|

Telecoms energize Europe

|

|

October 24, 2000: 12:16 p.m. ET

Phone titans lift bourses; Frankfurt soars more than 3%, Paris up 2.3%

|

LONDON (CNNfn) - European markets closed sharply higher Tuesday as telecom investors took heart from the lower-than-expected prices that network operators paid in Italy's auction of third-generation mobile-phone permits that ended Monday.

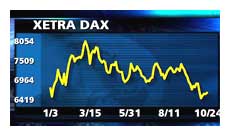

Frankfurt's Xetra Dax was the biggest gainer among the region's leading bourses, soaring 181.94 points, or more than 2.7 percent, to 6,802.81. Deutsche Telekom (FDTE) blasted up 10.25 percent and SAP (FSAP), Europe's leading software maker, roared 10.1 percent.

The blue-chip CAC 40 in Paris climbed 141.40 points, or 2.3 percent, to 6,323.74. France Telecom (PFTE), which won an Italian 3G license via its local affiliate, jumped 7.2 percent. The blue-chip CAC 40 in Paris climbed 141.40 points, or 2.3 percent, to 6,323.74. France Telecom (PFTE), which won an Italian 3G license via its local affiliate, jumped 7.2 percent.

London's benchmark FTSE 100 index rose 122.5 points, or 1.9 percent, to 6,438.4, with index heavyweight Vodafone Group (VOD) rising 1.4 percent, also buoyed by success in the Italian sale of mobile phone licenses,

"There's relief around the industry that the final 3G auction is over," Mark James, an analyst at Nomura International, told CNNfn.com. "The next sale of licenses is in France next year and that has been factored into company spending because it's a fixed-fee beauty contest."

"But the same issues are still lingering, particularly the constraints on capital for companies such as British Telecommunications; but we're fans of Vodafone, which has a stronger balance sheet, has doubled its size over two years and is debt free."

European telecom stocks have been under pressure for months

after auctions in the U.K. and then Germany sparked fears that the costs of buying third-generation mobile licenses were spiraling out of control.

Among other leading European markets, the AEX index in Amsterdam rose 1.8 percent, the MIB 30 in Milan climbed 1.7 percent, and the SMI in Zurich gained more than 1.3 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, rose more than 2.1 percent. The index's telecom sector jumped 5.3 percent.

In the U.S. Tuesday at midday, the Dow Jones industrial average rose 1.6 percent to 10,434.13, while the Nasdaq composite climbed 1.6 percent to 3,524.18.

In the currency market, the euro rose to 83.65 U.S. cents from 83.52 cents in late New York trading Monday. The currency is up only slightly from its all-time low of 83.23 cents, tallied Oct. 18.

In the telecom sector, the positive mood for Europe's biggest companies spilled over to second-tier firms. France's Bouygues (PEN) soared 7.3 percent and Dutch-based network operator Equant (PEQU), which has shares traded in Paris, added 4.1 percent.

COLT Telecom Group (CLT), a U.K. business telecom service provider, surged 14.9 percent, Cable & Wireless (CW-) leapt 10.3 percent, British Telecommunications gained 11.5 percent and Internet data carrier Energis (EGS) jumped 13.1 percent.

In Amsterdam, KPNQwest, the fiber-optic network company part-owned by Royal KPN, shot up more than 18.9 percent. Dealers said that even though its third-quarter loss widened, the company's sales showed a better-than-expected increase from the previous quarter. Royal KPN surged 7.6 percent. In Amsterdam, KPNQwest, the fiber-optic network company part-owned by Royal KPN, shot up more than 18.9 percent. Dealers said that even though its third-quarter loss widened, the company's sales showed a better-than-expected increase from the previous quarter. Royal KPN surged 7.6 percent.

Many tech stocks, which had fallen earlier in the session after the latest earnings warning by a U.S. counterpart, rebounded after a strong gain on the tech laden Nasdaq index. German chipmaker Infineon Technologies (FIFX) rose 4.5 percent after earlier declining 2.3 percent.

But, Franco-Italian counterpart STMicroelectronics (PSTM) was still down 2.8 percent.

That was after chipmaker National Semiconductor (NSM: Research, Estimates) said late Monday its sales and earnings in the second and third quarters might fall short of previous expectations.

Network equipment maker Marconi (MNI) rose 3.3 percent in London, while French rival Alcatel (PCGE) jumped 6.5 percent and U.K. fiber-optic equipment maker Bookham Technology (BHM) soared 11.8 percent.

Computer consultant Cap Gemini (PCAP) was the CAC 40's leading decliner, shedding 3.5 percent.

Gains for drug stocks

Drug stocks were generally up across Europe. SmithKline Beecham (SB-) rose 2.7 percent and its intended merger partner Glaxo Wellcome (GLXO) rose more than 2 percent. Germany's Schering (FSCH) added 4 percent.

London's FTSE index also got support from Imperial Chemical Industries (ICI), up 4.8 percent. And index newcomer Lattice Group (LAT), a gas pipeline and telecom operator, rose 1.8 percent after it was split off by gas producer BG Group.

News and financial data company Reuters Group (RTR) jumped 6.4 percent. In partnership with the three biggest hitters in the foreign exchange market -- Chase Manhattan Bank Corp. (CMB: Research, Estimates), Citibank, and Deutsche Bank (FDBK) -- Reuters unveiled an Internet foreign exchange marketplace called Atriaz. Shares in Deutsche Bank rose 1.8 percent.

Granada Media (GME) rose 8.3 percent after the British TV company agreed to sell most of HTV, a regional broadcasting franchise, to rival Carlton Communications (CMM) in exchange for Carlton's 20 percent stake in Meridian Broadcasting, another regional TV station, and £181 million ($262 million) cash. Carlton rose 2.2 percent. Granada Media (GME) rose 8.3 percent after the British TV company agreed to sell most of HTV, a regional broadcasting franchise, to rival Carlton Communications (CMM) in exchange for Carlton's 20 percent stake in Meridian Broadcasting, another regional TV station, and £181 million ($262 million) cash. Carlton rose 2.2 percent.

On the earnings front, Switzerland's Serono, the biggest biotechnology company in Europe, fell 6.5 percent in Zurich even after reporting better-than-expected third-quarter earnings. Growth in sales of its biggest-selling drug slowed, damping recent investor enthusiasm for biotech shares.

-- from staff and wire reports

|

|

|

|

|

|

|