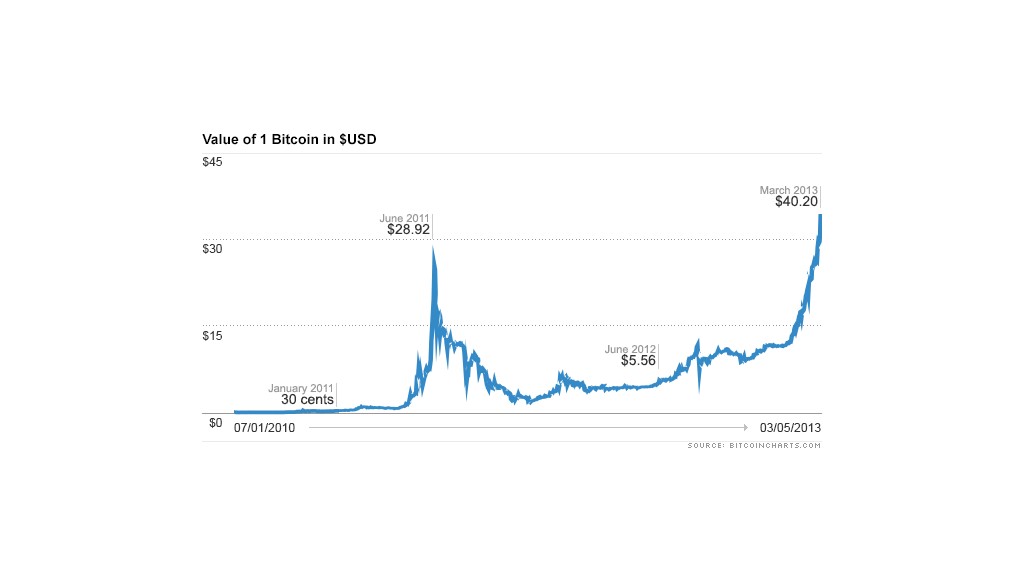

Bitcoin sounds like something from science fiction: A purely digital currency, created by an anonymous hacker, that operates outside the world's traditional banking systems. The four-year-old currency is very real, though, and it's trading an all-time high, tripling in value in the last two months alone.

One bitcoin is was worth about $40 U.S. dollars on Tuesday, and surged on Wednesday to nearly $49. That's up from around $13 in January, and 5 cents in 2010, according to Mt. Gox, the bitcoin market's main exchange. On that and other trading sites, buyers can swap their digital coins for cold, hard cash.

Watchers of the alternative currency attribute some of bitcoin's rise to the recent decision by several popular-in-geek-circles vendors to accept the coins -- most notably, blog hosting site Wordpress and the online community Reddit.

"These guys are killing it on retail," Peter Vessenes, chairman of the trade group Bitcoin Foundation, said of bitcoin's growing acceptance with merchants.

The coins are also much easier to obtain than they used to be. Until recently, a buyer typically needed to navigate an international wire transfer and wait days for the transaction to clear. Sites like like Coinbase and Bitinstant let customers buy bitcoins with U.S. cash or bank transfers. Vessenes' own bitcoin exchange, CoinLab, is set to launch later this month.

Some longtime advocates are leery of the recent run-up.

"Most people don't think $40 is a valid price right now," said Jon Holmquist, head of marketing at two Bitcoin-related startups, Coinabul and Bitcoinstore.

Stefan Thomas, founder of community site We Use Coins, thinks the rise is a bit of a self-fulfilling prophecy.

"When the price starts going up, you get a lot of speculators that want to ride the wave," he said.

Because the number of transactions and overall value of coins in circulation is relatively low, the currency is quite volatile -- it went from under $1 to over $28, then back to $7 in 2011 alone.

Bitcoin was created in 2009 by an anonymous developer using the pseudonym "Satoshi Nakamoto" -- the Japanese equivalent of a bland name like "John Smith." It has no central-bank backing. The idea was to create a currency that's free from government intervention and can be used to conduct transactions without hefty exchange or processing fees.

One deal chronicled on the bitcoin data site BlockChain involved a transfer worth nearly $80,000. The processing fee was 1.8 cents. Beat that, Western Union.

Coins are "minted" by a network of computers running specialized software on powerful (and often pricey) hardware systems. The software is designed to release new coins at a steady -- and finite -- pace. Right now, one new "block" of 25 bitcoins is generated roughly every 10 minutes, adding to the pool of around 10.8 million circulating coins.

The underlying system that generates coins is extremely difficult to attack, but the "digital wallets" bitcoin owners use to store their wealth haven't been so lucky. A series of high-profile thefts in 2011 crashed the currency's value, and one exchange operator lost 24,000 bitcoins to a thief in September. Critics also contend that the anonymous nature of the currency could make it the monetary instrument of choice for money launderers. It's already the standard currency for Silk Road, a notorious online drug bazaar.

Still, bitcoin backers think its recent rise is a sign of its growing community and more widespread acceptance. They see it as a valid alternative to traditional cash.

"The U.S. dollar is an obvious Ponzi scheme," said Thomas, who thinks the U.S. government has too much debt to raise interest rates high enough to defend the dollar if there were ever a run on it. With Bitcoin, "you feel like you're in control of your money."