The chaos in Iraq is understandably distressing many, but in a weird twist, investors who own energy stocks are benefiting from the unfortunate situation.

In fact, violence in the Middle East and Vladimir Putin's use of withholding natural gas as an economic weapon against Ukraine are actually lifting the energy sector to record levels.

That's for two reasons. The obvious one is that higher energy prices translate to larger revenue for producers.

But there's a spillover impact: Rising geopolitical tensions make U.S.-focused exploration and production companies all that much more appealing.

"If you can say you don't have any Middle East operations, you don't have to worry about Russia and oh by the way, we're growing our production double-digits -- that's a pretty attractive story for investors," said Brain Youngberg, an analyst who covers energy companies at Edward Jones.

Related: Gas prices rising but glut coming

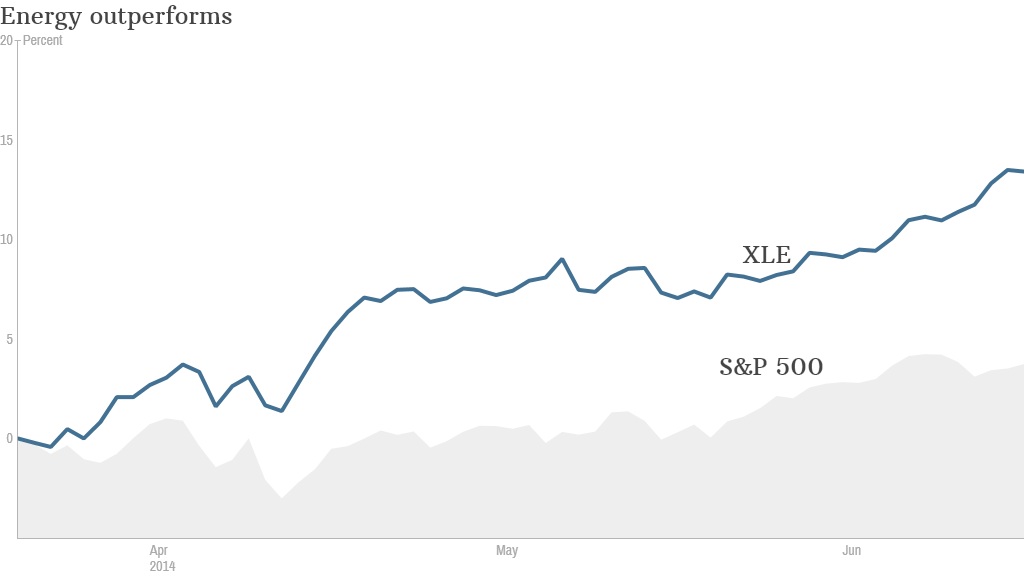

While the stock market pulled back in recent days from record levels, the energy sector continued its run. The SPDR energy sector (XLE) ETF -- a good tracker of the industry -- is up 2% over the past week.

A slew of energy stocks have hitall-time highs in recent days, including Anadarko Petroleum (APC), which is up 34% so far this year. Chevron (CVX) and ExxonMobil (XOM) also touched record highs, although their shares are barely up on the year.

Investors who have owned energy stocks for a number of years are probably thinking this bonanza is long overdue. The sector has trailed the broader markets during much of the five-year bull market, in part because oil prices have mostly been stuck in the same $80 to $100 range since 2011.

"Some of it is just catchup," said Youngberg.

Related: The bull market turns 5, but not done yet

The recent rally comes as U.S. crude oil prices flirt with the $107-a-barrel level for the first time since September. Last week, Brent crude, the global benchmark, topped $114 a barrel.

Investors are now betting oil prices could remain in the triple-digit territory instead of reverting back toward $80.

"With all of the global issues going on -- Crimea, Libya, Iraq -- expectations have changed. Maybe oil isn't going to pullback much," said Youngberg.

While higher oil prices won't make consumers happy and are keeping a lid on stock prices overall, they will pad the profits of oil producers -- up to a point.

"I'd caution investors that with prices at these levels, there's probably more downside than upside risk at this point," said Jason Stevens, director of Morningstar's energy equity analyst team.

Related: Why are oil prices rising?

That's because if crude oil spikes above a certain level -- say $125 a barrel -- the energy market would likely experience a slowdown in demand. Consumers and businesses would cut back on energy use because it's simply too expensive and other alternatives make more sense.

"That could become a self correcting problem," said Stevens.

It's also important to note that not all energy companies are benefiting.

Oil refiners like Phillips 66 (PSX) and Tesoro (TSO) saw their shares come under pressure amid the Iraq turmoil because they are hurt by higher prices.

Large, integrated oil companies such as Chevron and ExxonMobil have struggled to advance much this year and continue to be valued more for their lack of volatility than their future prospects.

Chevron "has its place for investors, but they should not own it for growth. You own it for the dividend and stability," said Youngberg.

The real energy growth story has come from companies with heavy exposure to the U.S. shale gas revolution. EOG Resources (EOG) has surged 34% this year, while Devon Energy (DVN) and Energen (EGN) are both up around 26% in 2014.

"People are willing to pay for that growth and the lower geopolitical risk that those companies offer," said Youngberg.