House Republicans are out to get rid of a federal agency, and employees at some small businesses could be among the casualties.

Top House Republicans want to stop funding the Export-Import Bank, because they believe the agency helps companies that don't need it, like giant corporations Boeing (BA) and General Electric (GE). The Ex-Im bank, as it is commonly known, provides loans to foreign entities that buy products from these large American companies.

But for some 3,000 smaller companies, the Ex-Im Bank works differently. Many of these businesses export products and services overseas to foreign companies that take loans from U.S. banks. The Ex-Im Bank provides government guarantees for such export financing.

Without that help, some small businesses say they'd have to give up their exports.

Related: Is this government agency worth saving?

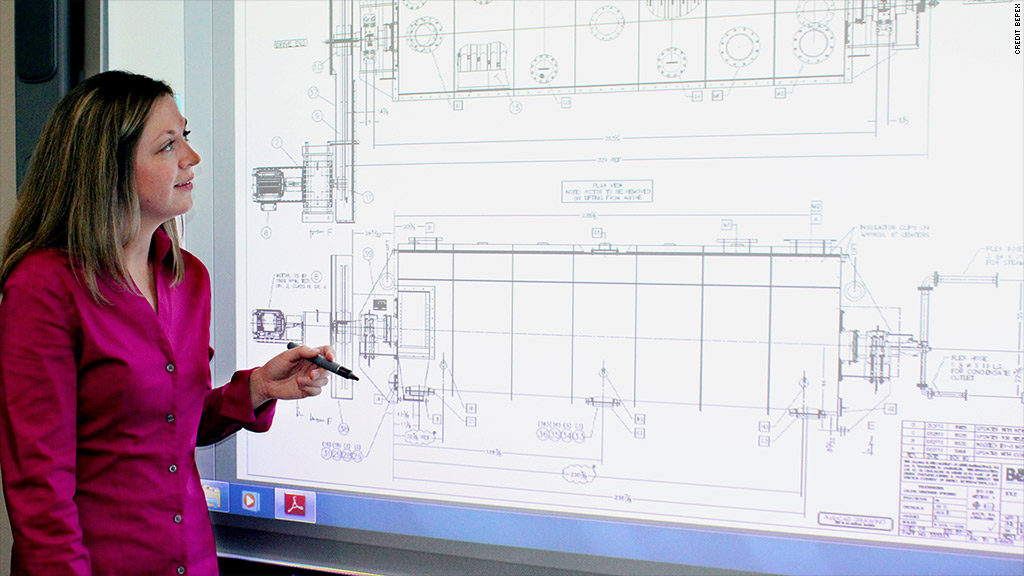

Take Bepex International, where half of all sales are exports backed by the Ex-Im Bank. Bepex CEO Ralph Imholte is warning that defunding the Ex-Im Bank would have a "dramatic effect" on his business.

"It would limit our ability to go out and compete for those projects," said Imholte, who employs 56 people, mostly engineers.

Bepex exports engineering designs to China. The company plans and designs equipment that creates products like absorbent compounds in disposable diapers, among other things.

Bepex works with Wells Fargo (WFC), which makes loans between $1 and $5 million to foreign companies that buy its services -- thanks to Ex-Im Bank guarantees.

Without the government's support of such loans, Bepex believes that it would be hard to compete.

Related: Made in America. Sold in China.

The Ex-Im Bank is also critical for exports at WallQuest, a small manufacturer of high-end wall paper. The wall paper is made in the United States, but 90% of its sales are overseas.

The Wayne, Pa., company sells in 61 countries, with about 30% of its revenue coming from China, which allowed the company to more than double its workforce -- from 80 employees in 2007 to 190 employees now.

Jack Collins, vice president of WallQuest said getting rid of the Ex-Im Bank is a "big risk."

"A GE or a Boeing can get financing through other sources," Collins said. "I won't say we'll be going out of business, but it's certainly going to be a big challenge for us and will slow our growth."

Yet, not all small business experts believe the Ex-Im Bank helps.

"We're against the Ex-Im bank because it's never going to help small businesses, and never will," small business advocate Lloyd Chapman of the American Small Business League. He stressed that the majority of Export-Import Bank loans and financing go to large companies, not small businesses.

Congress has until Sept. 30 to pass a law to keep the Ex-Im Bank going. If they do nothing, the bank won't be able to make, guarantee or insure any new loans or exports. The agency is currently in jeopardy, especially since incoming House majority leader Rep. Kevin McCarthy added his voice to those calling to end the agency.