|

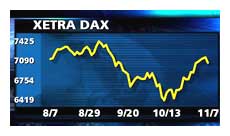

Europe mixed, DAX falls

|

|

November 7, 2000: 12:42 p.m. ET

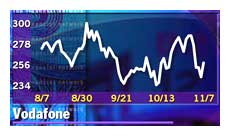

Vodafone leads London higher; Alstom, TotalFina lift Paris; techs hit Frankfurt

|

LONDON (CNNfn) - Europe's major bourses ended mixed Tuesday as London and Paris bounded back from earlier losses while weak technology stocks left Frankfurt in negative territory.

London's FTSE 100 rose 0.6 percent, to reach 6,466.9, with mobile phone operator Vodafone Group (VOD) and retailer Marks & Spencer (MKS) among the best performers.

In Paris, the blue chip CAC 40 index edged up 0.5 percent to 6,386.07, led by engineering firm Alstom (PALS) and  auto parts maker Valeo (PFR). auto parts maker Valeo (PFR).

Frankfurt's electronically traded Xetra Dax shed 0.8 percent, to 7,081.59. Chipmaker Infineon Technologies (FIFX) slumped 6.2 percent and Siemens (FSIE) shed 3.9 percent.

In Amsterdam, the AEX index lost 0.5 percent, the SMI in Zurich was little changed and Milan's MIB30 rose 0.4 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks was 0.1 percent higher at 1,646.63, with its information technology sector down 2.7 percent and the oil and gas component up 1.8 percent.

In the currency market, the euro weakened to 85.88 U.S. cents from 86.22 cents in late Monday trading in New York. Traders' eyes were on the European Central Bank, which has bought euros in the past two sessions to try to support the currency, without pushing it decisively higher.

"History has shown currency intervention is a long drawn-out battle," Steve Barrow, a currency economist at Bear Stearns, told CNNfn. "It will take weeks, if not months, with or without the U.S., to boost the euro. It'll take a miracle."

In the U.S., the technology-heavy Nasdaq composite index was 0.1 percent higher, while the blue-chip Dow Jones industrial average slipped 0.1 percent in slow mid-session trade as dealers eyed the U.S. presidential elections.

Vodafone, the most heavily weighted stock on London's key index, added 6.2 percent, helping to offset losses in the tech sector. Vodafone rose after a Reuters report that the Swiss government will allow Swisscom to sell a small stake to the British mobile phone operator. Swisscom fell 0.6 percent. Vodafone, the most heavily weighted stock on London's key index, added 6.2 percent, helping to offset losses in the tech sector. Vodafone rose after a Reuters report that the Swiss government will allow Swisscom to sell a small stake to the British mobile phone operator. Swisscom fell 0.6 percent.

Among other telecoms, Deutsche Telekom (FDTE) rose 1.3 percent and COLT Telecom (CTM) shed 5.9 percent.

Retailer Marks & Spencer (MKS) was up 5.4 percent after beating analysts' estimates despite posting a 5 percent drop in pretax first half profit. Consumer goods firm Unilever (ULVR) rose 3.2 percent.

British Airways rose 3.8 percent after several investment banks raised their ratings on the airline's stock. Europe's biggest carrier reported Monday that second-quarter profit more than doubled, beating analysts' expectations. British Airways rose 3.8 percent after several investment banks raised their ratings on the airline's stock. Europe's biggest carrier reported Monday that second-quarter profit more than doubled, beating analysts' expectations.

Business service company Hays (HAS) rose 3.7 percent after investment bank Schroders Salomon Smith Barney raised its recommendation to 'buy' from 'neutral.'

In Paris, Alstom (PALS) jumped 5.4 percent after reporting first-half operating profit rose 35 percent, beating expectations.

Among other CAC 40 gainers, Valeo rose 3.3 percent and oil firm TotalFina Elf (PFP) added 2.6 percent. British rival BP Amoco (BP-) gained 1.4 percent after reporting a 94 percent gain in third-quarter underlying profit.

Techs tumble

Technology stocks were among Europe's biggest decliners following losses on the Nasdaq a day earlier. Finland's Nokia, the world's biggest mobile-phone maker, dropped 4.1 percent, Swedish rival Ericsson slipped 3.4 percent amid talk of possible analysts downgrades. Britain's Bookham Technology (BHM), a maker of components for fiber-optic networks, fell 5.5 percent.

Network systems firm Spirent (SPT) slumped 4.9 percent. Dutch network service provider Equant (PEQU) shed 3 percent in Paris after reporting third quarter net loss widened to $31 million from $10.4 million in the year earlier period.

Europe's largest software provider SAP (FSAP) lost 2.1 percent in Frankfurt.

Telecom equipment maker Marconi (MNI) fell 0.5 percent while its larger French rival Alcatel (PCGE) rebounded from earlier losses to end up 2.2 percent.

Among chipmakers, Infineon Technologies (FIFX) plunged 6.2 percent after warning it expects weaker demand and lower prices for chips used by the personal computer industry in the current fiscal quarter. French competitor STMicroelectronics (PSTM) fell 3.6 percent, leading Paris' decliners. Among chipmakers, Infineon Technologies (FIFX) plunged 6.2 percent after warning it expects weaker demand and lower prices for chips used by the personal computer industry in the current fiscal quarter. French competitor STMicroelectronics (PSTM) fell 3.6 percent, leading Paris' decliners.

Consumer electronics powerhouse Siemens (FSIE) shed 3.9 percent after the company signed an agreement with Japan's Toshiba to develop

next-generation mobile phones, as the partners sought to save costs and become more competitive.

British American Tobacco (BATS) fell 4 percent. A Florida judge upheld a jury's award of a record $145 billion in punitive damages against leading U.S. tobacco companies in a class action lawsuit brought by sick smokers in Florida, setting the stage for appeals. The ruling affects tobacco companies including Brown & Williamson, a unit of British American Tobacco.

Deutsche Bank (FDBK) fell 0.6 percent. The German bank said it was taking a 10 percent stake in newly listed Borussia Dortmund to stabilize the soccer club's share price a recent sharp decline. The club's stock fell 4 percent Monday and is down 13 percent since it came to the market Oct. 31.

-- from staff and wire reports

|

|

|

|

|

|

|