|

GM 4Q beats forecasts

|

|

January 17, 2001: 2:38 p.m. ET

Carmaker will miss 1Q forecast but meet '01 target; Delphi profits also hit

|

NEW YORK (CNNfn) - General Motors Corp.'s profit plunged in the fourth quarter, although the automaker managed to top lowered forecasts when it reported results Wednesday.

And Delphi Automotive Systems Corp., the auto parts maker spun off by GM, was in much the same situation.

GM said it is comfortable with current estimates for full-year 2001 profit, although it probably will miss current first-quarter forecasts with only a "marginal" profit in the current period.

The world's leading automaker earned $609 million, or $1.15 a share, excluding special items, in the fourth quarter. Analysts surveyed by earnings tracker First Call were looking for the company to earn $1.12 a share in the difficult quarter, down from an adjusted $1.3 billion, or $1.95 a share, in the fourth quarter of 1999.

The company said it believes it will hit the recent earnings forecast of $4.25 a share for the year, which would be down from 2000 earnings of $8.58 a share. Earnings tracker First Call already had lowered full year forecast to $4.16 a share early Wednesday before the announcement, though. The company said it believes it will hit the recent earnings forecast of $4.25 a share for the year, which would be down from 2000 earnings of $8.58 a share. Earnings tracker First Call already had lowered full year forecast to $4.16 a share early Wednesday before the announcement, though.

The First Call forecast called for a 91 cent a share profit in the first quarter, which is not in line with the outlook of John Devine, GM's new chief financial officer.

"We'll be testing our breakeven point in the first quarter," he said in a conference call Wednesday. But he said he's confident that improved sales in the second half of the year, and the debut of some higher-profit vehicles, particularly light trucks, should help rescue profits for the year, although he would not give a quarter-by-quarter outlook.

"It will not be all be catch up in the fourth quarter," he said.

The company had numerous special items, including a charge for cutting salaried staff, closing some plants and discontinuing the Oldsmobile, along with a gain from the sale of its Hughes Electronics satellite business to Boeing. The Oldsmobile charge was slightly higher than the company's earlier guidance.

The special items left the company with net income of $89 million, although the apportionment of earnings between GM's two classes of common stock left the company with a loss of $1.16 a share in the period. That compares with net income of $1.1 billion, or $1.86 per share, in the fourth quarter of 1999.

Click here for update on automotive stocks

Overall revenue slipped to $45 billion from $46.3 billion a year earlier as total vehicle sales fell to 2.1 million from 2.2 million.

While vehicle sales edged up in Latin America and the Asia Pacific region, they fell in the two key markets, North America and Europe, despite record overall U.S. auto sales last year.

Initial January sales in the United States actually are going relatively well and appear ahead of last year's pace, when the overall market was much stronger. But Devine said company officials aren't changing their overall outlook for a slow first quarter by these initial results.

"It's still early," he said. "I don't think (GM North America President) Ron Zarrella is ready to declare victory, but so far it looks pretty good."

Delphi earnings also edge past lowed targets

In other automotive earnings news, Delphi Automotive Systems Corp. also saw a drop in profits and sales, although it also beat analysts' earnings targets.

Delphi, the world's largest auto parts supplier which was spun off from GM in 1999, earned $200 million, or 36 cents a share, in the fourth quarter. First Call was forecasting only 32 cents a share. The company earned $269 million, or 48 cents a share, a year earlier.

Delphi said it, too, sees a difficult first half of the year, as GM and other major automakers have shut North American plants for much of January to deal with excess vehicle inventory. The company said it is looking at first quarter net income of $90 million to $120 million, which would come out to about 16 to 21 cents a share if shares outstanding stay roughly the same as at the end of 2000. First Call's forecast called for earnings per share of 21 cents in the current period. Delphi said it, too, sees a difficult first half of the year, as GM and other major automakers have shut North American plants for much of January to deal with excess vehicle inventory. The company said it is looking at first quarter net income of $90 million to $120 million, which would come out to about 16 to 21 cents a share if shares outstanding stay roughly the same as at the end of 2000. First Call's forecast called for earnings per share of 21 cents in the current period.

Overall sales fell to $6.9 billion from $7.3 billion a year earlier. That put sales just below analysts forecasts of $7.1 billion. But the company saw one sales success as its non-GM business grew during the quarter to $2.1 billion from $1.9 billion. A desire to broaden its customer base was given as one of the primary reasons for the spinoff.

Operating income as a percentage of sales narrowed to 4.5 percent from 5.4 percent a year ago, but the company said it is pleased it was able to cut costs nearly in line with the drop in sales.

"We were successful in moderating the impact of the rapid fourth quarter order decline through aggressive inventory management, workforce adjustments and other cost reduction initiatives," said J.T. Battenberg, Delphi's CEO.

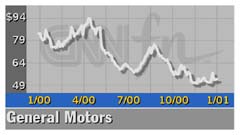

Shares of GM (GM: Research, Estimates) opened slightly higher following the pre-market report but were off $1.25 to $54.50 in midday trading Wednesday. Shares of Delphi down 38 cents to $14.31

|

|

|

Hughes sales gain amid deal speculation - Jan. 16, 2001

GM CEO sees no need for plant closure - Jan. 9, 2001

GM cuts production target - Jan. 8, 2001

Big Three at crossroads at auto show - Jan. 7, 2001

Big Three post big sales drop - Jan. 3, 2001

Analyst says hard landing hitting autos - Dec. 15, 2000

GM cuts jobs, Oldsmobile division - Dec. 12, 2000

Auto sale fall hits profits, production - Dec. 1, 2000

GM posts record 3Q EPS and looks at separating from Hughes - Oct. 12, 2000

|

|

|

|

General Motors

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|