|

EMC heats up storage

|

|

December 5, 2000: 6:54 p.m. ET

EMC's new product heats up competition with Network Appliance

by Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - EMC Corp., the dominant maker of products companies use to store large amounts of computer data, unveiled a low-priced storage system Tuesday aimed at attacking Network Appliance Inc., a smaller but fast-growing rival.

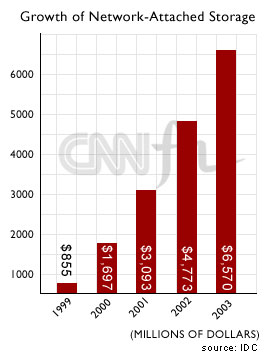

The new device, code-named Chameleon while it was under development, has been long awaited by industry analysts. The new storage device is aimed at expanding EMC's (EMC: Research, Estimates) presence in the market for network-attached storage, which is the technique of attaching a storage device to a network instead of to an individual server.

Network-attached storage has the advantage of allowing multiple servers to share one storage device, and is well adapted for situations where users need to access small amounts of data on a frequent basis. However, trying to send large blocks of data over an Internet connection can be slow.

By contrast, most storage today is directly attached to a server. The market in 1999 was 92 percent server-attached storage, amounting to $27.7 billion in revenue. However, server-attached storage is expected to decline to 62 percent of the market by 2003, according to the IT research firm IDC.

EMC's network-attached device, called the CLARiion IP 4700, starts at about $82,000, making it EMC's lowest-priced offering. The IP 4700 can be expanded up to 3.6 terabytes of storage space, and EMC claims it can be installed on a network in ten minutes. A terabyte is one trillion bytes, or 1,000 gigabytes.

"The networking of storage is reshaping information technology around the increasingly strategic role of intelligent storage. Over the next few years, more than 80 percent of the world's storage systems will be directly connected to some type of network," said Joe Tucci, EMC's president and chief operating officer, in a statement.

Storage stocks have performed well

According to the IT research firm Gartner Dataquest, Network Appliance (NTAP: Research, Estimates) had a 60 percent share of the network-attached storage market last year, with EMC holding a 22 percent share. EMC is the largest player in the market for server-attached storage.

EMC closed up $9.75 at $89.25, a 12 percent gain, amid the largest single day percentage gain in the Nasdaq composite index. Brocade Communications (BRCD: Research, Estimates), another storage industry player, was up $28.02, or 17 percent, at $189.98, while Emulex (EMLX: Research, Estimates) jumped $34.19 to $159.87

While Network Appliance currently trades for about half of its 52-week high of $152.75, storage stocks in general have held up quite well this year. As of the end of last month, the storage sector was up about 32 percent so far this year, while Internet stocks as a group were down 75 percent and computer hardware was off 45 percent.

The exploding amount of data created by the use of the Internet has propelled storage stocks to the stratosphere. Even at half of its 52-week high, Network Appliance sells for 185 times what analysts expect the company to earn in the fiscal year ending April 2001, and it sports a market capitalization of $24 billion. Its stock is seven times higher than it was in January 1999.

Analysts dismiss threat

Network Appliance's stock soared $23.70 to $81.58, a 41 percent surge, as analysts downplayed the threat the company faces from EMC.

"We think this will be an incremental boost to the overall network attached storage market and is an incremental revenue opportunity for EMC, and therefore positive for EMC," said Merrill Lynch analyst Tom Kraemer. "We believe Network Appliance will face more competition from EMC, but we did not see any new major software that hugely disturbs what is occurring in this space."

"EMC spent very little time discussing its new Chameleon product but talked about its existing Celera product and its new piece of software for it, HighGround, which we do not think will have any near term impact," Kraemer added.

Mark Santora, senior vice president of marketing at Network Appliance, said he was "under whelmed" by EMC's product announcement.

"The IP 4700 is exactly the same as what other industry vendors are offering, such as Sun and Compaq," Santora told CNNfn.com. "EMC acquired a file system from CrosStor, put it on top of its CLARiiON storage arrays, and used CPU cards from Data General. If EMC's name was not on this box, there would not be any ink on this product today."

Santora said that Network Appliance has been competing successfully against EMC's more high-end Symmetrix line, which costs millions of dollars, and that EMC's introduction of a lower-end product could cannibalize sales of its more expensive storage devices.

Other storage announcements

IBM (IBM: Research, Estimates) and Sun Microsystems (SUNW: Research, Estimates) also have made significant storage-related announcements this week.

IBM on Tuesday announced a "universal storage system" capable of sharing data across any storage hardware, platform or operating system. The computer giant said that its Storage Tank system "simplifies the complexities created by the growth of the e-business infrastructure."

"The e-business infrastructure is built upon a variety of applications running on different platforms across different networking protocols -- and they all need to share data," said Linda Sanford, senior vice president and group executive, IBM Storage Systems Group, in a statement. "Universal access to data is a quantum leap towards the industry's goal of interoperability."

Sun Microsystems announced Monday that it had agreed to acquire HighGround Systems Inc., a privately held maker of storage management software, for $400 million. Merrill Lynch's Kraemer said in a research note issued Tuesday that Sun's purchase of HighGround "could be more strategic than when Sun partnered with AOL to get Netscape's enterprise assets."

The acquisition helps Sun protect its core server and Solaris operating system business, Kraemer said.

"EMC and several of the other storage vendors essentially aim to disembowel servers," he wrote. "They do this by peeling off the functionality that today resides in the server operating system and transferring it to storage products. This effectively marginalizes the server operating system and, therefore, Sun's key technology asset."

The acquisition of HighGround will help Sun prevent the storage vendors from making servers into a commodity, he said.

|

|

|

|

|

|

EMC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|