It was 1940, and war was enveloping Europe. In Washington, defense costs were beginning their steep spiral into the stratosphere.

In the first six months of the year, as German armies swept across northern Europe, President Franklin D. Roosevelt sent Congress a series of military spending requests, each bigger than the last. On May 16, the president asked for $1.2 billion; on May 30, he asked for another $1.3 billion.

|

| Joe Thorndike is a contributing editor at Tax Analysts and a columnist for Tax Notes magazine. |

Congress began debating a variety of ways to pay for the country's military buildup, and the individual income tax quickly emerged as the most likely source of new money. Support for exempting less income, and thus imposing higher taxes, cut across the political spectrum; even many liberals, led by FDR, embraced the idea.

The enormous funding needs of World War II would soon transform the income tax from a "class tax" to a "mass tax." Throughout the New Deal, tax burdens had been very light or even non-existent on lower- and middle-income Americans, and Roosevelt emphasized income taxes on the very rich. Now he would push to raise taxes on a much broader swath of workers.

Revenue was one reason. But as the war became a reality for Americans, the notion of shared sacrifice emerged as another main justification for higher taxes.

"A part of the sacrifice means the payment of more money in taxes," Roosevelt warned in 1941.

The income tax, enacted 100 years ago, was the nation's most famous tax, and one deeply rooted in notions of social justice. Its annual filing requirement made a connection between the taxpayer and his government -- a connection absent from most sales and consumption taxes.

Related: The millionaire 'super tax'

Notions of fairness and sacrifice were also tied up with tax visibility. Tax experts had long contended that people should be aware of the taxes they paid. Such awareness encouraged scrutiny of public affairs and left taxpayers more attuned to the costs of democratic governance.

As America's involvement in World War II deepened, all taxpayers faced a heavier burden.

The average effective rate for the top 1% of taxpayers climbed from roughly 20% in 1940 to almost 60% in 1944. On the other end of the scale, the marginal tax rate in the bottom bracket in 1940 was 4.4% and it began after an $800 exemption for individuals. In 1944, the exemption was $500 and the rate was 23%.

Related: Presidents and their tax rates

The war years also brought the Victory Tax, a short-lived income tax that bolstered the regular income levy by taxing Americans near the bottom of the income scale.

The Victory Tax was most notable, however, for an innovation it brought to the federal tax system: withholding. The tax was deducted directly from both salaries and wages. That ensured that taxpayers would remain current with their obligations and gave the Treasury Department quick access to new revenue.

Until it became a "mass tax," the income tax was administered without withholding.

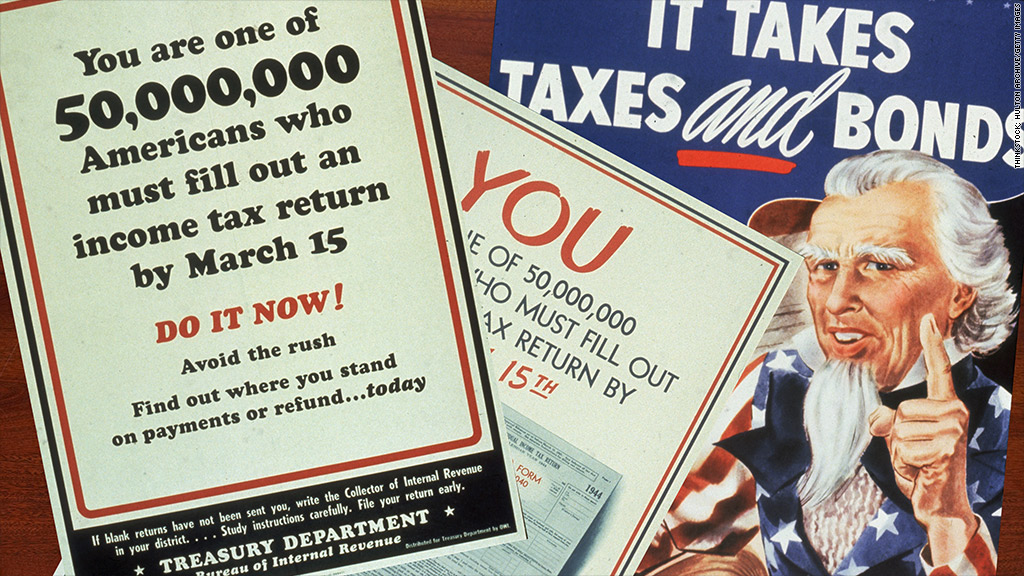

Treasury officials used a massive public relations campaign to advise new taxpayers of their fiscal responsibilities. Posters, radio announcements, popular songs and even a Donald Duck cartoon drove home the new tax filing requirements. Officials stressed that millions of previously exempt Americans now had to file returns.

Related: Taxing the rich - What's fair?

Withholding changed the income tax forever. It made the levy more responsive and flexible, both reflecting and facilitating its conversion into a powerful economic tool. Moreover, as one legal historian has pointed out, it helped create a taxpaying culture, getting Americans comfortable with regular deductions from their paychecks. No small feat in an era when such deductions were all but unknown.

In the end, the exemption cuts of World War II totaled just $500 for individuals, but they transformed the nature of the American state and society. Similarly, the rate changes, while often simply a matter of adjusting numbers in a table, were enormously important to the taxpayers who suddenly found themselves with marginal tax rates over 90%.

In many vital respects, the wartime tax regime broke with the history of New Deal revenue reform. Almost overnight, the income tax had "changed its morning coat for overalls." Millions of middle-class Americans unaccustomed to paying direct taxes to Washington joined the tax rolls for the first time.

Sunday marks the 100th anniversary of the ratification of the Constitution's 16th Amendment, which ushered in the modern federal income tax. This commentary by historian Joseph J. Thorndike is adapted from his new book, Their Fair Share: Taxing the Rich in the Age of FDR (Urban Institute Press).