US Airways and American Airlines are joining forces in an $11 billion deal to create the world's largest airline.

The new airline, which will use the American Airlines name, will beef up American's network, particularly along the East Coast, where US Airways (LCC) is a major player with its Washington-New York Shuttle and hubs in Philadelphia and Charlotte.

The proposed merger of US Air and American parent AMR (AAMRQ), which filed for bankruptcy in November 2011, is the latest in a series of moves that have combined what were 10 major airlines in 2001 into four mega-carriers.

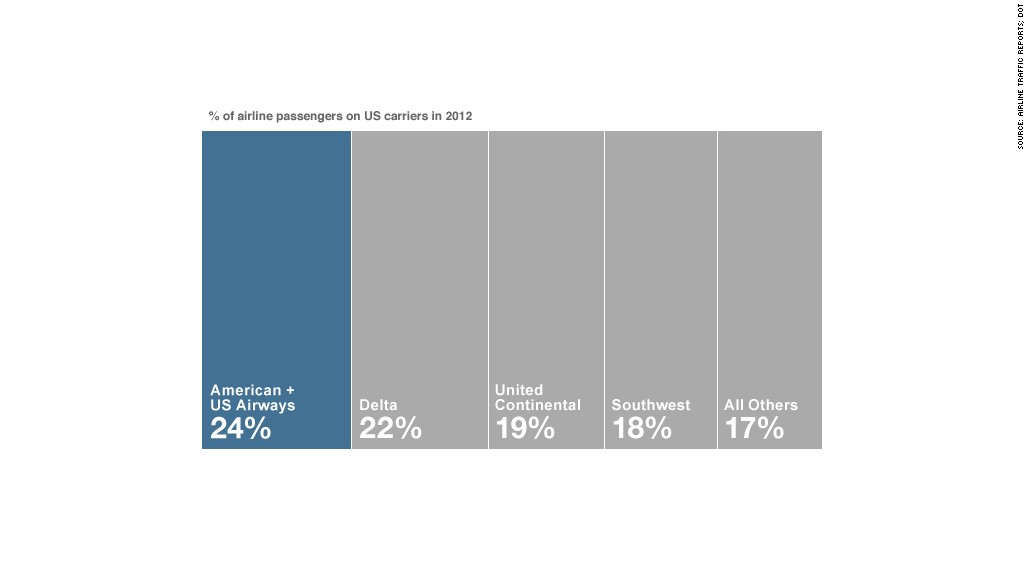

The combined US Airways-American joins United Continental (UAL), Delta Air Lines (DAL) and Southwest Airlines (LUV) as the industry's dominant players in the United States. Together, they accounted for 83% of U.S. airline passengers last year. The consolidation has meant fewer choices for the nation's fliers, who have only one non-stop choice available to them on about a third of the nation's major routes.

Related: How 10 major airlines got down to a 'final four'

But even as competition has dwindled, fare increases have remained in check, inching up less than 2% a year in the last decade. And most experts don't expect this deal to trigger a surge in ticket prices. There are only 13 routes served on a non-stop basis by both American and US Airways, according to JPMorgan Chase analyst Jamie Baker, and eight of those routes will be served by the one airline after the deal.

However, passengers will probably experience a lot more travel disruptions -- from lost luggage to flight delays -- as the two airlines combine systems, which is typically the case when airlines merge. The deal still needs the approval of the bankruptcy court and federal regulators, a process that will take months to complete.

Related: Airline mergers can mean lost luggage, flight delays

US Airways has been very public about its desire to acquire American ever since AMR filed for bankruptcy, although American management had hoped to remain independent. But the three major unions at American pushed for the merger because their members were unhappy with the contract concessions and job cuts that American management was demanding.

Indeed, when American used a bankruptcy court ruling to impose a less favorable contract on the pilots, management said the number of pilots calling in sick increased, as did the number of maintenance reports they filed before flights. Flight delays and cancellations soared, prompting some of American's business customers to start using other airlines.

The combination could vault the new airline into first place in terms of passenger traffic. American, which was the world's largest airline ten years ago, has fallen to No. 3 in miles flown by paying passengers, the reading most often used to rank airlines, and No. 4 in terms of the number of passengers. But adding the traffic from US Airways and its feeder airlines could put the combined airline in the lead in both measures. Between them, the airlines operate 6,700 daily flights to 336 destinations in 56 countries.

Related: Less choice for passengers

The combined airline will be part of the Oneworld alliance of global airlines, which includes American, British Airways and Japan Airlines. It will pull out of the Star Alliance, which includes US Airways as well as United and Lufthansa. The frequent flier plans of the two companies will be combined.

Doug Parker, the CEO of US Airways, will hold the same position with the new airline, while AMR CEO Tom Horton will serve as non-executive chairman. The deal is essentially a purchase of AMR by US Airways, as US Air shareholders will receive a share in the new company for each of their US Air shares. But the US Air shareholders will hold only 28% of the shares of the combined company, with most of the rest going to AMR creditors.

This would be the second time that US Airways, the nation's No. 5 air carrier, has bought a larger rival out of bankruptcy court. In 2005, what was then known as America West bought US Airways out of bankruptcy.

One year later, US Airways launched a hostile $8 billion bid for larger rival Delta, which was bankrupt at the time. But Delta was able to hold off that effort.