NEW YORK (CNN/Money) -

U.S. stocks closed mixed Friday as strength in selected issues including Microsoft and American Express gave a boost to the Dow Jones industrial average, while weakness in telecom and Internet names kept the Nasdaq composite in the red.

While the gains were mild, it marked the first time the three major indexes closed out the week in positive territory in more than a month.

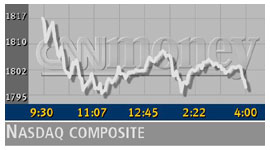

The Dow Jones industrial average snapped a four-week losing streak to close at 10,257.11, up 66 points, or 0.65 percent, on the week; on Friday, the average added 51.83 points. The Nasdaq composite added more than 40 points, to close the week up 2.3 percent at 1,796.83, breaking a five-week losing streak; on Friday, it lost 5.60 points. The Standard & Poor's 500 index ended a four-week losing streak by adding 14 points, or 1.3 percent, to close the week at 1,125.17; Friday saw a gain of 0.70.

Approximately 44 percent of the companies that comprise the Standard & Poor's 500 have reported results so far. In the next week, 150 more names will be reporting quarterly results, including Dow components 3M (MMM: up $1.21 to $124.89, Research, Estimates), Dupont (DD: down $0.38 to $47.36, Research, Estimates) and ExxonMobil (XOM: up $0.06 to $42.52, Research, Estimates), as well as AOL Time Warner (AOL: down $0.28 to $20.93, Research, Estimates), WorldCom (WCOM: down $0.35 to $5.98, Research, Estimates), PeopleSoft (PSFT: down $0.17 to $23.47, Research, Estimates) and Amgen (AMGN: down $0.70 to $56.82, Research, Estimates).

"This could be another quiet week. We have news from the Fed on Wednesday and another week of earnings. It'll be interesting to see the tech earnings. That's what's gonna drive action," Mike Murphy, head of equity trading at Wachovia Securities, told CNNfn's Street Sweep.

Microsoft brought surprising good cheer Friday after Merrill Lynch upgraded the company's shares to "buy" from "neutral," dulling the impact of a mixed profit report late Thursday. The No. 1 computer software maker reported fiscal third-quarter earnings of 49 cents a share, better than a year earlier but 2 cents short of estimates. Looking forward, the company said fourth-quarter results will miss expectations as well.

Shares of American Express (AXP: up $1.04 to $43.43, Research, Estimates) rose after CIBC World Markets and Prudential both upgraded their ratings on the financial services company after it reported better-than-expected results Thursday. Shares of International Paper (IP: up $0.84 to $42.17, Research, Estimates) rose after the company reported first-quarter earnings of 12 cents a share, a nickel better than estimates, on revenue that declined from the year-earlier period.

The markets got a mild jolt in the afternoon when the FBI said it had received "unsubstantiated information" that "unspecified terrorists" may launch an attack against U.S. financial institutions, particularly in the Northeast. The FBI said an alert was issued to law enforcement and financial institutions, which have been told to report any suspicious activity to authorities.

"People are taking some comfort in results and a feeling that the economy is getting better, but there's still some caution," said Jack Ablin, chief investment officer at Harris Trust. "We need to see more evidence of a sustainable recovery. We need companies to start seeing profits more through top-line growth than just cost-cutting measures."

Treasury prices were a little higher, pushing the 10-year note yield down to 5.19 percent.

European bourses closed mixed to lower, as did Asian markets. The dollar was a little stronger against the yen and a little weaker versus the euro. Light crude oil futures fell 16 cents to $26.44 a barrel in New York.

Market breadth was mixed. On the New York Stock Exchange, winners beat losers by more than 8-to-7 as 1.18 billion shares traded. Decliners topped advancers on the Nasdaq 9-to-8 as 1.66 billion shares changed hands.

Telecoms take a hit

A number of analysts downgraded phone service provider Qwest Communications (Q: down $0.97 to $6.60, Research, Estimates) after it warned that first-quarter and full-year results will miss estimates and that it will cut 2,000 jobs. Nortel Networks (NT: down $0.07 to $3.97, Research, Estimates) reported a larger loss than a year earlier, in line with estimates, and said second-quarter results will be flat with the first quarter.

The telecom impact extended to the Dow, crimping regional phone service provider SBC Communications (SBC: down $1.17 to $32.72, Research, Estimates).

Shares of online auction site eBay (EBAY: up $1.35 to $54.39, Research, Estimates) were a little weaker after it reported a profit Thursday that more than doubled from a year earlier but failed to give forward-looking guidance.

Concerns about Boeing (BA: down $0.95 to $42.75, Research, Estimates), which has pressured the Dow of late, continued to swirl despite news that the aircraft maker has been awarded a $4.5 billion contract to build 40 fighter jets for South Korea, while media and entertainment company Walt Disney (DIS: up $0.55 to $24.95, Research, Estimates) gave the Dow strength after both CIBC World Markets and Goldman Sachs upgraded the stock.

On the plus side for techs, Goldman Sachs issued some positive comments about No. 1 Unix server maker Sun Microsystems (SUNW: up $0.63 to $9.15, Research, Estimates) after it said late Thursday that it lost a penny a share in its fiscal third quarter, when analysts thought it would lose 2 cents. Looking forward, the company said it expects revenue to be up slightly in the current quarter.

"Action is being driven by the news of the day, namely Microsoft, Nortel, Qwest," said Tim Heekin, head of stock trading at Thomas Weisel Partners. "The fact that we're hanging in there with so much negative news out there is good."

|