|

End of the road for Olds

|

|

December 12, 2000: 6:58 p.m. ET

General Motors cuts jobs, Oldsmobile brand in restructuring; issues warning

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - General Motors Corp. announced a broad restructuring plan Tuesday that calls for the company to phase out its Oldsmobile division, America's oldest car brand, cut thousands of jobs and take a one-time charge of up to $2.5 billion. The world's largest automaker also issued a warning about its profits for the fourth quarter.

The changes mark the biggest steps yet by newly installed GM Chief Executive Richard Wagoner to shake up GM as the auto industry braces for a rough period of slowing sales and intensifying global competition.

Oldsmobile was founded in 1897 and became part of GM in 1908. Long known for its innovative products such as the V8 engine, automatic transmission and front wheel drive, Oldsmobile's doom may have been sealed when it was late coming to the light-truck segment of the market, where automobile buyers have flocked in recent years. Oldsmobile was founded in 1897 and became part of GM in 1908. Long known for its innovative products such as the V8 engine, automatic transmission and front wheel drive, Oldsmobile's doom may have been sealed when it was late coming to the light-truck segment of the market, where automobile buyers have flocked in recent years.

Lack of light trucks

It does not have any pickup trucks and did not start selling a minivan until its 1990 model year and a sport/utility vehicle a year later. Those two models only accounted for less than a quarter of its sales so far this year, while in the industry as a whole truck sales now account for 49 percent of sales.

Wagoner said it was a difficult decision to cut the Oldsmobile brand, but the move was necessary to concentrate engineering and other resources on more profitable products. The brand will continue to the end of the product cycle of different Oldsmobile vehicles now on the market, probably about three years.

"Our teams worked hard to find profitable ways to further strengthen the Oldsmobile product line, including consideration of products developed with our global alliance partners," Wagoner said. "But in the current environment, we simply couldn't find an approach that would ensure Oldsmobile's future success." (249KB WAV) (249KB AIFF)

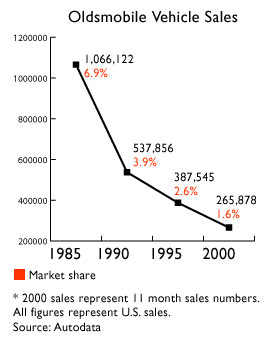

Steady decline in Oldsmobile sales, share

The industry sales trend meant that Oldsmobile's sales and market share plunged steadily for well over a decade, dropping to only 265,878 vehicles sold in the first 11 months of this year, representing only 1.6 percent of the U.S. market. By comparison, in 1985 the brand sold 1.1 million U.S. vehicles, or 7 percent of that market.

The sales are even weaker than those numbers suggest, said David Healy, analyst with Burnham Securities. He said about half the sales are lower-profit fleet sales to companies or to GM employees at a discount. He said the elimination of the Oldsmobile brand was inevitable. The sales are even weaker than those numbers suggest, said David Healy, analyst with Burnham Securities. He said about half the sales are lower-profit fleet sales to companies or to GM employees at a discount. He said the elimination of the Oldsmobile brand was inevitable.

"My initial reaction was, 'What took them so long?'" said Healy. "They had too many brands, too many fiefdoms, and they had to simplify it. Even after they phase out Oldsmobile, they'll have too many, but I don't see them making another move for the foreseeable future."

The death of a name that was once as honored as Oldsmobile is proof that owners of premium brands must continue to update their product to survive, said Britt Beemer, chairman of America's Research Group and an expert on brand identity.

"Oldsmobile demand and sales did not collapse overnight. GM sat back and watched it happen," said Beemer. "Your father's car ultimately became a hearse. You've got to have product categories that are growing categories. The four-door sedan is not the growing category."

This is not the first elimination of a long-time U.S. car brand. DaimlerChrysler announced a year ago it would be dropping its Plymouth brand.

There are about 2,800 Oldsmobile dealerships in North America, and the overwhelming majority also sell another GM brand. Only 63 are standalone Oldsmobile dealers.

Kevin Campbell, owner and operator of Glen Campbell Chevrolet Oldsmobile, which was established in 1946 in Williamsville, N.Y., said he was concerned about the announcement but said he wanted to see more details before he knew what it meant for him. Kevin Campbell, owner and operator of Glen Campbell Chevrolet Oldsmobile, which was established in 1946 in Williamsville, N.Y., said he was concerned about the announcement but said he wanted to see more details before he knew what it meant for him.

"Certainly losing a franchise has a big impact but it's hard to say," Campbell said, who was about to attend the 11 a.m. satellite conference call being piped into dealerships across the country. "What is pertinent is how they plan to phase out the brand and what they do, if anything, to compensate."

GM warns on earnings

Still, it was not Oldsmobile's weak performance that prompted Tuesday's earnings warning -- it was continued problems in Europe. The company warned Tuesday that losses in Europe would be "significantly" worse than the $181 million it lost there in the third quarter. Wagoner blamed weak sales and prices in Europe for the problem. (287K WAV) (287K AIF)

GM said it now expects to earn $1.10 to $1.20 a share for the fourth quarter, compared with $1.70 a share forecast by analysts on Wall Street.

That forecast was lowered from $2.42 a share by analysts after it posted record third-quarter results but warned of coming softness in sales. The company earned $1.86 a share in the fourth quarter of 1999.

The earnings figure would be before a $1.5 billion to $2.5 billion charge to account for the phase out of the Oldsmobile brand as well as the job cuts, GM said in a statement. The company will also take a $1.2 billion gain in the quarter on its previously announced sale of its Hughes Electronics (GMH: Research, Estimates) satellite business to Boeing Co. (BA: Research, Estimates)

The company said job cuts would equal about 10 percent of salaried work forces in North America and Europe as well as about 10 percent of North American contract employees. The cuts will mean about 5,000 salaried employees and 1,100 contract employees will lose their jobs in North America, along with about 1,600 salaried employees in Europe.

Plant closings

Hourly employee job cuts will come to about 4,000 in North America and 2,000 in Europe, although the company said that U.S. hourly workers should be able to find new positions with the company filling in for other retiring employees.

Production will be about 15 percent lower early next year compared with the start of this year, as GM works to adjust production in the face of weakening sales. While Wagoner stressed sales are still strong on a historical basis, he said the increasing global competition means that GM must respond more quickly to adjust production.

"I'm not sure these are responses to outlooks for weakening markets. It's trying to structure so we can be successful in the future," he said.

As for plant closings, the engine plant in Lansing, Mich., will be closed next September, and production will continue to be curtailed at Saturn plants in Wilmington, Del., and Spring Hill, Tenn. The car plant in Oklahoma City will also be converted to truck production. As for plant closings, the engine plant in Lansing, Mich., will be closed next September, and production will continue to be curtailed at Saturn plants in Wilmington, Del., and Spring Hill, Tenn. The car plant in Oklahoma City will also be converted to truck production.

In Europe, the Luton, England, car plant will cease production in 2002. That combined with previously announced plant closings will cut annual vehicle capacity by 400,000 by 2004.

"This is strictly a resource allocation decision," said Ron Zarrella, the president of GM North America, said about the overall restructuring. "We want to strengthen our other brands and use our resources to strengthen those brands. Will bring vehicles forward to the production line faster than they otherwise might be able to do."

Shares of GM (GM: Research, Estimates) closed up 19 cents at $51.75 Tuesday, but that was well off its high of the day of $54.13.

Click here to send mail to Chris Isidore

|

|

|

|

|

|

|