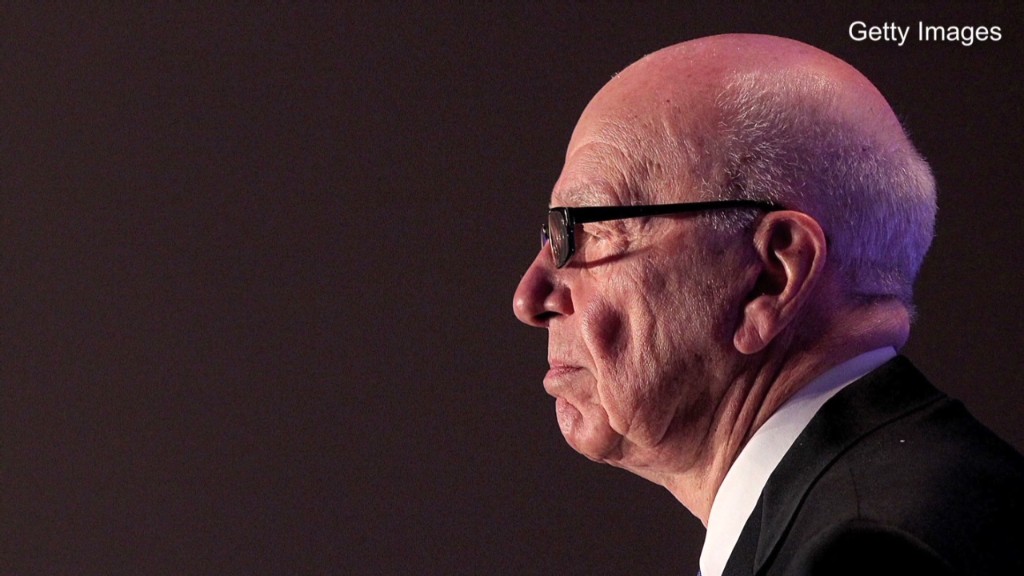

Rupert Murdoch isn't saying anything about his bid for Time Warner, the parent company of CNN. But he is taking himself off the list of possible bidders for Tribune Publishing.

"Sorry can't buy Trib group or LA Times -- cross-ownership laws from another age still in place," Murdoch tweeted late Thursday night.

Murdoch was referring to Federal Communications Commission rules that limit how many newspapers and broadcast television stations a single company can own.

But the Twitter message confirms that Murdoch has thought about pursuing Tribune, and particularly the Los Angeles Times.

Last year, when Tribune (TRBAA) was actively considering a sale, The New York Times reported that Murdoch was "weighing whether a bid would be worth the headache and regulatory battles."

Tribune later decided not to sell its eight papers immediately, but to spin them off into a new company, Tribune Publishing, instead. The split is expected to take effect in August.

After that point, a buyer might be able to acquire the new company -- which also owns the Chicago Tribune and Baltimore Sun.

The journalism institute Poynter said earlier this month that a new rumor about Murdoch's interest in Tribune was making the rounds, and that "various circumstances would make such a deal logical for both buyer and seller."

Anything can happen down the road, of course, and Murdoch's tweet might have been a way to blow off some steam about government regulation.

Of Murdoch's two companies, News Corp (NWSA). would be the one interested in more newspapers. It already owns Wall Street Journal publisher Dow Jones and the New York Post.

21st Century Fox (FOXA), the home to Murdoch's movie studio and cable and TV programming networks, is the one that made a bid for Time Warner (TWX).

There have been no new reports about overtures from Fox to Time Warner since Wednesday's confirmation from both companies that Time Warner had rejected the bid Fox proposed in June.

Related: Why Murdoch wants Time Warner

The original bid was worth about $86 per share. Time Warner indicated in a statement on Wednesday that Fox could never pull together a compelling offer (both in terms of value and the right mix of cash and stock), but that has not stopped Wall Street from speculating on a magic number that could rekindle talks.

Janney Capital Markets analyst Tony Wible, who wrote about a potential tie-up of Fox and Time Warner last month, said Thursday that he expects a $100 per share offer from Murdoch.

"Simply put, Fox has the capacity to pay more but would likely target a mix of stock and cash," he wrote in a report.

And even though Murdoch did not tweet directly about Time Warner, he did seem to hint that the deal may have been a reason why he hadn't tweeted since July 8 before writing a trio of tweets from Australia yesterday.

"Sorry, I have been busy lately with many preoccupations!" he wrote.

CNN's Cristina Alesci contributed to this report.