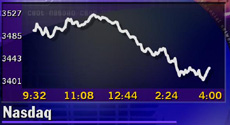

NEW YORK (CNNfn) - The Nasdaq composite index slid for a second day Tuesday on weakness in chip stocks after National Semiconductor became the latest company to ready Wall Street for disappointing earnings.

Also hurting technology stocks was a sell-off in Amazon.com, Compaq Computer and Nortel Networks ahead of the release of their quarterly financial results.

But the Dow Jones industrial average rose for a fourth session, adding 1.2 percent, as investors returned to many of the financial, consumer and retail stocks hammered this fall.

"Stock prices have done massive amounts of correcting," said Chris Wolfe, equity market strategist at J.P. Morgan Securities, who believes the market partially overreacted to fears of a slowing economy so prevalent last month.

Financial results from Colgate-Palmolive surpassed Wall Street estimates, sending investors into consumer products stocks such as Procter & Gamble. And Minnesota Mining & Manufacturing gained for a second day after posting strong quarterly earnings. Financial stocks also rose. Financial results from Colgate-Palmolive surpassed Wall Street estimates, sending investors into consumer products stocks such as Procter & Gamble. And Minnesota Mining & Manufacturing gained for a second day after posting strong quarterly earnings. Financial stocks also rose.

But National Semiconductor's earnings warning knocked a third off the value of that stock and sent Intel and Applied Materials lower.

The mixed action comes just four trading sessions after stocks plunged to some of their lowest levels of the year. Those levels, some analysts say, may represent the bottom of a market that sold off since Labor Day.

"We think this bull has legs," Alan Skrainka, chief market strategist at Edward Jones, told CNNfn's Market Call. Skrainka said he is encouraged by strong profit news and the health of the economy.

The Dow gained 121.35 to 10,393.07 and is up 4.2 percent from Wednesday's close.

The Nasdaq slid 48.90, or 1.4 percent, to 3,419.79 but is still 8 percent higher since Wednesday. The S&P 500 rose 2.35 to 1,398.13.

Market breadth was mixed. Advancing issues on the New York Stock Exchange topped declining ones 1,560 to 1,279 on trading volume of 1.1 billion shares. But Nasdaq losers beat winners 2,135 to 1,814. More than 1.8 billion shares changed hands.

In other markets, the dollar edged lower against the euro and yen. Treasury securities fell.

Techs falter

National Semiconductor tumbled after saying sales and earnings in both the second and third quarters of fiscal 2001 may fall below expectations. National Semiconductor (NSM: Research, Estimates) plunged $12.56, or 33 percent, to $24.38.

Other chip makers suffered. Intel (INTC: Research, Estimates), lost $1.25 to $42.06 and Applied Materials (AMAT: Research, Estimates), tumbled $4 to $49.44. Other chip makers suffered. Intel (INTC: Research, Estimates), lost $1.25 to $42.06 and Applied Materials (AMAT: Research, Estimates), tumbled $4 to $49.44.

A series of high-profile tech companies reporting results after the close of trading Tuesday, including online retailer Amazon.com (AMZN: Research, Estimates), telecom equipment maker Nortel (NT: Research, Estimates) and Compaq Computer (CPQ: Research, Estimates), all suffered.

Amazon slid 44 cents to $29.56, Nortel lost $3.63 to $63.31 and Compaq declined 70 cents to $27.

Amazon ultimately said it lost 25 cents a share in the third quarter, a narrower loss than the 33 cents Wall Street expected. Nortel Networks beat forecasts by a penny, earning 18 cents per share. And Compaq posted profits of 31 cents per share, two cents ahead of expectations.

More than half of the companies in the S&P 500, or 265 firms, have released earnings for the July-September period. Fifty-seven percent of them have topped forecasts, according to First Call, while 17 percent fell below expectations. Earnings have jumped 16 percent, on average, over levels in the year-ago quarter.

Tuesday's corporate results showed similar strength.

Colgate-Palmolive (CL: Research, Estimates) jumped $3.65 to $53.05 after the maker of soap, toothpaste and other products, earned 44 cents a share in the latest quarter, a penny above Wall Street forecasts, and up from 38 cents a share a year earlier.

Competitor Procter & Gamble (PG: Research, Estimates), a Dow stock, advanced $4.06 to $73.63.

Also on the Dow, 3M (MMM: Research, Estimates) added 25 cents to $90.06, a day after reporting a record third-quarter profit of $499 million, or $1.25 a share, a penny better than the First Call consensus forecast.

Two beaten-up stocks -- Xerox and AT&T - continued to falter.

AT&T (T: Research, Estimates), whose shares are off more than 50 percent in a year, slipped 75 cents to $26.88. The New York Times said the company's board approved a split of the telecommunications company, the biggest overhaul since its breakup in 1984.

And Xerox (XRX: Research, Estimates) lost 31 cents to $8.81 after reporting a third-quarter loss of 20 cents a share excluding one-time items. That's a penny worse than Wall Street's lowered forecast, which came after the company's most recent warning. The copier maker also announced a restructuring plan that includes job cuts.

Investors Tuesday showed interest in proven companies with stable earnings. Among them, J.P. Morgan (JPM: Research, Estimates) rose $6.63 to $145.13 while Wal-Mart (WMT: Research, Estimates) climbed $1.06 to $48.38.

More news from CNNfn.com for investors:

· It's dot.com, not dot.bomb

· Retire really, really young

· Mets, Yankees and money

The gains mark a sharp contrast to the almost daily sell-off during the six weeks since Labor Day.

J.P. Morgan's Wolfe said investors are realizing the economy is not in as bad shape as some feared. Still, he expects profit gains to slow with economic growth.

"We're steering investors away from paying for growth at any price," he said.

At the same time, the market generally performs well in November and December.

"I think what you're looking at is a change in investor sentiment," Barry Hyman, chief investment strategist at Weatherly Securities, told CNNfn's Market Call.

After a six-week sell-off, Mark Donohoe, institutional equity sales trader at US Bancorp Piper Jaffray, told CNNfn's market coverage he sees more optimism in the markets. (364K WAV) (364K AIFF).

Still, not every strong profit report drew buyers Tuesday. Exxon Mobil (XOM: Research, Estimates) earned $4.3 billion, or $1.22 a share, in the latest third quarter, nearly double the $2.2 billion, or 62 cents a share, a year earlier. But the shares, 19 percent higher over the last year, fell $2.31 to $86.75.

Click here for the latest earnings news.

And Pfizer (PFE: Research, Estimates), the nation's largest drug maker, reported third-quarter earnings of 27 cents a share, 2 cents a share above expectations. Its shares, up 19 percent over the last six months, declined $2.38 to $43.

The major stock indexes are still down for the year, with the Nasdaq off 16 percent, the Dow lower by 9.6 percent and the S&P 500 off 4.8 percent.

Techs have suffered this year but energy, drug and financial stocks have all gained, rewarding investors with diversified portfolios.

|