The stock market was tanking again Thursday. But one tiny company was escaping the carnage. And that's an understatement.

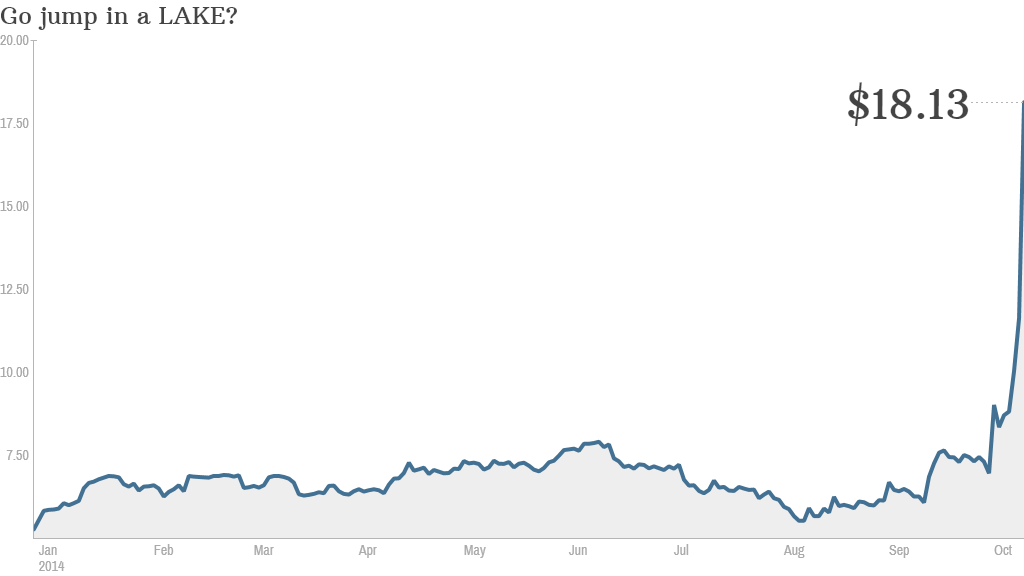

Lakeland Industries (LAKE), a maker of hazmat suits with sealed seaming, soared more than 50% due to growing Ebola fears.

The stock is up 160% so far this month. The trading volume has been, to put it mildly, insane. More than 47 million shares exchanged hands Thursday. The average daily volume for the stock over the past three months is just 616,000 shares.

So investors (or more likely traders) thinking about buying now need to be extremely careful.

Troubling fundamentals: Lakeland is not profitable. It lost $384,000 in the second quarter, mostly due to problems with a subsidiary in Brazil. The company's sales were down slightly in the second quarter as well.

No analysts at a major investment bank follow the company, which has a market value of less than $100 million.

Several mutual funds and hedge funds focusing on so-called microcap stocks are invested in Lakeland.

But these institutions -- the so-called smart money on Wall Street -- collectively own less than 30% of Lakeland's stock, according to FactSet Research. Compare that to some of the bigger companies in the market. Institutions own more than half the shares of blue chips like Apple (AAPL), GE (GE) and Exxon Mobil (XOM).

Brian Rafn, director of research with Morgan Dempsey Capital Management, which owns about 355,000 shares of Lakeland, said his firm has been an investor in the stock for about eight years. It makes up about 1% of its portfolio. Rafn said the firm has not increased that percentage during the recent surge -- but it has not been selling any shares either.

Rafn conceded that the stock will be very volatile over the short term. But he likes it because it has a steady core business of supplying protective suits to oil workers and fire departments.

He said the recent spike on Ebola worries makes Lakeland a "Jack Bauer stock," a reference to the terrorist fighting hero on the Fox show "24."

Will Lakeland actually benefit from stronger demand? Still, it's not clear just how much Lakeland will really benefit from increased demand for protective gear. Lakeland said in a mid-September statement that it was increasing manufacturing capacity for its hazmat suits and added that the U.S. State Department put out a bid for 160,000 suits.

Some traders may have misinterpreted that to mean that Lakeland had received an order for 160,000 suits. But that's not what the news release says. And the Ronkonkoma, N.Y.-based company has turned down numerous requests from CNN for comment.

A spokesperson for the State Department told CNN that it was aiming to supply 130,000 (not 160,000) sets of hazmat suits and other personal protective equipment (PPE) in the coming weeks. The State Department added that it was getting supplies from "multiple locations around the world, and there are many suppliers."

Lakeland also cited reports that claimed there was a short supply of hazmat suits. The company touted that it had "appropriately qualified and certified suits, ample manufacturing capacity, and numerous distribution points to supply these garments."

But there may no longer be a supply shortage of hazmat suits. A spokesperson for the World Health Organization told CNN earlier this week that it "has purchased additional PPE in the last months and is still doing so in addition to a close monitoring of the supply pipeline with main partners."

Lakeland also faces stiff competition from much larger companies that make protective gear, including DuPont (DD), Honeywell (HON) and Kimberly-Clark (KMB).

Investors have been making speculative bets on several smaller drugmakers, most notably Tekmira (TKMR) and Chimerix (CMRX), that are working on Ebola treatments. But Lakeland may be the riskiest Ebola investment of them all.

CNNMoney's Cristina Alesci and Laurie Frankel contributed to this report.

Editor's note: An earlier version of this article incorrectly reported the second quarter loss for Lakeland Industries.