Repeat after me: The Federal Reserve is going to raise interest rates later this year.

There. That wasn't so hard, was it?

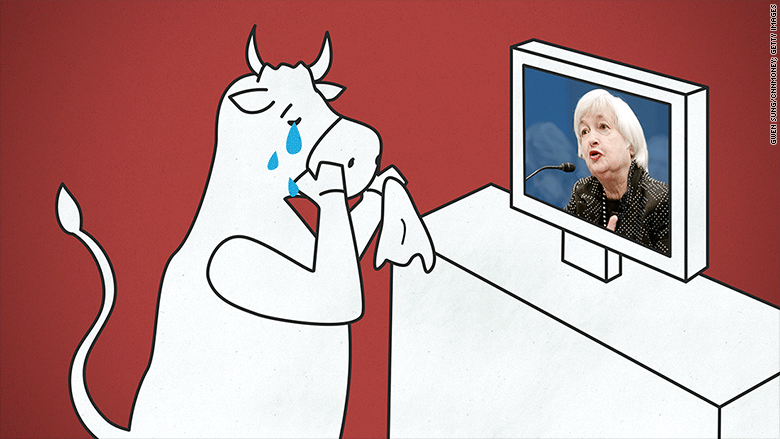

But many investors are whining about how Fed chair Janet Yellen is about to finally turn out the lights on this great bull market we've been enjoying for the past six years.

Get over it.

Related: The bull market turns 6. Now what?

Strong dollar helps Main Street. Yes, higher rates could mean an even stronger dollar. And that's one thing that's worrying Wall Street lately because it could hurt corporate profits.

But for average consumers, the mighty greenback is a good thing. It makes it cheaper to travel and also lowers the price of imported goods.

"If you look at the U.S. economy, there are very few signs of weakness. Nothing out there suggests that the strong dollar is actually hurting the economy," said Sam Wardwell, investment strategist at Pioneer Investments.

Related: The dollar is crushing other currencies

Instead of panicking about how higher rates are going to kill the bull, shouldn't Wall Street focus instead on the reason why the Fed is probably going to be able to FINALLY raise interest rates from the near-zero levels they've been stuck at since December 2008?

Healthy economy: All this fuss is because we have a healthier economy, especially the labor market. A higher number of jobs were added last month than expected while the unemployment rate dipped to its lowest level since before the financial crisis. That sparked a huge sell-off on Friday.

That is myopic. A stronger job market should lead to higher levels of consumer spending ... which is still the driving force of the U.S. economy.

This is why Wardwell thinks consumer discretionary stocks -- such as retailers, autos and housing suppliers -- should do well over the next year.

Sure, wages continue to lag. They rose just 2% over the past 12 months. But there are signs that salaries could soon climb.

Related: 3% raises could be back this year

Wages uptick soon: Another government jobs report, known as the Job Openings and Labor Turnover Survey or JOLTS for short, just showed that there were slightly more job openings in January 2015 than people hired.

And more people voluntarily quit their jobs as well. In other words, people looking for work are finding it, and they're starting to have more negotiating power to work where they want and for higher salaries.

"Companies cannot fill their open positions and will have to pay more to attract workers," wrote analysts at research firm Pavilion.

Higher wages should make the Fed feel more confident that rate hikes won't derail the economic recovery. And if people start to make more money, that should also push up the prices of things to a more normal level of inflation.

Remember that the Fed is supposed to try and promote the highest level of employment it can while also keeping prices stable. Mild inflation is far more preferable than deflation. Just ask anyone in Europe or Japan.

Related: What happened during prior Fed rate hikes?

(Don't fear) the rate hike reaper. The market also seems to be forgetting two other important things about the coming rate hikes. For one, it seems highly unlikely that Yellen is going to repeat some of the mistakes made by some of her predecessors and raise rates too sharply.

Does it really matter if the first increase comes in June or September? No. The first move will probably be small. Probably a quarter of a point. A half a point at most.

Interest rates could be around 1% to 1.25% by the end of 2015. That's not something any sane person should consider to be cripplingly high.

And given how transparent the Fed has become under Yellen and her former boss Ben Bernanke, is it even possible for the Fed to surprise the market anymore? Every rate increase will probably be painfully telegraphed.

Related: Janet Yellen says too many Americans are still struggling

Finally, there are probably going to be millions of Americans doing their version of the old Mypos Dance of Joy from "Perfect Strangers" once the Fed finally starts to raise rates.

That's because responsible savers have been penalized for putting money in the bank. The average rate on a savings account is a measly 0.44% according to Bankrate. That can only improve once the Fed raises its federal funds rate.

So Wall Street may have to get used to higher rates. Let's face it. There was never going to be a perfect time for the Fed to start tightening.

The market has become a liquidity junkie. It's addicted to the Fed's easy money policies. It's time for them to end.

"One of the main criticisms of the Fed is that its programs did not help Main Street," Wardwell said. "We might get the other side of the pendulum this year. This could be a good year for Main Street even though we might finally get a market correction."