|

Rx for uncertain future

|

|

November 21, 2000: 11:23 a.m. ET

Diversifying a portfolio and planning for a cushion with MS in mind

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Jeffrey Portlance, 35, is not looking to be a millionaire. In fact, he'd be happy if his investments could generate $24,000 a year when he retires so long as he can get that income from his portfolio no later than age 57.

But he also wants to have enough to draw on some of his savings sooner if need be. Portlance has been diagnosed with multiple sclerosis, he said, but thus far the chronic disease has not affected his ability to do his job – and there's a fair chance it never will.

The progress and severity of MS is worse for some people than others, and its course unpredictable. Symptoms, for instance, can range from occasional numbness in the limbs to paralysis or loss of vision, according to the National Multiple Sclerosis Society. But MS does not have to mean one is unable to work.

Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

Financial planners say if Portlance, who makes $41,000 a year as a system consultant at Wells Fargo in Minneapolis, rebalances his portfolio he has a good chance of accomplishing his early retirement goals -- even though he has an outstanding $7,000 loan on his 401(k), $1,800 in credit card debt, and custody of a 12-year-old daughter. And, they say, there are steps he can take to build a savings cushion to protect against the potential expense of MS.

It helps that he doesn't plan to buy a house anytime soon or to fully fund his child's college education.

Get a divorce from company stock

In addition to his cash-balance pension plan to which his employer contributes quarterly, and 800 options to buy company stock over the next few years, Portlance has saved about $24,000 in his 401(k).

Currently, more than 70 percent of his 401(k) is invested in a company-stock fund. That concerns certified financial planners Judi Martindale of San Luis Obispo, Calif., and Bud Kasper of Lee Summit, Mo.

"He's got way too much invested in that company," Martindale said, noting that it's too risky to have both your job and the bulk of your long-term savings tied to the same place. "He can't get rid of the options, so he shouldn't buy anymore (company stock)."

Indeed, Kasper said, "I don't care if you love Wells Fargo to death, you've got to reduce your exposure."

Less is more

The rest of Portlance's money is invested in varying amounts among the plan's other funds, which are proprietary to Wells Fargo's 401(k) plan. But, the planners noted, simply investing in all funds in a plan doesn't guarantee effective diversification or reduced risk, since there often is overlap in the funds' holdings.

Both planners recommend Portlance redistribute his money so that it is concentrated in fewer funds with less overlap. Both planners recommend Portlance redistribute his money so that it is concentrated in fewer funds with less overlap.

Martindale suggests he limit his holdings to just three, with 60 percent of his money in the S&P 500 stock fund, 30 percent in the diversified equity fund and 10 percent in the stable value fund, which has heavy bond exposure.

Although such a portfolio has a 90-10 split between stocks and bonds, "it's like a conservative 90," Martindale said -- explaining that the holdings in the portfolio she chose are not as risky since they do not give him much exposure to the volatile small-cap arena.

Time to sing

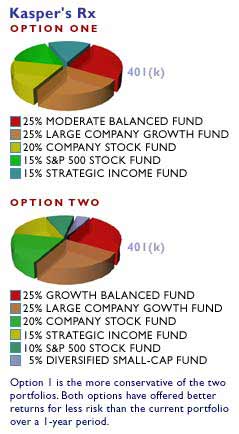

Kasper is not as averse to Portlance keeping some money invested in the company stock fund, and he recommends two portfolios that would give him a more aggressive position both in small caps in particular or stocks generally.

Both portfolios have offered better performance for less risk than the current configuration in Portlance's 401(k), which yielded a 13.6 percent return in the past year. Both portfolios have offered better performance for less risk than the current configuration in Portlance's 401(k), which yielded a 13.6 percent return in the past year.

For instance, Kasper said, had Portlance invested a quarter of his money in the plan's growth balanced fund, another quarter in the large-company growth fund, 20 percent in the company stock fund, 15 percent in the conservative strategic income fund, 10 percent in the S&P 500 fund and another 5 percent in the diversified small-cap fund, he would have gotten an 18.5 percent return.

His more conservative portfolio recommendation does not include the small-cap fund, and replaces growth balanced with the moderate balanced fund. That portfolio would have yielded Portlance a 19.5 percent average annual return over five years versus his current portfolio's 16 percent average return.

Whatever route Portlance chooses, Kasper said, "he has a lot of time to make his portfolio sing."

Make provisions for MS

But since Portlance also wishes to have money available to him should MS afflict him more seriously, there are several adjustments he can make to his overall financial picture, the experts said.

For starters, Martindale said, he should consider building an emergency fund. After paying monthly expenses he doesn't have much left over to save and his savings account has fewer than $200. So she recommended he halve his 401(k) contributions -- currently 13 percent -- and put the other half in a money market account until he has $4,000 socked away in cash. That way, he will not forfeit his employer's match, which is dollar-for-dollar on the first 6 percent of his contributions.

Click here to read last week's Portfolio Rx; and be sure to read this week's Checks and Balance column.

Chartered financial consultant Martin Eichel of Valley Stream, N.Y., suggests he might continue to put 6.5 percent of his money in taxable stock mutual funds, because they will give him more flexibility than a 401(k) in his pre-retirement years.

Having money outside of a 401(k) might also allow him to set up an irrevocable living trust that would provide for his care and for his daughter after he dies.

Should his stock options prove profitable, "it'll make a huge difference," Martindale said. After consulting with a certified public accountant on how much and when to exercise them to minimize the tax bite, he might use them to build a more accessible cushion. She recommends he put half of the proceeds in low-cost, tax-efficient funds and half in a high-yielding savings account.

His Roth IRA, which he just opened with $100, might be the place he puts some money into an international fund, since that choice is lacking in his 401(k) plan, she said.

Read fine-print on insurance

All the planners recommended Portlance dispense with his debt as soon as he can, since that will sap the potential for compounding in his investments.

But most importantly, Eichel said, Portlance should read his health, disability and long-term care insurance policies carefully. He pays for both through plans at work.

Since a medical crisis can wipe out anyone's savings, and given that Portlance might have trouble obtaining an insurance policy on his own with a pre-existing condition, he should check to see if there is a clause that addresses how he can continue coverage should he ever leave his employer.

"He has to focus on protecting those policies," Eichel said.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|

|

|

|

|

|

|