Forget April showers. A storm descended on Wall Street in recent weeks, and high-flying momentum stocks like Facebook (FB) and LinkedIn (LNKD) have been washed out. Cash has been flowing instead into the more comforting arms of stable names such as Walt Disney (DIS) and Comcast (CCV).

Call it the "safe rotation" on Wall Street: Sexy is out, boring is in.

Investors are hunting for stocks with a track record of churning out consistently good earnings and dividends. So what are those companies?

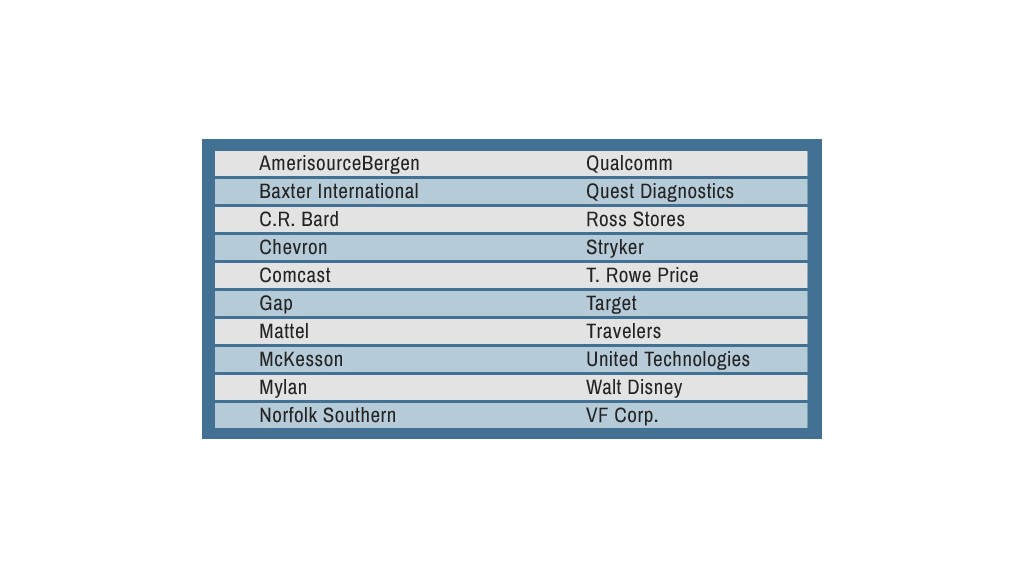

Sam Stovall, chief investment strategist at Capital IQ, put together a list of 20 undervalued S&P 500 stocks fitting the "boring, but stable" characteristics.

His stable stock list includes NBC owner Comcast (CMCSA), apparel maker Gap (GPS), discount retailer Target (TGT) and energy behemoth Chevron (CVX).

"When the seas start to get rough, investors will likely prefer those companies that offer a higher quality of earnings and greater stability of price returns," he said.

Related: Stock experts say the bull isn't dead yet

Stovall started his search by looking at the letter grades S&P gives companies. The grades are based partially on the consistency of their earnings and dividend growth during the last decade.

Interestingly, the 128 companies with "A" grades have underperformed their peers over the past year. S&P said these more stable stocks had an average return of 16.9% over the last 12 months, compared with 21.7% for below average (aka B, B- or C) companies.

But higher returns often come with higher risks. People have become jittery about whether many "B" and "C" grade stocks can really continue to grow.

One of the best ways to get a "gut check" on whether companies are overvalued is to look at the price-to-earnings ratio. Stovall said the average 2014 price-to-earnings ratio of B and C grade companies is 26.6, compared with just 16.9 for above average stocks.

"It would appear natural to us that investors now begin reemphasizing large-cap stocks over the more volatile and expensive small-cap issues," he said.

Related: Investors aren't bringing sexy back

To whittle down the list of stocks that could stand to benefit from this safe rotation, Stovall looked only at S&P 500 stocks with both a high letter grade and a rating of "buy" or "strong buy" from S&P Capital IQ.

That leaves a broad list of 20 stocks from six sectors, including seven from the consumer discretionary sector: cable giant Comcast, media conglomerate Disney (DIS)apparel maker Gap, (GPS) toy company Mattel (MAT), retailer Ross Stores (ROST), discount retailer Target (TGT), and Nautica owner V. F. Corporation. (VFC)

These names could benefit from resilient consumer spending. Consider that the latest data show personal spending jumped 0.9% in March, the fastest pace since August 2009.

There's also seven health care stocks that fit the criteria: AmerisourceBergen (ABC), C.R. Bard (BCR), Baxter International (BAX), McKesson (MCK), Mylan (MYL), Quest Diagnostics (DGX) and Stryker (SYK). The health-care sector has been boosted in recent weeks by a flurry of M&A, with deal activity in this group soaring to the fastest pace on record, according to Dealogic.

S&P's list of stable stocks is rounded out by energy behemoth Chevron, money manager T. Rowe Price (TROW), blue-chip insurer Travelers (TRV), railroad company Norfolk Southern (NSC), diversified manufacturer United Technologies (UTX) and chip maker Qualcomm (QCOM).

Related: Wall Street is addicted to a new drug: M&A health care deals

To be sure, there's no guarantee the flow of funds out of momentum names will continue.

The rotation out of momentum stocks began in early March, hammering previously red-hot Internet and biotech stocks. The carnage has left Facebook (FB), Twitter (TWTR), Gilead Sciences (GILD) and Tesla (TSLA) all down more than 10% from the end of February, while Netflix (NFLX) has tumbled over 20%, and cybersecurity company FireEye (FEYE) has plunged close to 30%.

Related: Twitter stock tanks. Down more than 10% in a day

"It's hard to tell what exactly is motivating this move, although it could be some form of risk aversion," said Kristina Hooper, U.S. investment strategist at Allianz Global Investors. She points to the geopolitical trouble in Ukraine and concerns about the true value of some social media companies as possible catalysts.

"We think that rotation into value may be short-lived," said Hooper, noting it's historically unusual to see such a move at this stage of an economic expansion, not to mention that many average Joe investors often pull out of stocks at the first signs of trouble.

Still, this is hardly a "usual" stock market, especially given the unprecedented measures by the Federal Reserve to jumpstart the economy and keep it humming.

"This is a very unique market environment. We have to expect the unexpected," said Hooper.