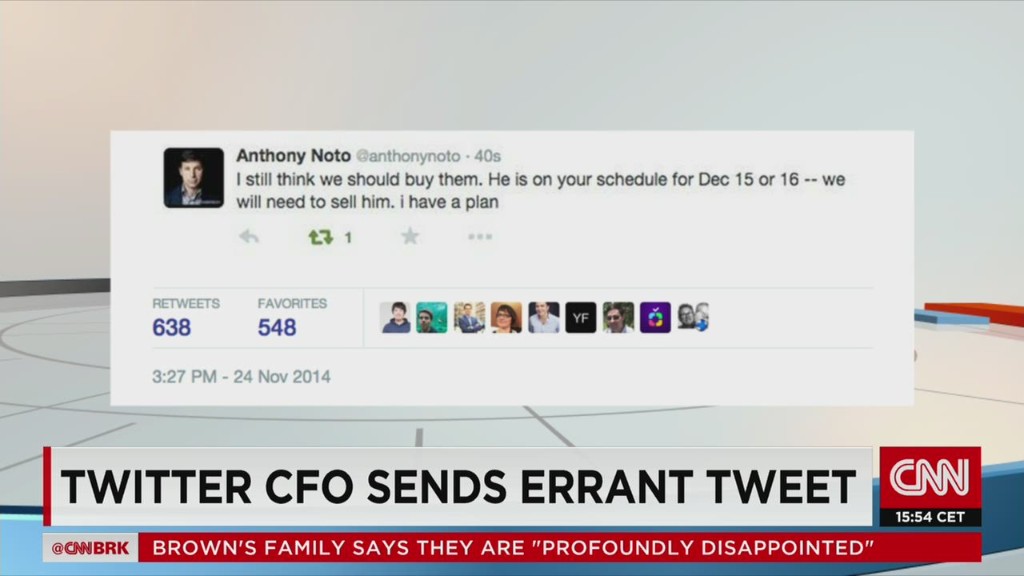

Thanks to an errant tweet from Twitter chief financial officer Anthony Noto a few weeks ago, the whole world knows that Twitter is shopping for a company to buy.

But maybe Twitter (TWTR) should consider selling itself instead of looking for more acquisitions?

Twitter has failed to live up to Wall Street's expectations after a blockbuster initial public offering in November 2013.

The stock is down nearly 45% this year, making it the worst performer by far in CNNMoney's Tech 30 index. Twitter's user growth hasn't been strong enough to impress investors. And while revenues have surged, profits have been miniscule so far.

Meanwhile, the social media company that Twitter is most often compared to -- Facebook (FB) -- is having a phenomenal year. Shares are up nearly 40%.

I love using Twitter. I might even be addicted to it just a little bit. But I've always viewed Twitter as more of a niche service.

All of my journalist friends are on Twitter. But most of my other friends and family members use it sparingly ... if it all. Everyone I know is on Facebook multiple times a day, however.

And in the world of online advertising, scale clearly matters.

It's the reason why Facebook, with a market valuation of $210 billion, is worth nearly ten times as much as Twitter. And it's the reason why Google (GOOGL), worth almost $360 billion, is eight times as big as Yahoo (YHOO).

So would Twitter be better off as a subsidiary of a larger tech or media company instead of looking to grow by acquisition? Perhaps.

Twitter has $3.6 billion in cash. That's respectable, but it's not that big of a war chest for mergers.

The company's bonds were rated as junk by Standard & Poor's last month. That may make it difficult for the company to get bigger by using debt to do deals. And because its stock price has been in freefall, offering shares to any possible takeover target would probably be a tough sell too.

And Wall Street has also been concerned by a recent round of insider sales at the company, including sales by co-founders Evan Williams and Jack Dorsey as well as CEO Dick Costolo, in the past few weeks.

But none of the sales were that big. And a Twitter spokesperson added that "other than charitable donations, all of the executives' stock sales were done in accordance with automatic trading plans put on file at least 90 days prior to the sales."

Still, there seems to be a sense that Twitter could be vulnerable if the stock keeps sliding.

One of my followers on Twitter, a person going by the name of @FilmProfessor9 (naturally) wondered on Monday if the company could be a good fit for Rupert Murdoch. That would be fun. And people would immediately start wondering if Twitter was then destined to become MySpace 2.0.

But I doubt Murdoch would want to spend more than $20 billion on Twitter, especially since the company would arguably be a better fit for his smaller News Corp. (NWSA) business than the larger media conglomerate Fox (FOXA).

Still, Google and Facebook could easily afford to buy Twitter. So could Alibaba (BABA). That would be a pretty interesting combination that could do some damage to China's Twitter-like Weibo (WB).

And what about Apple (AAPL)? The most valuable company in the world has an iNormous amount of cash on its balance sheet. Adding Twitter to the fold could help the company diversify beyond hardware and software and make it more competitive against Google and Facebook in the online ad race.

Mind you, this is all just idle speculation. There have been no rumors to suggest that Twitter is looking to sell or that any of the aforementioned companies are sniffing around.

But all it might take to put Twitter in play is an activist shareholder or two to buy a stake and make some waves.

Carl Icahn has often been mentioned as someone who might want to invest in Twitter in order to shake things up ... although that rumor seems to be based almost entirely on the fact that Icahn has been one of the more savvy users of Twitter on Wall Street.

Ironically enough though, if the rumor does come true, most people will probably learn about it from a tweet by @Carl_C_Icahn.