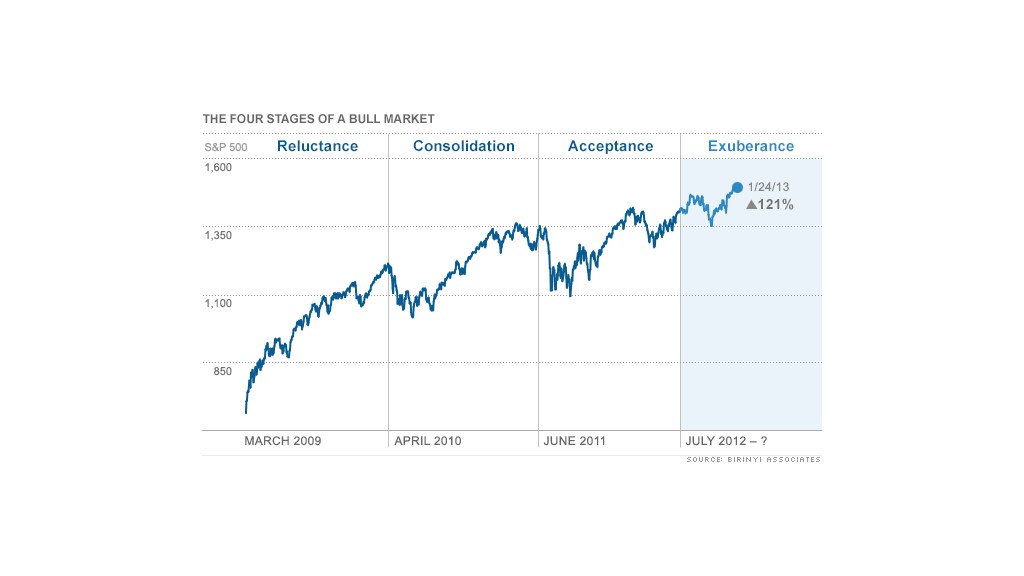

With stocks at 5-year highs and the bull market entering its fifth year, questions about how much longer the bull has to run are beginning to swirl.

Laszlo Birinyi, a renowned market analyst who was among the first to call the market bottom four years ago, says the bull market likely entered its fourth and final stage last summer. He calls this the "exuberance" period, saying that's when the "fireworks" happen.

In fact, both the first and last stages historically serve up the best returns.

"This is when all the people who have been reluctant and hesitant to invest in the stock market start realizing this isn't the New York City subway system," said Birinyi, president of research and money management firm Birinyi Associates. "There's not going to be another train coming so they better get on board."

So far, the S&P 500 has climbed almost 8% since the exuberance stage began. As more investors join in, Birinyi says those gains will only increase. In previous bull markets, the last stage has yielded an average increase of 40% for the S&P 500.

Related: Where will the next big bull market come from?

With the benchmark index just 5% away from its all-time high of 1,576.09 hit in October 2007, Birinyi says there's a strong likelihood that S&P 500 will soar to a new record high in 2013.

How long will it continue? That's a prediction that Birinyi is unwilling to make, noting that the market does not follow a calendar. He contends the bull market could last another year, or even two, depending on investor sentiment.

"When we see that everyone is bullish and is able to articulate it, we know the top is near," said Birinyi. "People are positive, but not quite bullish yet. Wall Street is forecasting a gain of 8% or 9% this year, not 15% or 20%."

CNNMoney's Fear & Greed Index, which looks at the VIX (VIX) and six other indicators to measure market sentiment, has been firmly in Extreme Greed mode since the start of the year. But just a month ago, the index was stuck in neutral.

Related: Why aren't investors scared?

Meanwhile, some experts are beginning to worry that the recent jump in U.S. stock market inflows by individual investors may be a sign that the bull market is nearing its end, as they are notoriously bad at timing the market -- usually coming in near the top.

But that may not be the case this time around, according to Bill Stone, chief investment strategist at PNC Wealth Management.

"The difference this time is that we've seen such a massive outflow from stocks," noted Stone, highlighting that investors have yanked about $550 billion out of U.S. stocks between the start of 2008 through the end of 2012.

During the first two weeks of 2013, they've added almost $13 billion back.

"A couple of weeks of inflow is just a drop in the bucket, so you can't possibly make the case that we're at the point that we need to ring the warning bells and start to worry," he said. "There's still a lot of money out there to come back, and we're nowhere near the point where everyone is back to buying stocks."

Related: Beware the bond bubble in 2013

Rather than worrying about the end of the bull market in stocks, Stone says investors should be taking note of the red flags in the bond market.

As investors fled the stock market, they plowed more than $1 trillion into the bond market during the last five years.

Interest rates are near rock bottom, and with the economy continuing to improve, many Wall Street experts think the bond bubble may be about to burst.