NEW YORK (CNNfn) - U.S. stocks ended flat Tuesday as Wall Street nervously focused on the tightest presidential race in decades.

Investor turnout remained low with traders seemingly unwilling to place big bets ahead of the an outcome that could effect business conditions among the nation's 7,000-plus publicly traded companies.

"Investors don't like uncertainly," Bruce Weindruch, president of HistoryFactory.com, told CNNfn's In the Money. "And what you're seeing this time is a lot of uncertainty right up to the end."

Microsoft and oil stocks, whose outlook could improve under a George W. Bush administration, gained ground. But shares of drug makers, criticized by Al Gore, gave back recent gains in an up-and-down trading session.

Telecommunications stocks fell after Cisco Systems, in its quarterly earnings report, sparked fears that spending on communications equipment could slow. Telecommunications stocks fell after Cisco Systems, in its quarterly earnings report, sparked fears that spending on communications equipment could slow.

Stocks opened lower and ground higher before finishing little changed. The wavering comes against a background of uncertainty over which party will capture the White House and Congress and the impact, if any, from those outcomes.

Elizabeth MacKay, chief investment strategist at Bear Stearns, said the market should gain after the election unless Democrats capture the White House and Congress.

"Anything else results in uncertainty and that's a positive," MacKay told CNN's Street Sweep.

But others note that the White House occupant often has little effect on the markets.

"The president only has so much influence over the economy and legislation," Angel Mata, head of equity trading at Legg Mason, told CNNfn's market coverage.

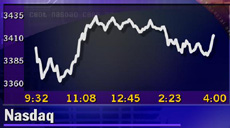

The Nasdaq composite index lost 0.42 point to 3,415.79. The Dow Jones industrial average declined 25.03 to 10,952.18, and the S&P 500 lost 0.32 to 1,431.87. The Nasdaq composite index lost 0.42 point to 3,415.79. The Dow Jones industrial average declined 25.03 to 10,952.18, and the S&P 500 lost 0.32 to 1,431.87.

Market breadth was mixed. Advancing issues on the New York Stock Exchange topping decliners 1,463 to 1,317, as more than 876 million shares changed hands. Nasdaq losers topped winners 1,992 to 1,835, on volume of 1.6 billion shares.

In other markets, the dollar rose against the euro but fell versus the yen. Treasury securities were little changed.

From Wall St. to Pennsylvania Ave.

With the election's end just hours away, Wall Street has been placing a series of bets, some of them contradictory, on the outcome.

Microsoft (MSFT: Research, Estimates), whose antitrust problems could ease under a Bush Justice Department, continued a week-long run, gaining $1 to $70.50. Exxon-Mobil (XOM: Research, Estimates), which could benefit if Bush succeeds in opening certain public lands to oil exploration, rose 31 cents to $89.

But drug stocks, which could face increased regulation under an Al Gore White House, have rallied in recent weeks. But Merck (MRK: Research, Estimates) declined $3.13 to $86.78 and Bristol Myers Squibb (BMY: Research, Estimates) lost $1.19to $61.06.

Charles Gabriel, senior political analyst at Prudential Securities, told CNNfn's Market Call that many of these moves make sense. (303K AIFF) (303K WAV).

Still, it's unclear whether recent sector gains could continue under a White House run by George W. Bush, who holds a slight lead in most polls. Some strategists forecast gains Wednesday as investors cheer the lifting of the uncertainty brought by the election's end. The race has rekindled the debate over how much effect the president really has on Wall Street.

The Clinton years coincided with a sustained bull market, but Gore appears to be receiving little lift from that period of equity gains. At the same time, the Nasdaq is off more than 30 percent from its March high, erasing billions of dollars from investors' portfolios.

Through Monday, the Dow is down 78 points from the end of the Democratic convention, a sign that's positive for Bush. In 14 of the last 16 elections, Dow gains during this home stretch period have coincided with a victory for the incumbent party.

Cisco rises

In the week's most-anticipated quarterly earnings report, Cisco Systems (CSCO: Research, Estimates) rose $1.63 to $56.75 after beating estimates by a penny per share.

The computer networking equipment maker late Monday posted first-quarter income of $1.36 billion, or 18 cents per share, 64 percent above the $814 million, or 11 cents, in the year-ago period.

But investors focused on concerns that Cisco will keep its inventories high, possibly hurting the companies' suppliers.  Among them, PMC-Sierra (PMCS: Research, Estimates), which makes communications chips, lost $25.94 to $127.88. Broadcom (BRCM: Research, Estimates), which makes integrated communications circuits, declined $42.38 to $176.63. Among them, PMC-Sierra (PMCS: Research, Estimates), which makes communications chips, lost $25.94 to $127.88. Broadcom (BRCM: Research, Estimates), which makes integrated communications circuits, declined $42.38 to $176.63.

In other stocks in the news, Pets.com (IPET: Research, Estimates) fell 44 cents to 22 cents after the online pet supply firm decided to cease operations.

And in one of the first successful IPOs in weeks, chip maker Transmeta Corp. (TMTA: Research, Estimates) jumped $24.25 to $45.25, more than double its offering price.

|