The U.S. economy isn't off to a great start in 2015.

It's looking so rotten that the Federal Reserve Bank of Atlanta just cut its growth projection to zero for the first three months of the year.

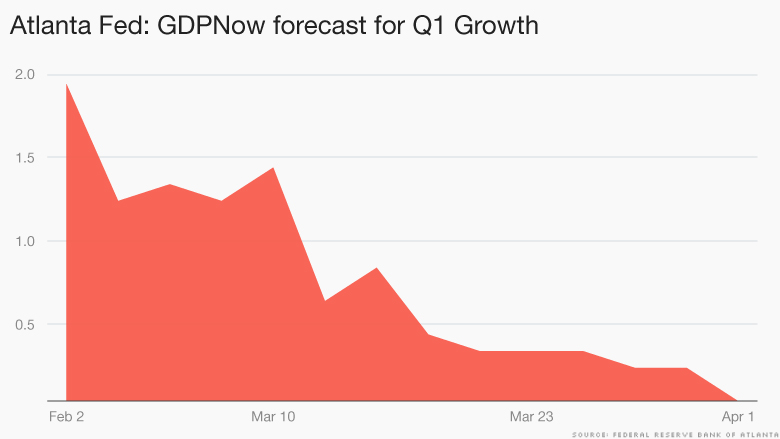

That's a big drop from the 1.9% growth forecast they started with in early February.

Of course, this is only an estimate. The official data on first-quarter growth will be released April 29. But it's yet another sign of the cracks appearing in the economy in a year when America was supposed to be the global growth leader.

What went wrong? Blame the weather and the strong U.S. dollar.

Related: This is the U.S. dollar's fastest rise in 40 years

American consumers and businesses haven't been spending much in recent months. There was hope that extremely low gas prices across the country would spur people to head to the shops and buy, buy, buy. But so far, that's not happening.

People aren't buying big things or small things. Retail sales are down. Home construction and sales came in weaker than expected, and orders for durable goods (think appliances and furniture) have fallen in three of the last fourth months.

On top of that, businesses aren't helping boost growth much either. While hiring has remained strong, there have been pullbacks in manufacturing and industrial production.

But the greatest headwind appears to be the strong U.S. dollar. It makes American goods more expensive to people overseas, and is also problematic for U.S. companies trying to bring their profits from abroad back home. They lose money on the currency exchange.

Related: Thank you strong dollar: these 5 travel spots are cheap

Companies as varied as Caterpillar (CAT), Coke (KO) and Apple (AAPL) have all warned that the strong dollar will likely hurt their bottom line this year.

All of this weighs down gross domestic product (GDP), the measure of economic activity. The Atlanta Fed dramatically cut its growth forecast in mid-March after seeing how weak American trade was so far this year.

Bad sign for the rest of the year? While this not the start anyone wanted to see, something very similar happened last year. Growth was actually negative in the first quarter of 2014. But the economy rebounded quickly in the spring and summer, and the U.S. finished last year with healthy 2.4% growth for the year.

Fed and Wall Street economists are still largely optimistic about the rest of the year. In fact, most still predict better growth in 2015 than last year.

All eyes will now turn to the latest jobs report on Friday. Despite the problems so far this year, hiring has remained strong. CNNMoney's Survey of Economists predicts 244,000 jobs were added in March. Anything less than 200,000 will be seen as a miss.