Are they party poopers or are they just being prudent?

In the last week, three vocal Federal Reserve officials have been urging their colleagues to stop filling up the proverbial punch bowl.

Not only do they want the Fed to stop buying bonds (there's already a plan in place to eliminate those as early as October) -- they also want the central bank to raise its short-term interest rate sooner than investors are expecting.

This isn't just economist talk. Doing so could raise the rates on everything from mortgages and small business loans, to credit cards and auto loans, thereby tightening financial conditions throughout the U.S.

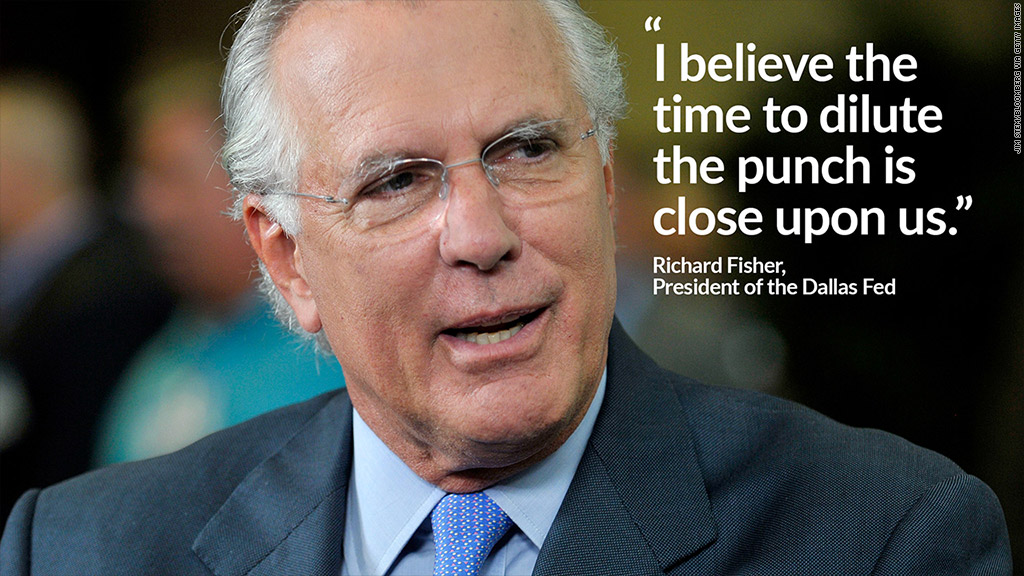

"I believe the time to dilute the punch is close upon us," Dallas Fed President Richard Fisher said in a speech at the University of Southern California on Wednesday.

What does he mean?

Since 2008, the Fed has been pouring copious amounts of this so-called punch (a.k.a. monetary stimulus), including two key ingredients: A low short-term interest rate and monthly bond purchases intended to reduce long-term rates as well. Both methods are meant to stimulate the U.S. economy by making it cheaper for businesses, consumers and homebuyers to borrow money.

This policy has been controversial because it has created incentives for investors to flee from safe assets in search of riskier investments offering higher returns.

Or in Fisher's words, the policy gives investors "beer goggles". "It enhances the appeal of things that might not otherwise look so comely."

Related: Yellen say U.S. economy still needs Fed stimulus

It's a stark contrast to Fed Chair Janet Yellen, who thinks the weak job market warrants ongoing Fed stimulus.

Fisher is part of an outspoken minority of Fed officials, known as inflation hawks, who are concerned that too much stimulus could fuel bubbles and trigger rapid inflation. Take junk bonds, farmland and debt of emerging countries as examples. All are priced at historic highs, they say.

"As I have said repeatedly, a bourbon addict doesn't go from Wild Turkey to cold turkey overnight," he said. The push to stop the bond buying is October isn't enough. "The punch is still 108 proof. It remains intoxicating stuff."

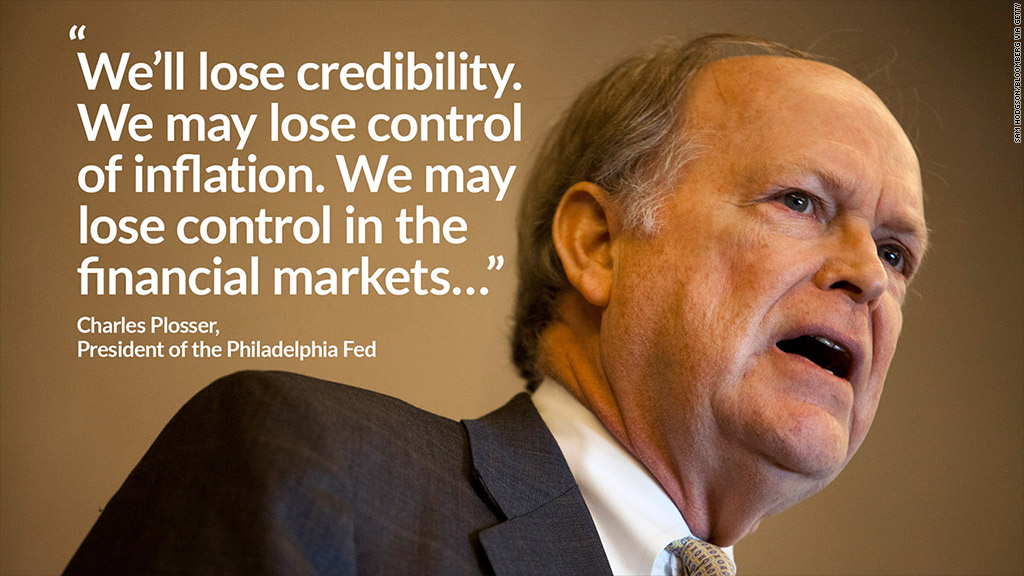

Fisher's camp includes Kansas City Fed President Esther George and Philadelphia Fed President Charles Plosser. Both have also spoken in the last week, with Plosser telling Bloomberg TV he thinks "we are closer than a lot of people might think" to a hike in interest rates.

A survey conducted by the New York Fed in June shows market participants generally forecast the rate hike will occur in the third quarter of 2015.

If the Fed doesn't act sooner, Plosser worries the Fed "may lose control in financial markets" and find itself having to raise rates faster and higher than otherwise hoped.

"We'll lose credibility. We may lose control of inflation," he said. "That could be very disruptive."

Speaking in Kansas City on Tuesday, George also spoke in favor of hiking rates soon.

"The transition to less accommodative and more sustainable policy will be challenging, though monetary policy does not want to find itself with a different set of problems that may arise by waiting too long" she said.

These hawks are clearly outnumbered at the Fed, but could they get their way? Plosser and Fisher are currently voting members on the Fed's policymaking committee, but George is not. That committee next meets on July 29 and 30.