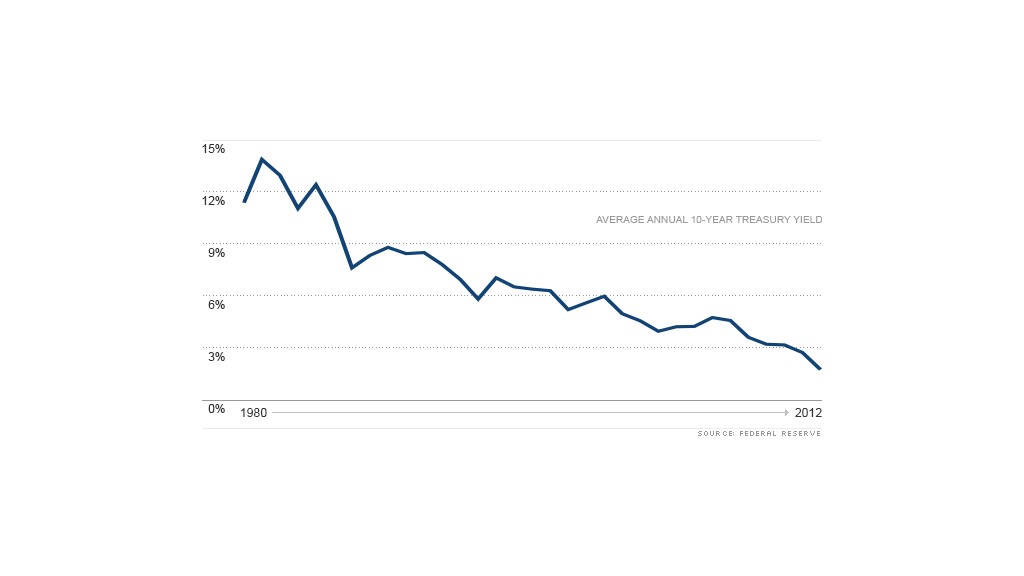

After three decades of declines, interest rates are near rock bottom, and many Wall Street experts think the bond bubble may be about to burst.

In fact, nearly 40% of the 32 investment strategists and money managers surveyed by CNNMoney think that interest rates will begin to rise in 2013, and another 30% say the shift will begin in 2014.

That would be even sooner than the Federal Reserve's projections. The central bank doesn't expect to raise the federal funds rate, the key interest rate that influences overall interest rates, until some time in 2015. The Fed said last month that it will keep its stimulative policies in place until the unemployment rate falls to 6.5%, which it doesn't think will happen before then.

"Like it's been in the case of Japan, low interest rates can go on much longer than expected, but right now it seems that all the stars are aligned for interest rates to rise," said Jeff Weniger, senior investment analyst at BMO Private Bank. "But ultimately, whether it happens in 2013, 2014 or 2015 doesn't matter too much. What matters is that you're not invested in bonds when they do rise."

Related: Bill Gross: Avoid long-term bonds

That's because investors could get stuck with big losses if they wait to sell until after rates rise, since the value of bonds decline when interest rate move higher.

The threat is especially worrisome for individual investors, who have been rushing into bond funds while fleeing the stock market in search of safety and the preservation of capital in the aftermath of the financial crisis.

According to fund flow tracking firm EPFR, individual investors have plowed nearly $210 billion in bond mutual funds and ETFs since the beginning of 2008, while yanking almost $700 billion out of U.S. stocks. In 2012 alone, investors added more than $90 billion to bonds, while pulling more than $150 billion from stocks.

Plus, the fact that the bond market has become so crowded is a danger in itself, said Ryan Detrick, senior technical analyst at Schaeffer's Investment Research.

"Bonds are definitely an area we would lighten up exposure," he said. "If we've learned anything over the past 100 years of market history, it is that when the crowd thinks one way, you might want to go the other way. Should you have some bond exposure? Yes. But should you be overweight bonds? Absolutely not."

Experts are most worried about bonds with longer maturities, and advise investors to shift into shorter-term notes, or into debt that offers floating rates -- those that would rise along with the market.

While most of those surveyed by CNNMoney believe the bond bubble could begin to deflate this year, others say interest rate increases are a ways off.

"Signs of economic growth could lead to transitory spikes in rate over the next few years, but a steady climb in interest rates seems far out on the horizon -- 2015 or 2016," said Dorsey Farr, partner at French Wolf & Farr. "We do not expect durable, robust growth or inflationary pressure until at least 2015, which means short rates will likely remain low through then, and long term rate may actually come down from current levels."

Others have an even longer timeline.

"For over 30 years investors have been worrying about rising interest rates and they have been steadily wrong," said Craig Callahan, president of ICON Advisors, who said rates could potentially remain low for another decade.