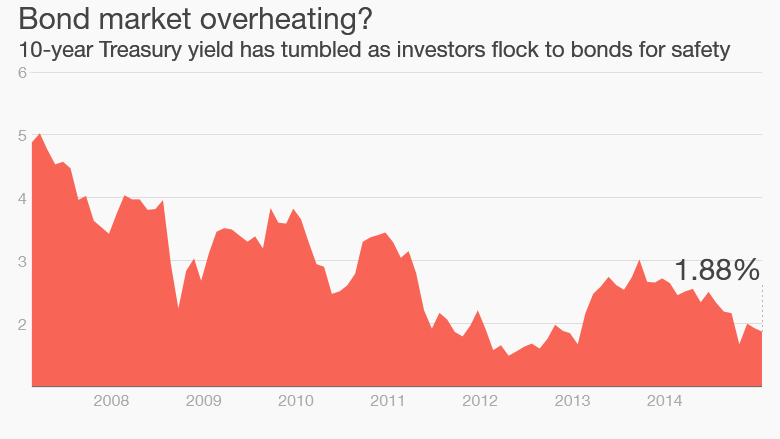

Investors have been on a bond buying bonanza for the past few years. The main reason? U.S. Treasury debt is thought to be among the safest investments in the world.

But some prominent people on Wall Street have recently raised concerns about how safe Treasuries really are.

Last week, JPMorgan Chase (JPM) CEO Jamie Dimon wrote in his annual shareholder letter that he was concerned that there are fewer bonds readily available in the market than in 2007. There simply aren't as many people re-selling.

"In a crisis, everyone rushes into Treasuries to protect themselves," he wrote. "This will be even more true in the next crisis. But it seems to us that there is a greatly reduced supply of Treasuries to go around."

High demand and low supply could lead to big moves in bond prices and yields in a short period of time. That's not what most mom-and-pop bond investors expect when they buy Treasuries.

But Dimon isn't just talking about a hypothetical situation. There already has been a lot more volatility in the bond market than many investors would like.

Related: Jamie Dimon fears that regulations will make the next financial crisis worse

October crisis: On October 15, bond yields went on a wild ride for no particular reason. It was even dubbed a Treasury flash crash.

Earlier this week, Simon Potter, executive vice president of the New York Federal Reserve, referred to that day as "unusual" and a "remarkable occurrence in one of the world's most liquid markets" during a speech about Treasury bonds.

Potter speculated that automated trading of Treasuries and reduced liquidity may have played a role and warned of the "possibility that sharp intraday price moves become more common."

That could be bad news for individual investors who have been loading up on bonds. Exchange-traded funds for bonds have become increasingly popular in the past few years.

Many investors have embraced ETFs like the Vanguard Total Bond Market Index Fund (BND), iShares Core U.S. Aggregate Bond Fund (AGG) and iShares 20+ Year Treasury Bond Fund (TLT), for example.

So what should you do if you've been investing more in bonds with the hope of avoiding risk?

Treasury bonds are still arguably a lot safer than many other bonds because the U.S. has a pretty good credit rating despite some occasional political fights about the debt ceiling.

Nobody in their right mind thinks America is going to have trouble paying its bills like Greece.

Related: Should I dial back on stocks?

Bond bubble? But most investors already know that. That's made investments in Treasuries something that people on Wall Street like to call a crowded trade. Some have even suggested that the Treasury bond market is a bubble.

Mike Gladchun, vice president and trader for the fixed income group at Loomis, Sayles & Company, said the influx of so-called retail money into the bond market could add to the volatility.

Bond investors have historically been less prone to panic and make drastic moves like stock market investors often do. But that could be changing -- especially since he also thinks liquidity has deteriorated.

"The bond market may not be as prepared as it might have been a few years ago," he said.

The Fed factor: There are other risks in the bond market. The Federal Reserve is likely to raise interest rates sometime later this year. It hasn't done so since 2006.

Many younger investors have no experience trading bonds while the Fed is hiking rates. Usually, investors sell bonds and yields go up.

But bond yields have remained relatively low. Investors may be ignoring the inevitable rate hike and could pay the price later.

"There is a big risk here. Investors buying Treasury bonds may not understand what could happen if rates go up," said Hank Smith, chief investment officer at Haverford Trust.

This is one reason why Smith thinks conservative investors looking for income may be better off with blue chip stocks than government bonds.

He notes that the dividend yields for McDonald's (MCD), Coke (KO), Johnson & Johnson (JNJ) and Procter & Gamble (PG) are not just higher than the rate on the 10-year Treasury -- they are also more than the yields on some of these companies' own bonds.

But there is, of course, no such thing as a completely safe investment. Too many bond investors may be forgetting that.