The Federal Reserve is not supposed to care about the stock market. It only has two official mandates: make sure enough Americans are working and ensure prices of consumer goods stay relatively stable.

But the minutes of the Fed's latest policy meeting clearly show that central bankers don't ignore Wall Street.

At its meeting in late October, Fed board members debated whether to acknowledge the recent stock market volatility in their official statement. Stocks plunged in late-September and early October before going on a ferocious rally at the end of the month.

According to the minutes, Fed members indicated that "a reference" to the turmoil in the stock market would show that the Fed "was monitoring financial developments while also providing an opportunity to note that financial conditions remained highly supportive of growth."

Related: Is the Federal Reserve out of firepower?

The Fed ultimately decided to not mention what was going on with stocks though.

Fed members said that doing so "risked the possibility of suggesting greater concern on the part of the Committee than was actually the case, perhaps leading to the misimpression that monetary policy was likely to respond to increases in volatility."

The Fed ended its nearly six-year long bond purchase program, known as quantitative easing or QE for short, at the meeting three weeks ago. That was widely expected.

Now the question is when the Fed will raise interest rates.

Related: Fed end 6-year effort to stimulate the economy

2015 interest rate rise: The minutes didn't offer many more clues other than acknowledging a rate hike is still on track for 2015. The Fed's key short-term interest rate has been near 0% since December 2008.

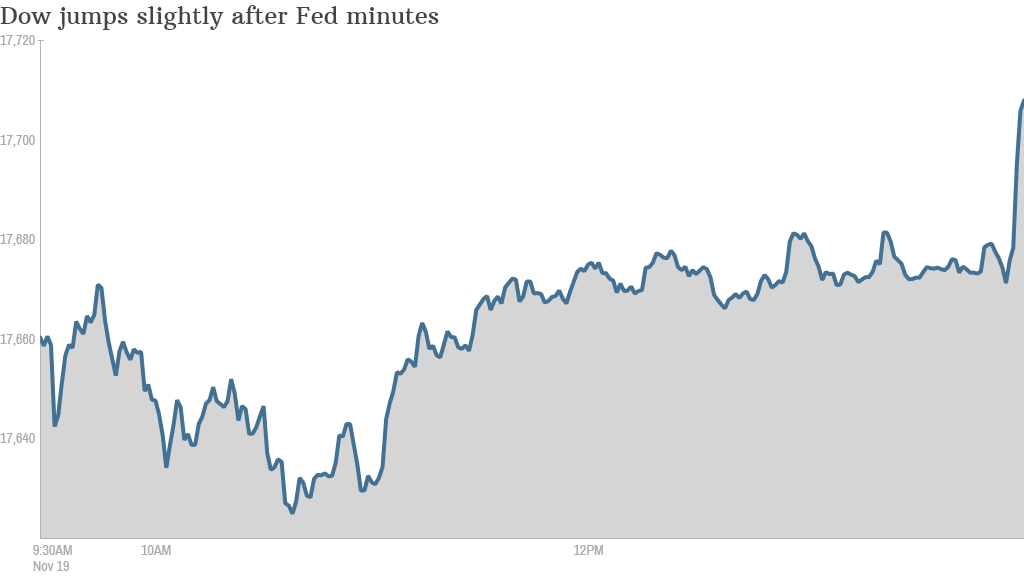

The stock market rallied shortly after the Fed minutes came out at 2p.m. ET. The Dow rose 30 points before falling back. Some investors have been concerned about an interest rate increase early in 2015.

There are some concerns about how the U.S. economy will fare now that the Fed is no longer going to be adding billions of dollars in liquidity to the markets every month through the purchase of Treasury bonds and mortgage-backed securities.

Defenders of the Fed argue that QE was necessary to help the U.S. economy during and after the Great Recession. But critics worry that the policy will eventually lead to runaway inflation and that QE has fueled bubble-like conditions in the stock market that are similar to 2007.

Related: Are stocks overpriced now?

Either way, the Fed is now in a tough spot.

Fed worries: The Fed's most recent meeting took place before the October jobs report was released. That report showed that the unemployment rate dipped to 5.8%, the lowest level since July 2008.

And while the overall economy and U.S. job market are clearly getting better, Fed chair Janet Yellen and other Fed officials are still worried about the large number of long-term unemployed and people only working part time.

So the Fed's next challenge will be to figure out how to raise interest rates gradually so it does not jeopardize the economic recovery -- or freak out the financial markets.

There are also increasing economic risks outside the U.S. borders. Some Fed members wondered if the central bank should mention that "recent foreign economic developments had increased uncertainty or had boosted downside risks to the U.S. economic outlook." But the Fed didn't put those concerns in its statement either.

The Fed also cut its inflation outlook for the fourth quarter and early next year due to falling oil prices. The lack of inflation could allow the Fed to hold off a little while longer before deciding to raise rates.

According to the minutes, most Fed members agreed that rate hikes should begin sometime in 2015 but that the precise timing will depend on the economic data.

But that may not make Wall Street happy. It wants a painfully telegraphed road map for rate hikes.