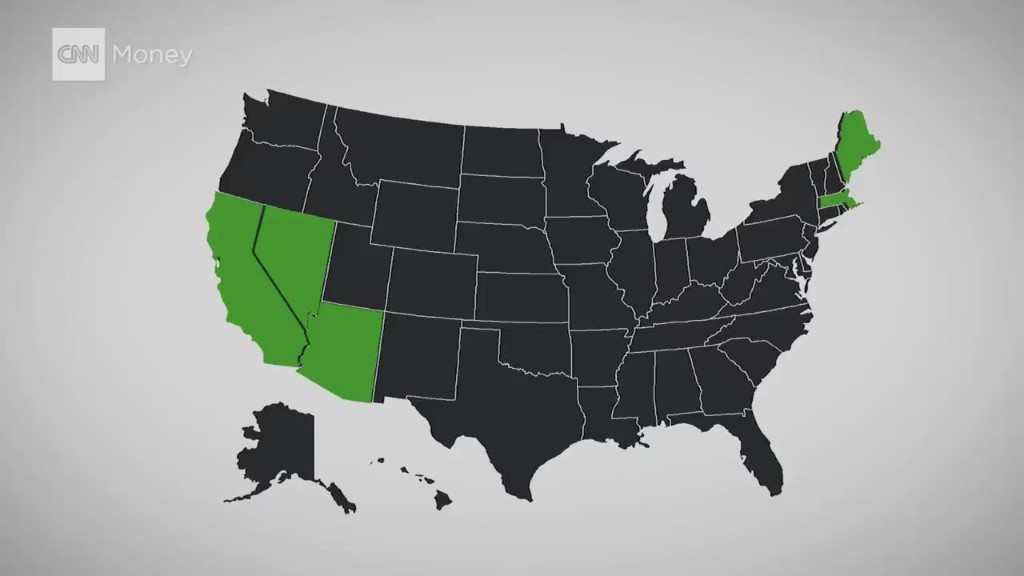

The marijuana business is attracting a lot of interest from entrepreneurs, venture capitalists and consumers in states where pot is legal for recreational and/or medicinal use.

There are even dozens of publicly traded pot stocks. But should you buy any of them? Probably not ... unless you don't mind seeing your portfolio do a Cheech and Chong and go up in smoke. (Sorry.)

Many of the companies are trying to attract investors with goofy names and ticker symbols that make it obvious they're in the pot business.

American Green (ERBB). CannaGrow Holdings (CGRW). Hemp (HEMP). Medical Marijuana (MJNA). WeedHire International (WDHR). (Amusingly, the stock with the ticker symbol is THC is not a pot firm but giant hospital owner Tenet (THC).)

These companies are basically wrapping themselves in a red, yellow and green flag with a leaf and the date 4/20 on it.

Related: Nine things to know about legal pot

But once you weed (sorry, again) out the large number of speculative penny stocks that don't trade on big exchanges like the NYSE or Nasdaq, you are left with just a handful of companies that seem legit.

"Opportunities are there but a lot of people don't know where to invest because of the early stages of the industry," said Michael Swartz, analyst with Viridian Capital & Research, an investment firm that caters to the cannabis industry.

Swartz said the biggest problem right now is that there is a shortage of "seasoned" (his word, not mine) executives and board members at many of these young and tiny pot companies.

The fact that marijuana is legal only in some states but not at the federal level also makes things more complicated.

Swartz said that investors looking at any pot company have to do their homework to make sure that the firms are complying with all laws and taking quality control seriously.

The lack of any real industry standard for products doesn't help either. He noted how a candy bar sold in one dispensary can have a different amount of THC in it than one with an identical brand sold in a nearby town.

Swartz said there's only one marijuana-related stock that actually trades on one of the big exchanges: GW Pharmaceuticals (GWPH), a British biotech listed on the Nasdaq.

The company is working on several cannabis-based drugs. The stock popped more than 25% this week after the American Academy of Neurology reported there were some promising results for patients in a clinical trial taking GW Pharmaceuticals' Epidiolex drug to treat epileptic seizures.

Hilary Bricken, an attorney with Seattle-based law firm Harris Moure, and contributor to its Canna Law Blog, agrees that GW Pharmaceuticals stands out in the crowded field of penny pot stocks.

It has a market value of more than $2 billion. It is working closely with the FDA on its drugs. A few Wall Street analysts cover it. And several well-known investing firms, such as Fidelity, Federated (FII), Janus (JNS) and BlackRock (BLK) are among the top holders of the stock.

Related: Hey, stoners! Boost your high with ... falafel?

Of course, the company is still very risky. Like many small biotechs, it's losing money. But it's a beacon of safety compared to the rest of the pot sector.

"This is a tough place to find legitimacy. Fraud has run rampant," Bricken said. "GW may be the only one that's viable. The rest of these companies live life from press release to press release."

The Securities and Exchange Commission cracked down on pot stocks last year, suspending trading in five of them "because of questions regarding the accuracy of publicly available information about these companies' operations."

The SEC added that two of those suspensions were due to alleged illegal trading activity.

But there is no denying the potential in the marijuana business. Alcohol and tobacco companies bring in billions of sales and profits every year. Why shouldn't there be an Anheuser-Busch InBev (BUD) or Altria (MO) of pot?

Swartz even thinks that before the end of the year, a big drug firm or agricultural products company will look to buy a cannabis business. Monsanto (MON)? Weeds and seeds? FrankenPot?

Bricken isn't so sure though. She thinks that such validation of the industry is still many years away since so many state and federal laws would need to be changed.

Still, many investors are willing to roll the dice with the hopes of a big pay day. Bricken knows this firsthand.

"My mom is on TD Ameritrade and is constantly asking me, "When should I invest in pot stocks?' My answer is, 'Never.' But she invested in one and it wound up getting investigated by the SEC," Bricken said.