|

Wall St. hit by warnings

|

|

March 28, 2001: 5:11 p.m. ET

Disappointments from Nortel, Palm, Disney infect the entire market

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - U.S. stocks fell Wednesday after another round of troubling news from Corporate America signaled that the economy's slowdown has not finished hurting sales and profits.

Nortel Networks, which makes communications equipment, and Palm, the handheld computer maker, both warned they would lose money in the current quarter. The shortfalls echo recent disappointments from appliance maker Maytag, brokerage Charles Schwab and chipmaker PMC-Sierra.

Sparing few companies, the economic slowdown also took its toll on Walt Disney. The media company announced plans to cut 4,000 jobs, or about 3 percent of its global work force.

"The market's saying there are more bumps in the road to come," Mark Donahoe, international equity trader at U.S. Bancorp Piper Jaffray, told CNNfn's The Money Gang. "The market's saying there are more bumps in the road to come," Mark Donahoe, international equity trader at U.S. Bancorp Piper Jaffray, told CNNfn's The Money Gang.

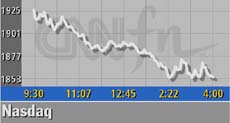

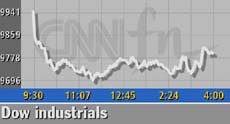

The Dow industrials skidded 162.19 points, or 1.6 percent, to 9,785.35, following a three-session gain. The Nasdaq composite index dropped 118.13, or 6 percent, to 1,854.13, while the S&P 500 lost 28.88, or 2.4 percent, to 1,153.29.

But the market's first broad losses of the week did not send the major indexes below their lowest levels of the year, which came last week. On Thursday, the Dow fell to 9,389.48, while the Nasdaq dropped to 1,830.23 a day earlier. The S&P 500 last bottomed at 1,117.58 a week ago today.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 2,147 to 928 on trading volume of 1.3 billion shares. Nasdaq losers beat winners 2,632 to 1,065 as 2 billion shares changed hands. More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 2,147 to 928 on trading volume of 1.3 billion shares. Nasdaq losers beat winners 2,632 to 1,065 as 2 billion shares changed hands.

In other markets, Treasury securities edged higher. The dollar rose against the euro and yen.

Short-lived gains

After a several-day break, another round of high-profile companies said their financial results would miss forecasts.

Nortel Networks (NT: Research, Estimates) fell $2.76 to $14 after warning that losses in the first quarter would come in wider than expected. The latest problems for Nortel, which also announced job cuts, spread to rival communications equipment makers.

Lucent Technologies (LU: Research, Estimates) fell $1.43 to $10.27, Cisco Systems (CSCO: Research, Estimates) lost $2.38 to $15.75, and JDS Uniphase (JDSU: Research, Estimates) declined $3.31 to $19.91.

Palm (PALM: Research, Estimates) said it will lose money this quarter, surprising analysts who expected a profit. Shares of Palm tumbled $7.44 to $8.06, affecting Handspring (HAND: Research, Estimates), a competitor in the handheld computer market, which shed $5.31 to $10.88.

Click here for a look at the latest warnings

Reduced demand for its products also caused Palm to announce job cuts. So did Walt Disney (DIS: Research, Estimates), which said its layoffs will save the company $350 million-to-$400 million a year as the economy slows. Disney fell 84 cents to $28.36.

ADC Telecommunications (ADCT: Research, Estimates) lost $2.34 to $8.22. The telecom equipment maker said it sees a second-quarter loss, not the profit that analysts expected. The company also announced job cuts.

In addition to the string of warnings, analysts complain that companies are unable to forecast their business outlook for the rest of the year.

"What we need is guidance from companies," Sam Ginzburg, director of global sales and trading at Gruntal & Co., told CNNfn's Street Sweep.

A long awaited IPO drew lukewarm demand. Agere Systems (AGR.A: Research, Estimates) rose 2 cents to $6.02 in its first day of trading. The Lucent spinoff, which makes optical components and chips, raised $3.6 billion, about half of what was originally expected. A long awaited IPO drew lukewarm demand. Agere Systems (AGR.A: Research, Estimates) rose 2 cents to $6.02 in its first day of trading. The Lucent spinoff, which makes optical components and chips, raised $3.6 billion, about half of what was originally expected.

The day's losses follow three days of triple-digit gains for the Dow industrials. The Nasdaq, which fell as low as 1,794 last week, rose for three of the last four sessions.

Wednesday's declines came as little surprise; over the last 12 months, rallies have always given way to selloffs.

"This is the nature of bear markets," Richard Cripps, chief market strategist at Legg Mason, told CNNfn's Market Call. "There are usually two steps forward, one step back."

The Nasdaq slid 20 percent below its record high in September, becoming the first major index to enter bear market territory. The S&P 500 followed earlier last month. And the Dow industrials spent a few hours in bear territory on Thursday before bouncing out of it.

Analysts warn that the market could face more trouble if companies continue to announce shortfalls. Those warnings typically happen over the next three weeks as firms close their books on the quarter ending Friday.

Investors seeking safety from the day's losses found few places to hide. Only three stocks rose among the 30 Dow industrials. Johnson & Johnson (JNJ: Research, Estimates) gained $3.03 to $86.28, following two days of losses. Merck (MRK: Research, Estimates) gained $1.54 to $75.15. Caterpillar (CAT: Research, Estimates) advanced 70 cents to $45.50. Investors seeking safety from the day's losses found few places to hide. Only three stocks rose among the 30 Dow industrials. Johnson & Johnson (JNJ: Research, Estimates) gained $3.03 to $86.28, following two days of losses. Merck (MRK: Research, Estimates) gained $1.54 to $75.15. Caterpillar (CAT: Research, Estimates) advanced 70 cents to $45.50.

Tuesday's stock gains followed a report from the Conference Board showing that the sentiment of American consumers surged in March. But the latest data displayed something different. An ABC News/Money poll released Wednesday found that half of the 1,015 people surveyed by telephone think the economy is worsening.

"The distinction (of the phone survey) is important," said Tony Crescenzi, bond analyst at Miller Tabak. "Because it suggests that the ABC/Money poll is more current and may have captured more of the impact of the recent stock market decline than did the Conference Board's."

The Conference Board surveys use mail-in responses.

|

|

|

|

|

|

|