There may not have been any major market malfunctions recently, but mini flash crashes still happen nearly every day.

Stock exchanges don't publicly release data about these mini crashes -- when a stock rapidly plunges then rebounds -- but most active traders say there are at least a dozen a day.

Dennis Dick, a proprietary trader at Bright Trading in Detroit, said he stopped tracking them because they happen so frequently.

While none have been as disruptive as the "flash crash" of 2010, or the ones that marred the IPOs of the BATS exchange and Facebook in 2012, they highlight the fragility of markets increasingly dominated by high frequency traders who count on fancy algorithms to make a quick profit.

So far this year, these mini crashes have taken place in shares of Apple (AAPL), Berkshire Hathaway (BRKA), insurance broker Aon Plc (AON) and apparel maker Hanesbrands (HBI).

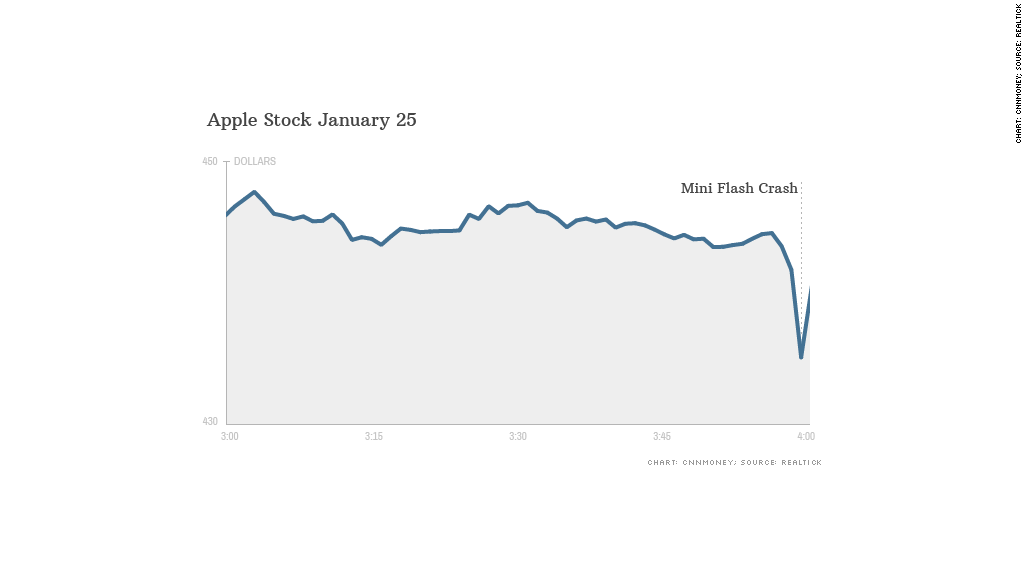

On Jan. 25, Apple's stock plummeted nearly 2% in the last minute of trading, with roughly 1 million shares changing hands. That's nearly 10 times the volume during any other time that day, and the move briefly wiped out as much as $7 billion of Apple's market value. Apple managed to recover more than half of that in the final few seconds of trading.

Other publicly traded companies have experienced even more extreme swings. On Feb. 5, Hanesbrands' stock dropped 3% in less than half a second before quickly rebounding.

And on Feb. 14, shares of U.S. Silica Holdings (SLCA), an industrial products company with a market cap of $1.2 billion, dropped 9% in less than 2 seconds, according to research firm Nanex.

During that minute, nearly 200,000 shares changed hands, roughly 100 times as many as any other minute that day. Within minutes, the stock was back near its prior trading level.

Related: Dow: Best streak since 'irrational exuberance'

Stock exchanges have explicit rules for canceling "clearly erroneous trades" and for triggering so-called circuit breakers that halt trading. None of the trades mentioned in this story met that criteria.

Generally, trades can be canceled if they fall 5% to 10% from the last trade, but the rules vary, depending on the market cap of a company and its trading volume.

Investors still have to notify the exchange within 30 minutes if they want their trade to be canceled.

And because many of the wild swings aren't extreme enough to be considered "clearly erroneous," individual investors may not even be aware that certain trades are being executed.

"It's hard to find out how or why your trade was executed the way it was," said Nanex founder Eric Hunsader.

The NYSE and Nasdaq declined to comment.

Related: Bank stocks still 50% below all-time high

Since the 2010 flash crash, the Securities and Exchange Commission and major U.S. stock exchanges have instituted new rules to lessen the impact of trading glitches. For example, a move of 10% or more will typically trigger a circuit breaker that automatically halts trading in the affected stock for about five minutes.

"Circuit breakers don't prevent the initial problems, but they prevent the consequences from being catastrophic," said Greg Berman, the SEC's associate director of the Office of Analytics and Research.

The SEC continues to make changes to try to combat the frequency and impact of the mini flash crashes.

On April 8, the SEC and the major U.S. exchanges will start rolling out a program called "limit up-limit down" that will pause trading in a particular stock for 15 seconds if its price falls outside of a normal range of 5% to 10% from the last trading price. If trading doesn't revert to a normal range, trading will be paused for another five minutes, similar to the current circuit breakers.