The U.K. election has all the ingredients of a thriller. The big parties are neck and neck, and the most likely outcome of Thursday's vote is a messy coalition or minority government. Yet investors seem unfazed.

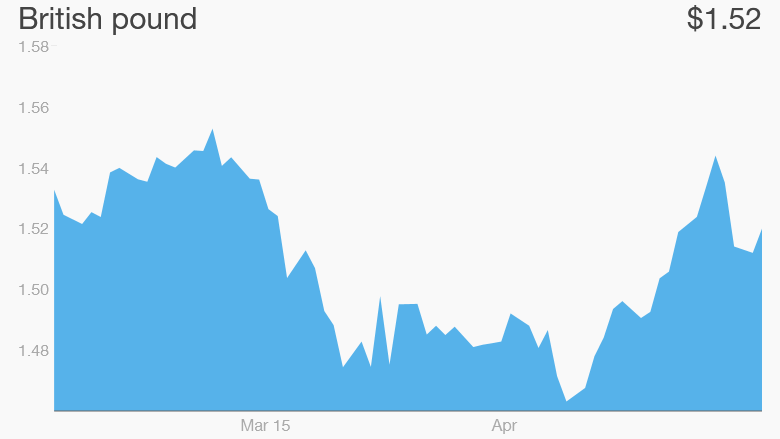

True, the pound has been jittery recently but stocks are trading around record highs and there's plenty of appetite for British government bonds.

Markets may get a wake up call once the votes are counted on Friday. If the opinion polls are correct, there won't be a clear winner. Analysts say weeks of horse trading to form a coalition could put Britain's recovery in danger.

In the worst case scenario, another election may be needed later this year.

"The lack of clarity surrounding such an (election) impasse would likely be damaging for UK growth and assets," Goldman Sachs (GS) analysts wrote last month.

Thursday's election contains potential risks for markets on all sides.

Conservative Prime Minister David Cameron has promised to hold a referendum on Britain's membership of the EU if he gets reelected. Quitting the EU would be a scary prospect for many executives, particularly in financial services.

If Labour wins, the rich and some businesses would be hit with higher taxes and tougher regulation. Cameron's Conservative colleague, George Osborne, told the Financial Times that the prospect of a Labour-led government could see investment and confidence drain away on "fallout Friday."

Adding to the uncertainty, the Scottish National Party looks poised for big gains in Scotland, renewing fears of the breakup of the United Kingdom.

Related: Is Britain booming, or barely coping?

Analysts are worried the confusion could hit hard if Britain wakes up to political gridlock with no clear winner on Friday.

"UK markets have been relatively calm, suggesting a smooth and swift government handover. We believe this view is too complacent -- and expect volatility in the currency and other UK assets," BlackRock (BLK) wrote in its election preview.

Related: U.K. election is a scary prospect for business

Any loss of confidence among foreign investors could spell serious trouble. That's because the U.K. runs a large current account deficit -- meaning the value of imports far outweighs exports -- and it needs foreign money to make up the gap. At 5.5%, it is the biggest deficit among major developed economies.

"This means the UK is reliant on the kindness of strangers (foreign creditors) to finance its spending," BlackRock said.

If these "strangers" decide to stay away, the economy could take a hit and growth would slow.