|

Yahoo! sees weak 2001

|

|

January 10, 2001: 7:24 p.m. ET

Web portal meets 4Q estimate, but warns on 1Q, full year 2001 results

By Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - The Web portal Yahoo! Inc. reported fourth-quarter earnings Wednesday that met analysts' expectations but warned that first-quarter and full year 2001 earnings will be below expectations because of softening ad sales.

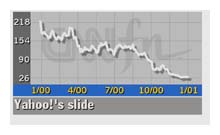

Yahoo!, whose stock fell nearly 20 percent in after-hours trading following the announcement, expects that slowing advertising sales and weaker economic conditions will cause its first-quarter earnings to fall up to 60 percent below what it reported in the same period last year.

It would be the first time that the Web portal has ever reported a negative quarter-over-quarter earnings comparison. For the full year, Yahoo! expects that its earnings per share could be 42 percent lower than current analyst estimates.

In an interview on CNNfn's Moneyline News Hour Wednesday, David Readerman, an analyst at Thomas Weisel Partners, said Yahoo!'s bleak forecast for 2001 is likely to continue to weigh on its shares as well as those of other companies that rely heavily on Internet advertising for their revenue. (114K WAV) or (114K AIF) In an interview on CNNfn's Moneyline News Hour Wednesday, David Readerman, an analyst at Thomas Weisel Partners, said Yahoo!'s bleak forecast for 2001 is likely to continue to weigh on its shares as well as those of other companies that rely heavily on Internet advertising for their revenue. (114K WAV) or (114K AIF)

For the quarter ended Dec. 30, Yahoo! said its earnings, before one-time items, totaled $80.24 million, or 13 cents per diluted share, compared with $55.7 million, or 9 cents per share, in the year-ago quarter. Analysts surveyed by earnings tracker First Call had expected the company to earn 13 cents per share.

Yahoo! (YHOO: Research, Estimates) said its fourth-quarter revenue rose 53 percent to $310.9 million from $203.1 million in the same period last year. That was slightly lower than the $315 million analysts had expected, according to First Call.

Traffic on the company's Web sites averaged 900 million page views per day in December, up from 780 million in September and 680 million in June. During December, Yahoo!'s global audience grew to more than 180 million unique users from 166 million in September and 120 million in December 1999.

Warns on 2001 earnings, revenue

While Yahoo!'s fourth-quarter financial results were on target, the Web giant's warning that its full-year 2001 revenue and earnings will be significantly below previous analyst estimates showed that the slowdown in Web advertising is affecting even the industry's most blue-chip player. A shortage of Web advertising dollars has caused dozens of commercial sites to either shut their doors or make layoffs.

In after-hours trading, its stock plunged $5.88 to $24.62, a near 20 percent decline from its Nasdaq close of $30.50. Yahoo! is now down about 90 percent from its close of $221.50 on Jan. 4, 2000, shedding about $109 billion of market value along the way.

"Over the next year, we expect to see some short-term effects from the apparent softening economy and the continued realignment of our client base," said Sue Decker, Yahoo!'s chief financial officer. "However, when we exit 2001, Yahoo! will be well on its way to becoming the Internet's leading global consumer and business services company." "Over the next year, we expect to see some short-term effects from the apparent softening economy and the continued realignment of our client base," said Sue Decker, Yahoo!'s chief financial officer. "However, when we exit 2001, Yahoo! will be well on its way to becoming the Internet's leading global consumer and business services company."

For the full year 2001, Yahoo! expects revenues to be $1.2 billion to $1.3 billion, with marketing services and commerce accounting for 80 percent to 85 percent of revenues, and business services growing to 15 percent to 20 percent. That's up to 15.5 percent lower than the current mean analyst revenue estimate of $1.42 billion.

In the first quarter of 2001, Yahoo! expects revenues between $220 million and $240 million, which reflects a changing customer mix, an expectation of slower advertising expenditures and a continuation of current general economic conditions. That's up to 27 percent lower than the mean analyst estimate of $303 million for the period, according to First Call. In early December, Merrill Lynch analyst Henry Blodget had lowered his first quarter revenue estimate to $290 million from $324 million.

Click here to see how Internet stocks are doing

The revenue shortfall comes as the Web portal is shifting its business away from financially weak dot.com customers to more traditional brick-and-mortar ones. The company's CFO said that Yahoo! expects 75 to 80 percent of its revenue in 2001 to come from customers other than pure-play dot.coms.

For the full year 2001, Yahoo! expects pro forma earnings before interest, taxes, depreciation, and amortization margins to average between 25 percent and 30 percent. Those margins are expected to shrink to 16 percent-to-20 percent in the first quarter. By contrast, Yahoo!'s margin for full-year 2000 was 37 percent.

Based on these assumptions, Yahoo! expects pro forma earnings per share of 33 cents-to-43 cents for the full year 2001, which is up to 42 percent below the current mean estimate of 57 cents.

| |

|

|

| |

|

|

| |

The environment continues to worsen versus our expectations, and we continue to think the seasonally weak first quarter will be the toughest quarter in terms of year-over-year growth. We also continue to expect the market to strengthen in the second half of the year, when the impact of the dot.com bubble has worked its way out of the system.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Merrill Lynch analyst Henry Blodget in a research note |

|

Pro forma earnings for the first quarter are expected to be in the range of 4 cents to 7 cents per share, the company said. That compares to the 10 cents per share Yahoo! reported for the same period in 2000.

Earlier this month, Merrill Lynch's Blodget again reduced his estimate for the online advertising market in 2001, as a result of continued cutbacks by dot.coms and a weaker overall advertising environment. His new estimate for 2001 is $8 billion, flat year-over-year, and down from his previous forecast of $9 billion. Six months ago, Merrill Lynch expected online advertising to increase 30 to 40 percent over last year's level.

"The environment continues to worsen versus our expectations, and we continue to think the seasonally weak first quarter will be the toughest quarter in terms of year-over-year growth," Blodget said in a research note. "We also continue to expect the market to strengthen in the second half of the year, when the impact of the dot.com bubble has worked its way out of the system."

Separately, Yahoo! had to take a $163 million non-cash charge in the fourth quarter to account for losses on investments it made in other Web companies. Like Yahoo!'s own shares, most Web stocks are at least 90 percent below their 52-week highs.

|

|

|

|

|

|

|