|

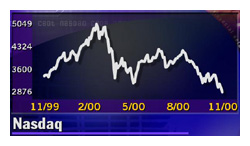

Nasdaq near 13-month low

|

|

November 20, 2000: 5:06 p.m. ET

Another day of selling for tech stocks, which have returned to 1999 prices

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index fell to its lowest level in more than a year Monday after some of Wall Street's most influential brokerages discouraged investors from buying technology stocks.

The declines, the latest in a sell-off that began after Labor Day, come on continued worries that the software, semiconductor and Internet shares that fueled the bull market earlier this year still don't reflect expectations for slowing earnings growth.

Monday's losses put the Nasdaq down 43 percent from its high on March 10, when investors paid almost any price for fast-growing tech stocks. Times have changed.

"There was a lot of speculative excess that had to be shaken out of the market," Peter Doyle, chief investment strategist and portfolio manager at Kinetics Asset Management, told CNNfn's Talking Stocks. "And I think that's what we're seeing here today."

Cisco Systems fell after Morgan Stanley Dean Witter cut its stock price target and downgraded two other computer network equipment makers. Lehman Brothers lowered its rating on eBay stock, helping to send other Internet stocks down. And one of Lehman's best-known analysts, Jeffrey Applegate, said he overestimated the opportunities in stocks, which could post their worst year in almost two decades. Cisco Systems fell after Morgan Stanley Dean Witter cut its stock price target and downgraded two other computer network equipment makers. Lehman Brothers lowered its rating on eBay stock, helping to send other Internet stocks down. And one of Lehman's best-known analysts, Jeffrey Applegate, said he overestimated the opportunities in stocks, which could post their worst year in almost two decades.

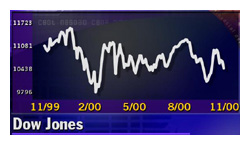

The Dow Jones industrial average, meanwhile, fell on a decline in Coca-Cola, which wants to buy Quaker Oats in a multibillion-dollar deal.

At the same time, the presidential impasse shifted to Florida's highest court, which could determine the course of a disputed election that has plagued the markets this month.

"We need some political certainty," Linda Jay, floor trader at RPM Specialists, told CNNfn's Market Call. "This political uncertainty is killing us."

The Nasdaq fell 151.55 points, or 5 percent, to 2,875.64. The decline gave the index at its lowest close since Oct. 28, 1999, when the Nasdaq finished at 2,875.22. The Nasdaq fell 151.55 points, or 5 percent, to 2,875.64. The decline gave the index at its lowest close since Oct. 28, 1999, when the Nasdaq finished at 2,875.22.

The Dow Jones industrial average shed 167.22 points, or 1.6 percent, to 10,462.65 and the S&P 500 lost 25.10 to 1,342.62.

The S&P 500, which comprises 75 percent of the U.S. stock market's value, is down 8.6 percent this year. The losses, if they hold, would be the worst since 1981, when the index fell 9.7 percent.

Still, investors sought safety in fixed-income securities, sending Treasurys higher.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,853 to 977 as more than 952 million shares changed hands. Nasdaq losers beat winners 2,998 to 974 on volume of 1.7 billion shares.

In other markets, the dollar rose against the yen but was little changed versus the euro.

Nasdaq searches for bottom

Cisco Systems (CSCO: Research, Estimates) lost $1.50 to $51.25 after Morgan Stanley Dean Witter lowered Cisco's price target to $75 from $90.

The firm also down downgraded Juniper Networks (JNPR: Research, Estimates) and Redback Networks (RBAK: Research, Estimates) to "outperform" from "strong buy."

The stocks, which surged earlier this year, fell sharply. Juniper lost $32.88 to $121.50 and Redback declined $8 to $72.75. The stocks, which surged earlier this year, fell sharply. Juniper lost $32.88 to $121.50 and Redback declined $8 to $72.75.

eBay (EBAY: Research, Estimates) dropped $8.94 to $34.50 after Lehman Brothers downgraded the online auctioneer to "neutral" from "buy." Lehman expressed concern that eBay's core business is slowing, and the potential for its acquisition is fading. Other Net stocks faltered, with Yahoo! (YHOO: Research, Estimates) losing $2.38 to $48.88 and (AMZN: Research, Estimates) declining $1.63 to $25.81.

Oracle (ORCL: Research, Estimates) fell $4.06 to $24.75, its lowest level since February. The software maker lost vice president Gary Bloom to competitor Veritas Software, which Bloom will head up. Veritas (VRTS: Research, Estimates) rose $2.88 to $107.25.

The tech losses come after a tough autumn for many of the stocks that, through last March, were the market's best performing issues. With the economy slowing, investors have been selling high-priced stocks amid this cooling environment.

One well-know analyst entered this re-valuing fray Monday. In a note to clients titled "Mea Culpa," Lehman's Applegate said his bullishness on stocks has been the wrong call for most of 2000. He shifted 20 percent of the firm's model portfolio into bonds from cash.

The Federal Reserve raised interest rates six times since the summer of 1999. Those increases, which have made it more expensive for companies and consumers to borrow money, have also raised the yields on bond, drawing money away from equities.

Still, Applegate sees today's cheaper valuations lifting the stock market next year, when he expects a 12 percent returns on equities.

President who?

The impasse over the presidential election hasn't helped the market. The Nasdaq has fallen 15.8 percent since Election Day. In the latest development, the Florida Supreme Court heard arguments Monday over whether the hand recounts in three counties will matter in determining the results.

Republicans want the outcome to stand as of Saturday's results, which show George W. Bush ahead of Democrat Al Gore. Republicans want the outcome to stand as of Saturday's results, which show George W. Bush ahead of Democrat Al Gore.

Charles Crane, market strategist for Spears Benzak Salomon & Farrell, told CNNfn's In the Money that election uncertainty is just one factor behind the market's sell-off. (425K AIFF) (425K WAV)

A series of possible mergers came to light Monday. Coke (KO: Research, Estimates) fell $4.88 to $56.56 after saying it is offering to buy Quaker Oats (OAT: Research, Estimates).

Quaker, whose products include the sports drink Gatorade, rose $4.69 to $95.

And Fifth Third Bancorp (FITB: Research, Estimates) shed $1.69 to $46.38 after agreeing Monday to acquire Old Kent Financial in a nearly $5 billion stock swap that will unite the two Midwest banks. Old Kent (OK: Research, Estimates) rose $8.56 to $46.38.

|

|

|

|

|

|

|