch to his counterpart at Honeywell, Michael Bonsignore, offering a competing bid. The bid came just as Honeywell's board was preparing to meet and vote on United Technologies' offer, which initially valued the company at more than $50 per share, sources said.

Honeywell ultimately closed Friday at $46 per share, up $10.12 for the day -- a sharp rise from the $41.13 level it traded at prior to being halted. The stock climbed an additional $1.50 to $47.50 in after-hours trading.

The decision to end talks caught traders and analysts off guard. Sources told CNNfn.com Honeywell and United Technologies were engaged in serious merger discussions as late as Friday morning.

Most analysts Friday had viewed Fairfield, Conn.-based General Electric as the most likely bidder. Like United Technologies (UTX: Research, Estimates), the diversified U.S. conglomerate will be able to gain significant synergies from a combination with Honeywell, analysts said. The two companies compete in several areas, including producing aircraft engines and industrial control equipment. Honeywell is also a leading maker of avionics, or aircraft electronics, as well as turbochargers and specialty chemicals.

Apparently aiding the deal were Welch's close ties with Honeywell's former chairman, Lawrence Bossidy.

Bossidy, a former top executive at GE, was chairman and chief executive of Allied Signal when the company agreed in June 1999 to acquire Honeywell. The combined company retained the name Honeywell, and Bossidy stayed on as chairman until April 2000.

GE would gain additional strength in the aircraft sector with the addition of Honeywell, but may have to make some divestitures to win the approval of antitrust regulators. GE also owns financial services powerhouse GE Capital and the NBC television network among its many businesses.

The deal could also be a significant blow to United Technologies, whose Pratt & Whitney unit has been losing ground to GE on aircraft engine orders, analysts said.

GE shares fell $3.38 to $52.25 Friday, posting a majority of its loss shortly after United Technologies made its announcement.

- from staff and wire reports

|

|

|

|

|

|

|